Burry's Latest Bearish Bet—But It's Not What You Think!

Burry's Latest Bearish Bet—But It's Not What You Think!

A CNN headline posted today reads, "Michael Burry, of ‘Big Short’ fame, just bet $1.6 billion on a stock market crash" Well, not exactly.

Hedge fund manager and founder of Scion Capital Michael Burry is most famous for his short of the subprime mortgages during the real estate crisis in 2007-2010.

Is Burry short $1.6 billion on the S&P 500 (SPY) and Nasdaq (QQQ)? The short answer is "NO."

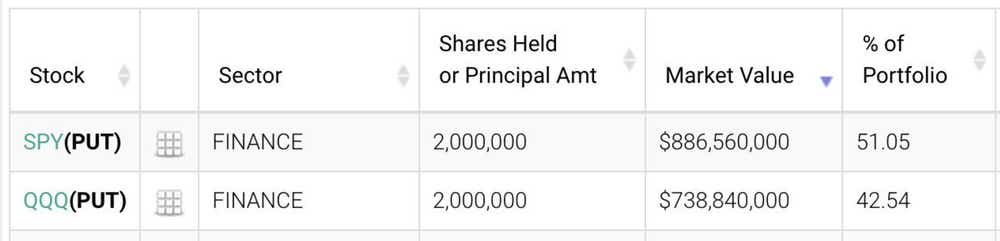

Burry released his Q2 13-F filing with the list of holdings most notable was his bearish option trade.

Michael Burry just shorted the market!

For the umpteenth time. And it's really not what you think it is.

Michael Burry is a hedge fund manager and founder of Scion Capital, most famous for his short of the subprime mortgages during the real-estate crisis in 2007-2010. This was famously portrayed in the movie The Big Short, which was based off his legendary call.

Burry released his Q2 13-F filing with the list of holdings most notable was his bearish option trade.

Is this The Big Short?

When Burry talks, people listen, but they might be getting the wrong impression here.

Is Michael Burry short $1.6 billion on the S&P 500 (SPY) and Nasdaq (QQQ)? The short answer is no. We don’t even know if he still holds this position as it is nearly 60 days since this reporting.

Financial reports use notional value as a metric for market value. Each option has the potential notional exposure of 100 shares of stock. So, the value of each option is calculated as 100 times the value of the security. This, of course, is a bit misleading as we do not know what his strike price is or expiration. And he would likely never take short shares on the position.

At 2 million “shares” of each of SPY and QQQ, this would equal 20,000 put contracts for each ETF. This is certainly a large position but is a drop in the bucket for either ETF which trades millions of put/call contracts per day.

He also didn’t throw $1.6 billion into a market short. So, what might he be holding? And what might be the actual value of the position be? It’s certainly not in zero days till expiration options!

Let's say he got it all right–and is holding a now slightly in-the-money strike on both SPY and QQQ. For SPY, say the $450 strike, and for QQQ say the 370. Let's assume through the end of the year, using the Dec. 15 monthly expirations.

Currently, the SPY 450 strike put option has an open interest of roughly 26,000 and QQQ $370 strike has an open interest of roughly 29,000 contracts, enough to account for his position size

The SPY $450 put currently trades at around $15, at 20,000 contracts that would equate to a current value of roughly $30,000,000. The QQQ $370 put option also trades at around $15 so around $30,000,000 in current market value.

While a total of $60 million in value is certainly large–and this is just my estimate, and the high end of the range at that–it is certainly not $1.6 Billion!

Is it time to get short?

Burry is certainly an enigmatic figure–he’s had some amazing calls but has also been on the other side of the trade many times. Just like any other trader!

The size of this trade is very small relative to the assets under management—the headlines are much sexier than the position.

SPY has a current implied volatility of 18%, implying a roughly +/- $40 one standard deviation move through the end of the year (roughly 10%).

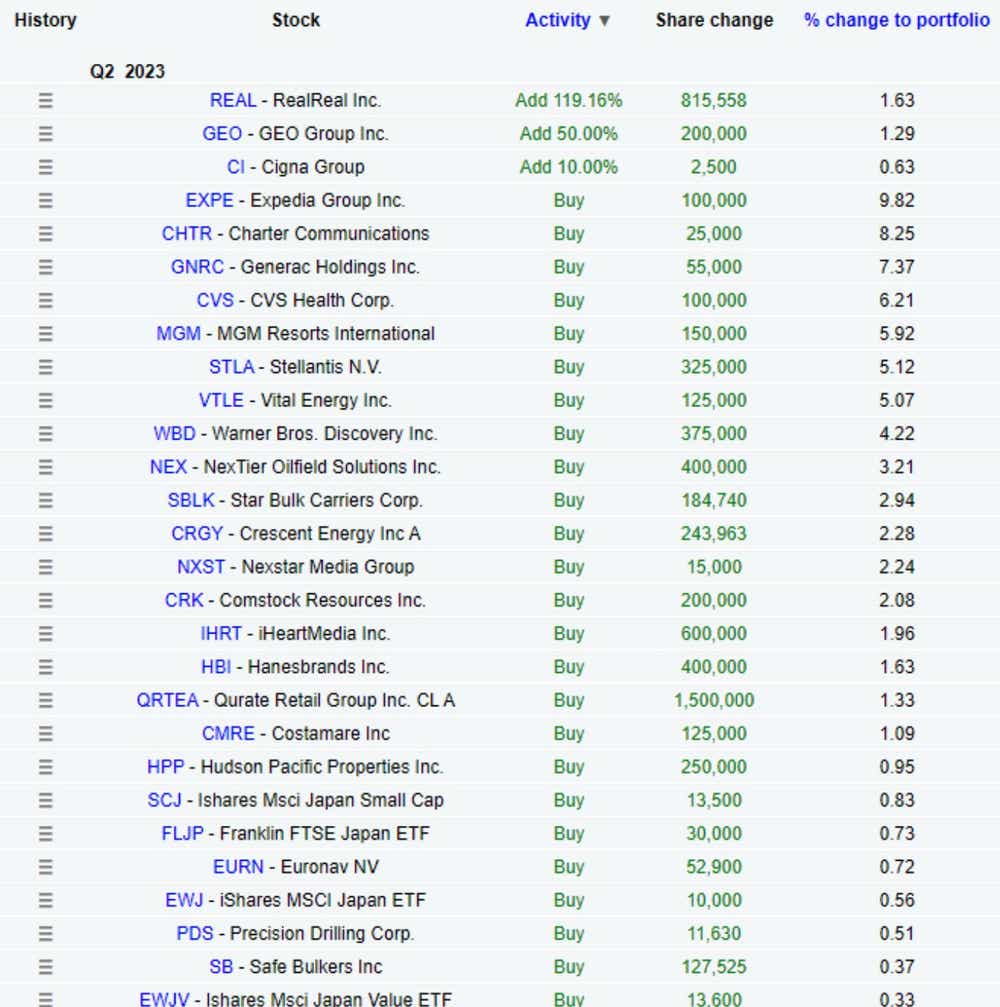

Here are the rest of his holdings:

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.