Junk Debt Sees Big Outflows in HYG: Will NFP Numbers Reward Buyers?

Junk Debt Sees Big Outflows in HYG: Will NFP Numbers Reward Buyers?

A Potential Floor Ahead of U.S. Jobs Numbers

- The junk bond market selloff is not over.

- Corporate debt remains at risk even with a Fed pivot, due to the economic malaise caused by the Fed's tightening cycle.

- HYG is at an inherent disadvantage vs. TLT, which is composed of safer debt.

Is the junk bond market selloff over?

The bound rout paused today while traders waited for the highly anticipated nonfarm payrolls report, otherwise known as the NFP, which was due Friday morning. The Federal Reserve uses this report as a critical input for decision making. It is currently triggering the bond selloff because of the "higher-for-longer" narrative that has spread into financial markets.

The Treasury market has experienced this more than any other part in the financial markets. Although short-term rates—the ones more sensitive to monetary policy moves—remain relatively calm, the threat of higher borrowing costs becoming permanent in the economy darkens the economic outlook. These fears are evident when we observe long-term bonds (/ZN and /ZB).

In the weeks following September's meeting of the Federal Open Market Committee, or FOMC, corporate debt experienced a notable selloff. Corporate bonds declare, “The recession is imminent.” But does it really? By examining the performance between Treasuries and corporate debt, we might predict an answer to that question.

This week, the iShares 20+ Year Treasury Bond Exchange-Traded Fund, also recognized by its ticker symbol TLT, has declined over 3%, which followed a 3% reduction the week before. Meanwhile, during the same reference periods, HYG has seen a selloff.

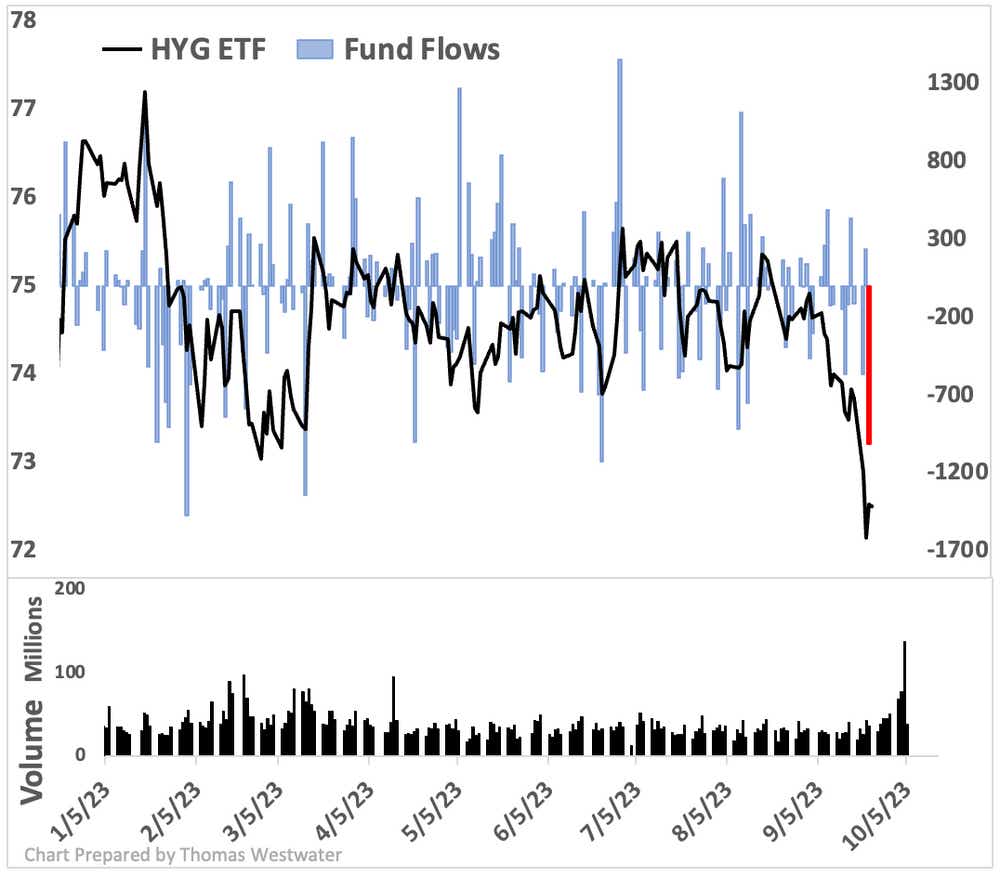

However, price performance tells only part of the story. Fund flows have remained relatively strong for TLT, as bond traders bet on a turnaround point in Federal Reserve policy. Alternatively, HYG is seeing heavy weekly outflows—with this week on track to record the biggest negative fund flow since July (see chart below).

Yesterday, HYG also saw one of its highest daily trading volumes on record, trading nearly 140 million shares vs. an average of about 36 million shares per day. That was on an up day, which signals some bullish appetite for the ETF, or exchange-traded fund, around the 72 price level.

The message traders are seeing—in my view—is this: the Fed will eventually pivot, and when it does, Treasuries will catch a bid. A cohort of traders are betting they can catch the turning point, which helps to stem fund flows out of TLT.

HYG, however, is at a disadvantage. Even with a Fed pivot, corporate debt will remain at risk for some time as the economic malaise caused by the Fed’s tightening cycle continues. This puts HYG at an inherent disadvantage vs. TLT, which is composed of safer debt. Will Friday’s NFP numbers save corporate debt if the numbers come in short?

What’s the trade on HYG?

The recent decline in bonds, particularly in junk debt, has caused a spike in volatility. That bodes well for those looking to collect premium on the instrument. Currently, HYG holds an implied volatility rank (IVR) of 32.5. That said, selling a put spread makes sense for those who may want to get into a long position at the current levels. For those betting on further selling, a short call spread may offer some attractive premium.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.