Stock Markets Face Make-or-Break Decision on U.S. CPI Inflation Data

Stock Markets Face Make-or-Break Decision on U.S. CPI Inflation Data

By:Ilya Spivak

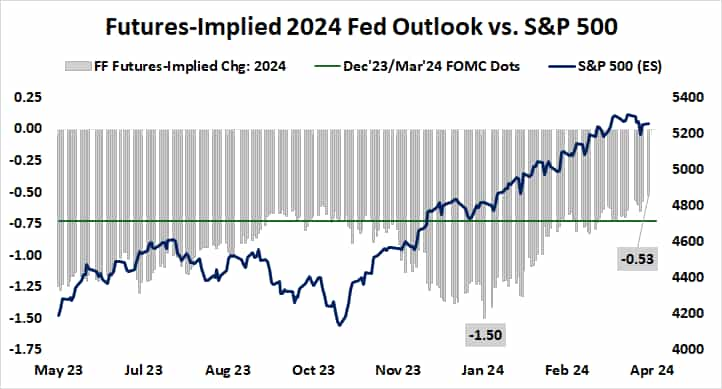

Stock markets may be forced to decide if their blistering five-month rally can survive with fewer Federal Reserve interest rate cuts than even the central bank itself expects

- U.S. CPI inflation data is front and center for Fed policy expectations.

- Minutes from June FOMC meeting may illuminate officials’ thinking.

- The ECB might set the stage to begin cutting rates ahead of the Fed.

Last week, Wall Street was of two minds about whether investors’ risk appetite can hold up amid diminishing expectations for stimulus from the Federal Reserve. Traders cheered shockingly soft service-sector ISM data that seemed to open the way for rate cuts but shrugged off a strong U.S. jobs report that seemed to pull in the opposite direction.

The time to decide on a reaction function may be at hand this week as key inflation data comes across the wires and the central bank allows a peek into its thinking with the release of minutes from June’s policy meeting. As it stands, the markets price in just 53 basis points (bps) in cuts this year, against the Fed’s call for 75 bps.

Here are the macro waypoints that are likely to shape price action in the week ahead.

U.S. consumer price index (CPI) data

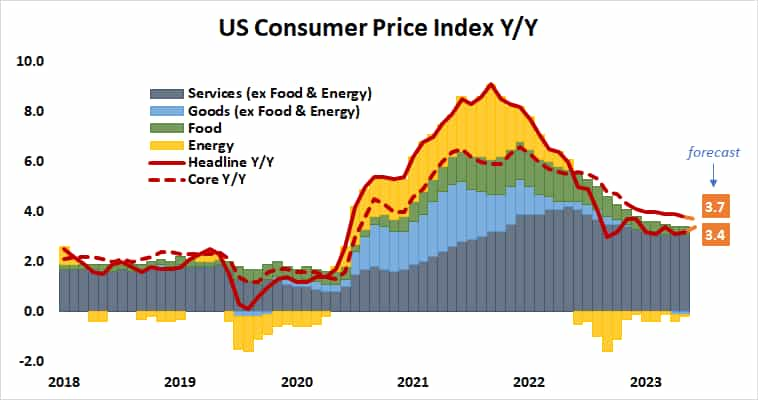

The March edition of the closely watched consumer price index (CPI) gauge of U.S. inflation will be looked at as defining input into Fed policy expectations for traders and central bank officials alike. It is expected to show that headline price growth accelerated to 3.4% year-over-year, the highest in three months.

However, the core measure excluding volatile food and energy prices–the focus for Fed officials trying to squeeze sticky inflation out of its last holdout in the service sector–is penciled in for a decline. It is seen inching down to 3.7% year-on-year, the lowest since April 2021. Progress here is mission-critical if the Fed is to justify rate cuts this year.

Federal Open Market Committee (FOMC) meeting minutes

An editorial account of last month’s meeting of the U.S. central bank’s policy-steering committee will be scrutinized by the markets. They will want to get a feel for officials’ logic in upgrading growth and inflation forecasts even as they stuck with December’s call envisioning three rate cuts in 2024.

Speaking at the press conference following this conclave, Fed Chair Jerome Powell said the upshift in expectations for key economic indicators reflected data that was already released. He then discussed starting to taper the pace of quantitative tightening (QT)–the slow reduction of the Fed’s balance sheet–in the near term.

European Central Bank (ECB) policy meeting

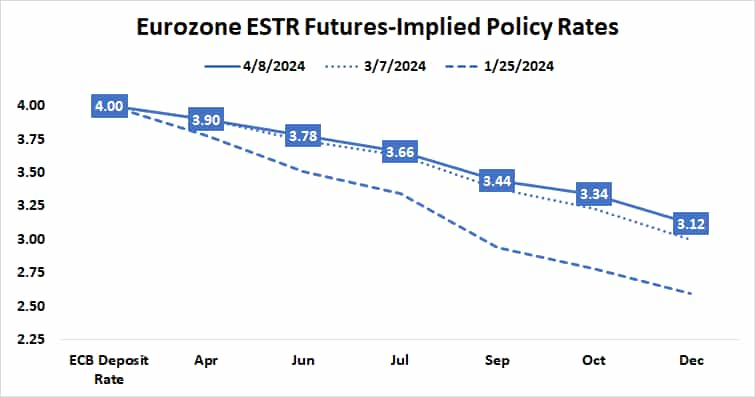

Rapid disinflation is expected to put the European Central Bank (ECB) on a path to begin cutting interest rates ahead of many of its major counterparts, including the Fed. President Christine Lagarde and company are expected to keep the target deposit rate unchanged at this week’s sit-down, but set the stage for the onset of easing at the next one.

The markets put the probability of a standard-sized 25 bps cut at a commanding 88% at the June policy meeting. At least two more cuts are seen appearing between September and December. Overall, markets have priced in 79 bps in easing for 2024, amounting to three cuts and a 16% chance of a fourth one.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.