The Bear Case for Coinbase (and others) After Bitcoin ETF Approval

The Bear Case for Coinbase (and others) After Bitcoin ETF Approval

Market update: Coinbase down 14.07% week-to-date

- The Bitcoin ETF approvals may bring legitimacy to the cryptocurrency industry, while ironically harming some legacy crypto companies along the way.

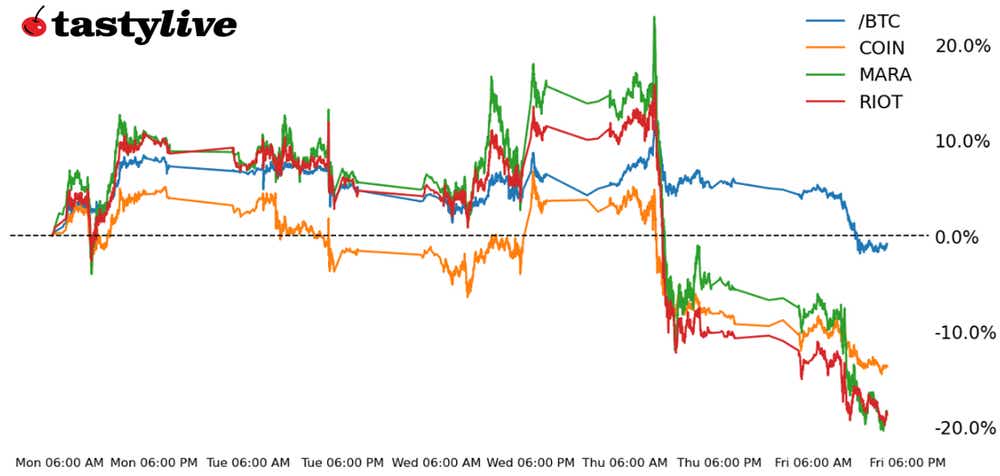

- Volatility in bitcoin (/BTC) was high this week, with prices more than -10% off their highs.

- Ethereum (/ETH) may be in the early stages of its own "buy the rumor, sell the news" cycle.

It’s been a banner week for the cryptocurrency industry, with the Securities and Exchange Commission (SEC) formally approving a slew of spot Bitcoin ETFs after a decade-long battle.

And what a week it’s been for anyone who has just been introduced to trading cryptocurrency markets: after rallying to its highest level since Dec. 21, bitcoin (/BTC) is on the verge of closing down more than 10% from its high. A timely reminder that volatility is a feature, not a bug!

Even though the reaction to the seminal news this week seems like a typical case of ‘buy the rumor, sell the news,’ there’s arguably been bigger casualties than /BTC itself (which was only down 0.05% for the week, despite its dramatic drop from its high, at the time of writing). Companies that have thrived over the past year as proxies to /BTC, like Coinbase (COIN), have been absolutely slammed this week. COIN was down over 14.5% at the time of writing. Unfortunately for COIN, the table is set for this bearish price action to continue.

Cryptocurrency companies are threatened by bitcoin ETF approvals

On the Jan. 10 episode of Overtime, we discussed the ramifications of the Bitcoin ETF approvals (starting at 25:28) and how it would impact the space beyond /BTC itself. The past two days of price action have vindicated the two perspectives laid out. And the two perspectives remain valid for the foreseeable future.

First, on the value of cryptocurrency companies and stocks. Much of the appeal for cryptocurrency stocks in recent years was unrelated to the business’ underlying prospects but rather their proximity to bitcoin and digital assets. Trading companies like Coinbase, Marathon Digital Holdings (MARA), or Riot Platforms (RIOT) were merely a proxy trade for bitcoin writ large.

Now, that’s no longer necessary. It’s much easier to get exposure to Bitcoin directly vis-à-vis the suite of recently approved ETFs. You can cut out the corporate middleman—the corporate governance, debt structures, cash flows, etc.—and not worry about any of the non-bitcoin factors in getting exposure.

For COIN, the bitcoin ETF approvals may even be worse. COIN makes a significant portion of its revenue from bitcoin transactions. If you’re using COIN to trade bitcoin, you’re paying a fee of roughly 2.5%. You can get the same exposure to Bitcoin by the ETFs as low as a 0.19% fee. This is a classic example of "ETF wars." When two ETFs offer the same exposure to the same product, the only way to compete is to reduce fees. Why pay more for the same thing?

Technically speaking, /BTC proxy companies are struggling mightily in the wake of the bitcoin ETF approvals.

COIN Coinbase price technical analysis: daily chart (May 2023 to January 2024)

Despite gapping open higher on Thursday, COIN quickly lost traction and crashed down to close near its 2024 lows on Friday.

COIN has lost 24.8% through the first two weeks of this year, and somewhat remarkably, volatility has started to decline (IV index: 84%; IV rank: 28.8). Momentum has turned bearish quickly. COIN is below its daily 5-, 13-, and 21-EMA envelope, which is in bearish sequential order. slow stochastics are trending lower while in oversold territory, and moving average convergence/divergence (MACD) is declining towards a cross below its signal line. The path of least resistance is lower towards the July 2023 high at 114.43.

MARA Marathon Digital Holdings price technical analysis: daily chart (May 2023 to January 2024)

Like COIN (and RIOT), Marathon Digital Holdings' strong start on Thursday was contained and collapsed into the end of the week. Now down 19.2% year-to-date, MARA’s technical profile has deteriorated sharply in recent days. MARA is below its daily 5-, 13-, and 21-day exponential moving average (EMA) envelope, which is not yet in bearish sequential order. Slow Stochastics are trending lower towards oversold territory, and MACD has issued a bearish crossover (albeit above its signal line). Now through the low in the first week of January, MARA appears poised to return to the 14/16 area in the coming sessions.

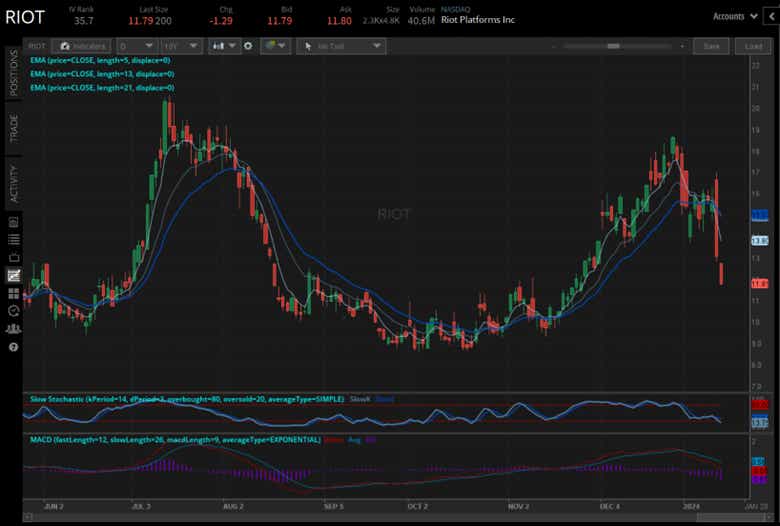

RIOT Riot Platforms Digital Holdings price technical analysis: daily chart (May 2023 to January 2024)

From bad to worse, RIOT’s technical setup may be the most daunting of the three discussed thus far. A clear head and shoulders pattern has formed with the head at 18.75 and the neckline at 13.75; a clean five-point move lower to 8.75 is eyed. Like COIN and MARA, RIOT’s momentum profile has turned aggressively bearish; further losses towards the measured move of 8.75 are expected.

Ethereum playing catch-up as hype cycle begins

The second perspective was that as the "buy the rumor, sell the news" cycle played out in /BTC, the focal point of speculative attention would shift to Ethereum (/ETH). There are debates over whether or not /ETH is a security. Let’s set those aside for a moment. /ETH enthusiasts have long said that once the SEC approved spot bitcoin ETF, spot Ethereum ETFs would be around the corner. The market is embracing the narrative. /ETH has outperformed /BTC by 16.03% this week. After lagging /BTC for 2023, the early part of 2024 may offer an opportunity for /ETH to outperform /BTC.

/ETH Ethereum price technical analysis: daily chart (November 2022 to January 2024)

Unlike most everything else mentioned here thus far, /ETH is far from bearish: it’s closing the week at a 52-week closing high, its highest close since May 2022. Momentum has turned increasingly bullish in recent days, with /ETH above its daily EMA envelope, which is in bullish sequential order. Slow Stochastics have risen into overbought territory, and MACD is trending higher above its signal line. No immediate upside target exists, as this is a pure "buy the rumor, sell the news" momentum setup at present time.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices