Diagonal Spreads for Earnings Announcements

Diagonal Spreads for Earnings Announcements

By:Mike Butler

In earnings trades, investors are betting on the direction the price of a stock will take after a company’s quarterly report

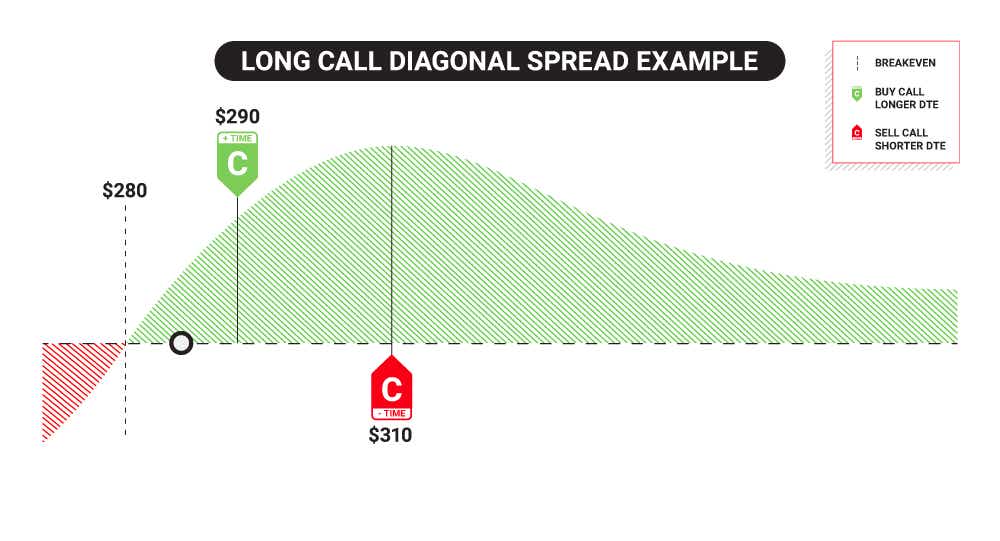

- Diagonal Spreads are vertical debit spreads with the long and short options in different expirations.

- Placing the long option farther out in time—relative to the short option—emphasizes the implied volatility exposure of the trade.

- Just before an earnings announcement, implied volatility is heightened in near-term options expiration cycles because of the lack of time and implied stock price movement from the earnings release.

Earnings Trades 101

When it comes to earnings trades, many traders and investors are speculating on the stock price movement that comes after the earnings announcement is released. Publicly traded companies report earnings once a quarter, and they either beat (positive sentiment), meet (neutral sentiment) or miss (negative sentiment) expectations each quarter.

There are multiple layers to earnings announcements, including an earnings-per-share (EPS) release, a quarterly revenue release and an earnings call where company leaders provide guidance for the future. It's common for traders and investors to have a good idea of what to expect each quarter from each company, but time and time again we see big surprises from earnings announcements—like new product releases or big surprises in the form of big misses or beats from revenue and EPS expectations.

What's interesting about an earnings announcement is that expectations could be great for a company, results could be great as well but the stock can still sell off. Beating an earnings expectation does not correlate with a strong positive move in the stock price all of the time. For this reason, there is plenty of uncertainty with what will happen with the stock price after the earnings announcement is released, and with this comes heightened implied volatility.

Diagonal spreads explained

Diagonal spreads have become one of my favorite trading strategies, as it enables me to stay small for directional assumptions in products. More importantly, though, it enables me to gain efficient exposure to implied volatility crushes from earnings announcements in a defined-risk way.

A diagonal spread is simply a vertical debit spread, where we push the long option farther out in time. This adds duration to the long option, which helps that long option retain some value even if the stock price moves against us. It's not a fail safe strategy because big moves against us can still result in the full loss of the initial debit paid up front.

Max loss—Because the long option is our asset in this trade, and the short option is a cost basis reduction component, the max loss on a standard debit diagonal spread is the debit paid up front. This is realized if the short and long option both expire out of the money (OTM) and worthless.

In the example above, let's say I paid $10.00 for this 20-point -wide 290/310 call diagonal spread. The max loss is $1,000 if the stock price is below $290 at the expiration of my long option.

Max profit—The max profit on a diagonal spread can't be defined because the long option will still have extrinsic value when the short option is at expiration. We can estimate our max profit range because we know the minimum value of the spread would be the distance between the strikes if it was in the money (ITM), just like a vertical debit spread. So, the max profit estimation on a diagonal spread is the distance between the strikes, plus an estimate of extrinsic value remaining in the long option at the short option's expiration, less the debit paid up front for the spread.

In the example above, let's assume I paid $10.00 for the 20 point wide 290/310 call diagonal spread. The maximum value of the spread if the stock price is above $310 would be $2,000. At the expiration of the short option, let's say there is $500 of extrinsic value left in the long option. That means my max profit estimation would be at $1,500 at the expiration of the short option.

$2000 intrinsic value in the spread + $500 extrinsic value in the long option - $1,000 entry cost = $1,500

Trading diagonal spreads for earnings announcements

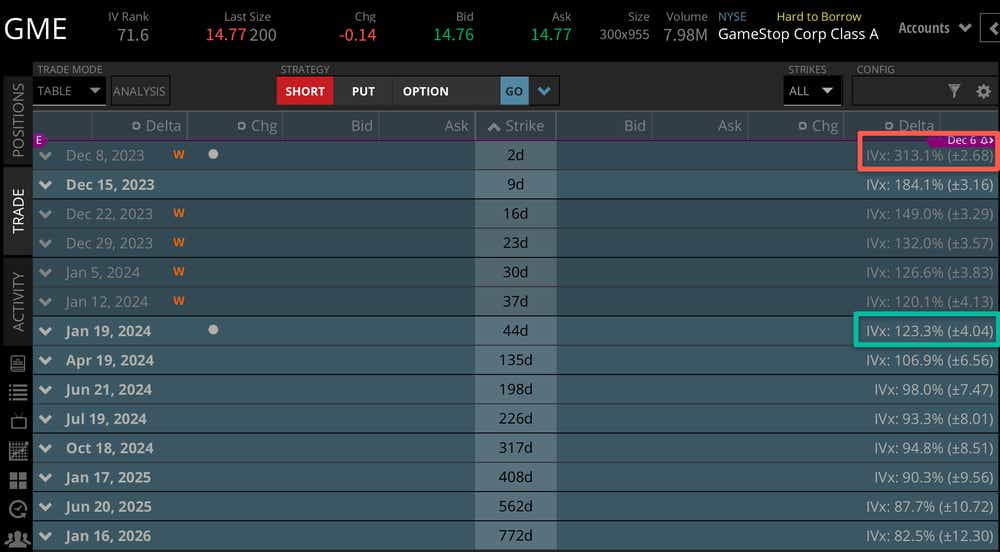

Implied volatility plays a big role in diagonal spread setups for earnings announcements. As I mentioned earlier, when a binary event looms, implied volatility is elevated in near-term cycles as extrinsic value stays elevated, with a very limited amount of time left until the options contract expires. This translates to a very high extrinsic value in these options relative to time, which is why the IV% (implied volatility percentage) is so much higher than further-dated cycles:

As we can see in this GameStop (GME) example, with earnings scheduled to be reported after the market closes today, there is a strong expectation of stock price movement over the next two days after the announcement. This isn't a small implied move, either, because the market is pricing in a +-$2.68 movement on the current stock price of $14.77—that's almost 20% in two days! This two-day cycle boasts a 313% implied volatility, which reflects just how much premium is still in this weekly options cycle relative to time.

Looking farther to the January '24 cycle, we can see the expected move is just +-$4.04 with 44 days to expiration (DTE). That's really not that big a difference, which is why the 2DTE cycle has such high implied volatility relative to the 44DTE cycle.

It doesn't mean there is more extrinsic value premium in the 2DTE cycle, but it does mean that relative to time, extrinsic value premium is significantly higher.

With a diagonal spread, we're trying to gain value on the long option, and we want the short option to lose value quickly. Earnings trades like this make for an efficient setup in this regard because I'd be selling the 2DTE cycle that has a big implied volatility crush ahead with all extrinsic value premium going to $0.00 by Friday's expiration. The 44DTE cycle should maintain some value even if the stock moves against the long option owner.

GameStop earnings diagonal spread example

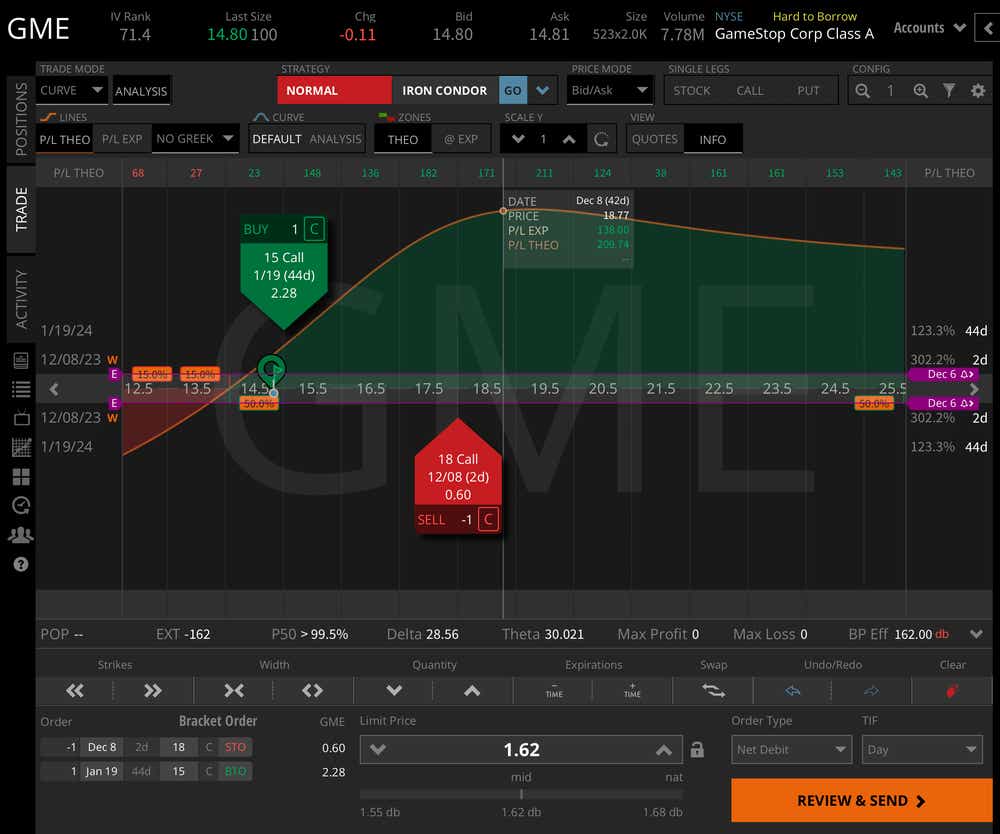

For GameStop earnings, I'm placing a call diagonal spread to express my bullish assumption on the stock. I'm buying the 15 strike January 2024 44DTE option for $2.28, and I'm selling the 18 strike Dec. 8 2DTE option for $0.60. That's almost a 30% cost basis reduction on the long option for just two days in the short option.

Max Loss —The max loss on this trade is the debit paid, which is $162. This is realized if the stock is below $15 by the expiration of the long option.

Max Profit—The risk graph above assumes we are at expiration on Friday, Dec. 8, and I also included a 20% reduction in implied volatility in the long option. The long option currently has an IV% of 123%, but further-dated contracts have an IV% around 100%, so I'm estimating that the long option will "crush" down to those levels. With all of this said, the max profit estimate on Friday if the stock is above 18 peaks at $211 according to this theoretical risk graph.

We will see what happens with GameStop earnings after the close today, but hopefully for this trade's sake we see a move to the upside!

Tune in to Options Trading Concepts Live at 11 a.m. tomorrow for a full review of this strategy.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.