U.K. CPI Preview: British Pound at Risk as Markets Call Bank of England Bluff

U.K. CPI Preview: British Pound at Risk as Markets Call Bank of England Bluff

By:Ilya Spivak

The British pound may fall as U.K. inflation data bolsters speculators betting that the Bank of England will be forced to cut interest rates faster than the central bank is willing to admit

- The British pound jumped as the Bank of England resisted rate-cut speculation.

- Markets are calling the central bank’s bluff, angling for dovish capitulation.

- Soft U.K. CPI data may bolster traders’ conviction, pressuring the pound lower.

The British pound raced higher as the Bank of England (BOE) pushed back against markets betting that it will have to join central banks in the U.S. and the Eurozone and begin cutting interest rates next year.

The currency jumped to a three-month high as BOE officials argued that “restrictive” monetary policy is likely needed for an extended period. The officials went on to warn that “policy must be restrictive enough for sufficiently long,” adding that “indicators of inflation persistence remain elevated.” BOE Governor Andrew Bailey hoped aloud that the top of the rate hike cycle has been reached, but pointedly added that it is too early to speculate on cuts.

Perhaps most tellingly, the voting tally on the nine-member Monetary Policy Committee (MPC) that steers policy remained unchanged at 6-3, with a majority favoring inaction while three members continued to press for a rate hike. That seemed to suggest a dovish shift in the consensus is yet to materialize.

Markets to the Bank of England: “We don’t believe you.”

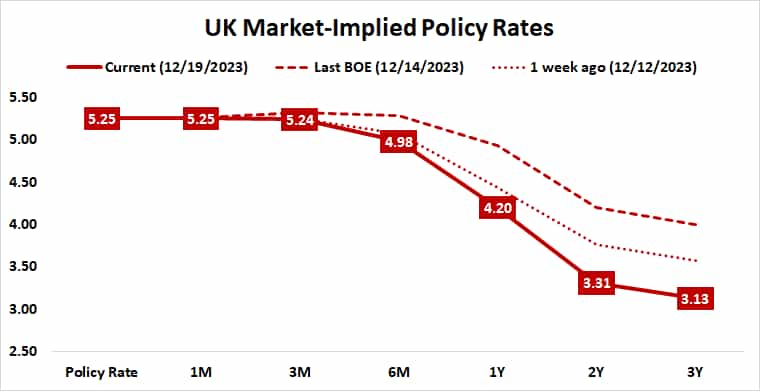

Investors are dubious. The implied policy path priced into the swaps market moved to a more hawkish setting in the immediate aftermath of the BOE meeting—explaining the pound’s surge—then swung sharply in the opposite direction. In fact, the one-year outlook puts rates even lower than they were pegged before the central bank weighed in.

As it stands, the first 25-basis-point (bps) cut is penciled in to appear no later than June. An earlier reduction in May carries a hefty probability of 73%. Four such cuts are on the menu for 2024, bringing the target interest rate down by a full 1%. The spotlight now turns to United Kingdom inflation data and how the markets might revise this view in its wake.

The headline consumer price index (CPI) measure of price growth is expected to have risen 4.3% year-on-year in November. That would be a climbdown from October’s 4.6% as well as the lowest reading since October 2021. Analysis from Citigroup warns U.K. data flow has been lagging forecasts recently, hinting a downside surprise risk.

British pound at risk if U.K. CPI data boosts rate cut bets

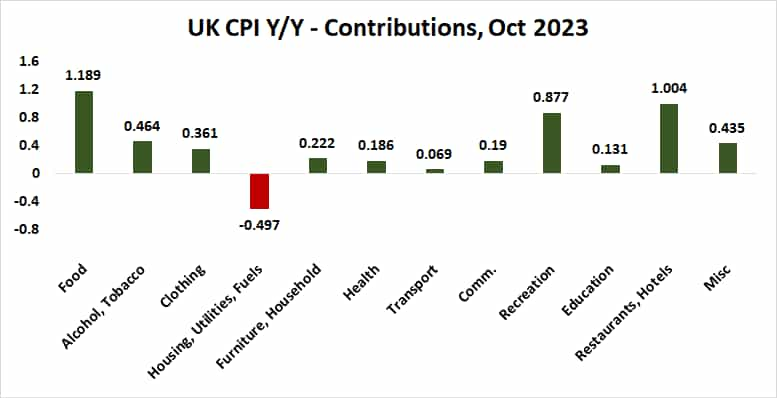

A look at the contributing factors keeping inflation above the BOE’s target 2% bolsters the case for continued cooldown. Food prices remain the single biggest factor. Leading data from the United Nations shows they’ve already shed 25% since peaking in March 2022. A transmission lag to CPI of about 7 months means disinflation here is set to continue.

The other key areas of uplift—recreation and hospitality—are firmly cyclical. Price growth here is likely to fizzle as the slowing economy cuts into discretionary spending. The latest round of purchasing manager index (PMI) data from S&P Global put the economy at near-standstill in December.

CPI data reiterating these themes anew may bolster the markets’ dovish conviction, underpinning bets on a “sooner and deeper” rate cut cycle and driving the British pound lower. Losses may be most pronounced against the Japanese yen, where the Bank of Japan triggered a kneejerk selloff this week, as expected.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices