Macro Week Ahead: U.S. CPI Inflation, Bitcoin ETF Decision, China Economic Data

Macro Week Ahead: U.S. CPI Inflation, Bitcoin ETF Decision, China Economic Data

By:Ilya Spivak

U.S. inflation data is in focus as markets remain laser-focused on the outlook for Federal Reserve interest rate cuts. Risk appetites may sour as the SEC approves bitcoin ETFs and China’s economy remains in the doldrums.

- Analysts eye U.S. CPI inflation data as markets remain fixated on the Fed rate-cut outlook.

- The SEC might approve bitcoin ETFs, but will that boost crypto prices?

- Anemic economic news from China might feed global recession worries.

Financial markets spent the first week of January backtracking on moves defining the final two months of 2023. That translated as pain for stock and bond markets while yields and the U.S. dollar marched higher as traders scaled back Federal Reserve rate-cut expectations.

The adjustment pointedly ran out of steam after Friday’s release of December’s U.S. employment data. Key benchmark assets—from Wall Street equity benchmarks to Treasury bond futures to major currencies—seesawed in broad ranges but ultimately settled little changed.

The key question now is whether this means that a corrective adjustment has played out, paving the way for late-2023 trends to reassert themselves, or if a further unraveling still looms. Below are the key macro waypoints ahead.

U.S. CPI data

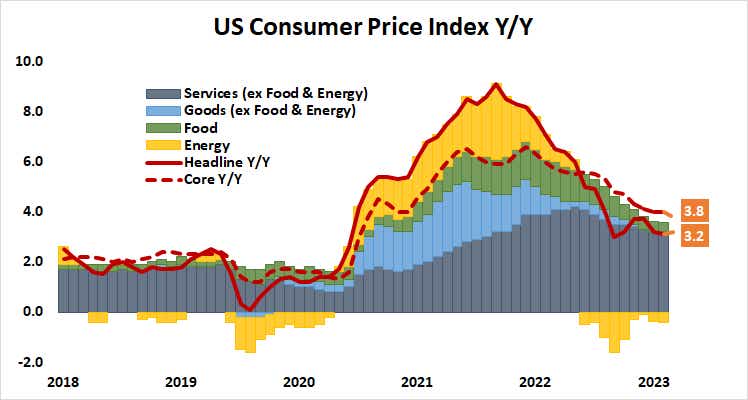

U.S. inflation data looks likely to support the case for a pivot away from interest rate hikes. Experts expect the headline consumer price index (CPI) to have risen 3.2% year-on-year in December, marking a slight pickup from November’s 3.1%. But it is likely to be the core CPI measure—excluding more volatile food and energy—that takes top billing.

The core inflation trend is the most relevant for Fed policymakers, and thereby for market-watchers trying to divine the central bank’s next moves. There’s little that officials can do about food and energy prices set on global markets. Furthermore, goods inflation has been thoroughly squeezed out, leaving services as the place to monitor.

On this score, there seems to be welcome news ahead for Fed Chair Jerome Powell and company. Core CPI growth is expected to inch down to 3.8% year-on-year, marking the slowest reading since May 2021.

Analytics from Citigroup suggest U.S. economic data outcomes have increasingly converged on consensus forecasts since mid-August as analysts upgraded 2024 growth expectations. That seems to imply that their models are relatively well-tuned to economic reality, making sharp deviations from the baseline seem less likely.

The markets may welcome a broadly as-expected outcome, reasoning that the sight of ongoing disinflation will at least encourage the Fed’s dovish instincts. This might nudge up stocks and bonds alike. A downside surprise could amplify such moves and put the U.S. dollar under pressure. An upside one may bring back last week’s trends.

The SEC will rule on bitcoin ETFs

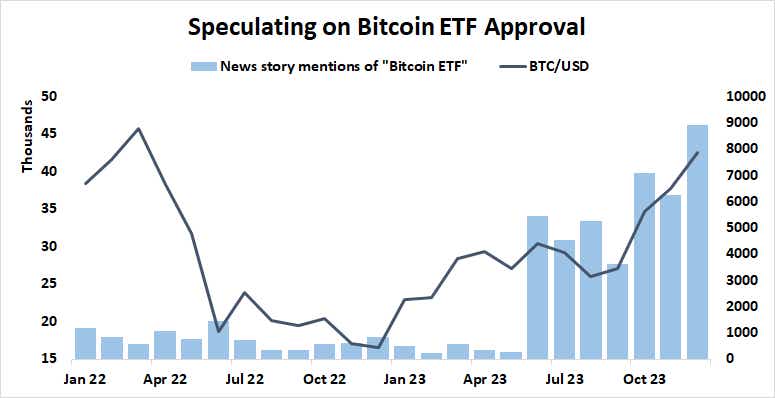

The U.S. Securities and Exchange Commission faces a Jan. 10 deadline to weigh in on a stack of applications for spot Bitcoin exchange traded funds (ETFs). One of the most closely watched bids to offer such a product comes from BlackRock. Experts widely expect approval. Markets have speculated that this will bring broader participation from retail buyers.

The key question now is whether such an outcome still might boost BTC prices after months of heady speculation. A measure of news story mentions of “bitcoin ETF” compiled by Bloomberg reveals interest has been growing rapidly in recent months. That has probably helped lift the crypto benchmark, along with building Fed rate-cut bets.

Approval now might bring a “buy the rumor, sell the news” response from the markets. Traders may opt to take profit on positions betting on a favorable SEC result once event risk uncertainty evaporates, leaving the story without fresh fodder for price movement.

Looking beyond the crypto space, markets may read a selloff following SEC approval as indicative of circumspect risk appetite and broader economic weakness. If speculators are not willing to bet that a flood of retail buyers will be unleashed quickly, that might be seen to imply defensively minded consumers.

China credit, inflation and trade data

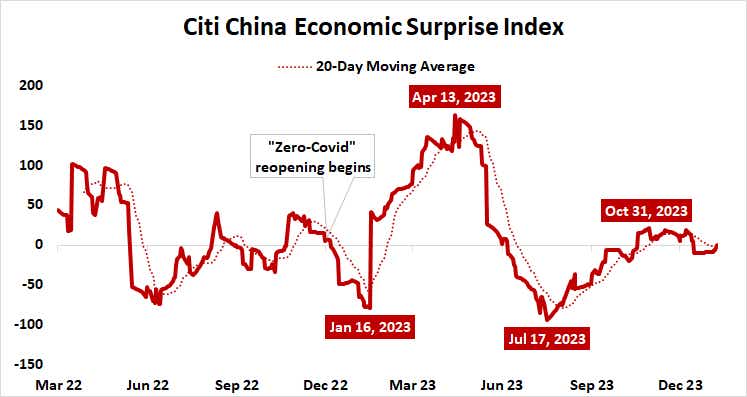

An assortment of economic indicators from China will help illustrate if the world’s second-largest economy is any closer to revival after limping along for a year since scrapping “zero-COVID” lockdowns. CPI and PPI numbers are expected to show deepening deflation in December, despite a slight pickup in lending growth.

The story on the trade side of the equation looks a bit more encouraging. Exports growth is projected to have accelerated, posting the largest rise since March 2023 at 9% year-on-year. Imports are seen falling 0.5% as domestic demand remains soft, but at a slower pace than the 0.6% decline in November.

As with the U.S., Citigroup data suggests that analysts’ forecasts and realized results for Chinese economic news-flow have converged. If this foreshadows broadly in-line outcomes, the bundle of indicators may help revive recession fears as the global business cycle continues to face headwinds from anemic conditions in one of the top growth engines.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices