Canadian Dollar Falls to 5-month Low as Oil Surges

Canadian Dollar Falls to 5-month Low as Oil Surges

The Canadian dollar decouples from oil. As Canadian dollar traders lose a vital oil signal, what should they focus on?

- The Canadian dollar (/6c) loses a vital signal in oil prices.

- Why is the U.S. dollar driving price action in the Loonie?

- What should traders know as the key correlation breaks down?

Unlike the U.S. dollar, which is fortified by a service-oriented yet deeply diversified economy, the Canadian dollar traditionally fluctuates in tandem with the price of crude oil, Canada's largest export. However, this relationship has recently diminished, a cause for concern given the recent surge in oil prices.

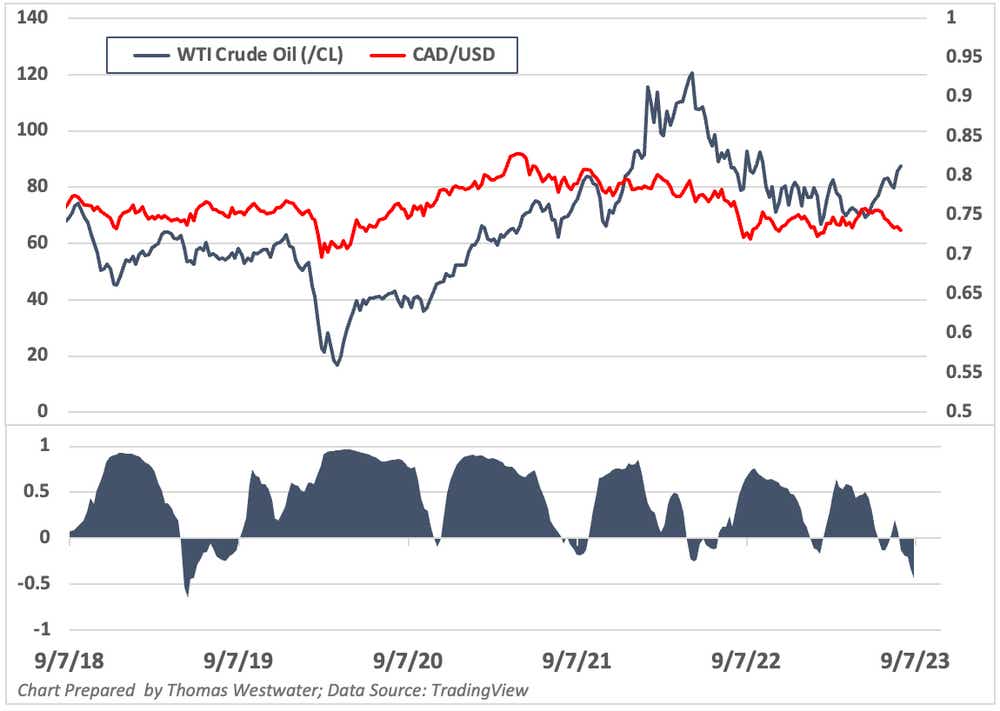

The correlation coefficient of the Loonie, a statistical measure of how two variables move in relation to one another (where 1 signifies a perfect positive relationship and -1 indicates a perfect negative relationship) against West Texas Intermediate (WTI) oil, has averaged 0.46 since September 2019. This figure represents a strong positive correlation. However, this measure plummeted to -0.43 in early September.

Despite a slight increase in Canadian crude oil exports over the last year, the decline does not justify the sharp selloff in the Canadian dollar (symbol: /6CU3), particularly considering the current oil prices. Since the beginning of August, /6CU3 has depreciated by 3.3%, hitting a five-month low, while crude oil (/CLU3) has appreciated by over 7%.

What explains this divergence?

Several factors are propelling the current market trends, with the primary force stemming from interest rate expectations in a faltering Canadian economy. The Bank of Canada (BoC) appears to have concluded its rate-hiking cycle. On Sept. 6, the BoC maintained its benchmark rate, signaling the end of its rate-hiking phase. Swap traders concur, as market pricing leans towards no additional rate hikes.

This decision was foreshadowed by Canada's gross domestic product (GDP) for the second quarter, which experienced a 0.2% decline on an annualized basis, falling short of analysts' expectations of a 1.2% growth. In contrast, the U.S. manufacturing sector demonstrated expansion, buoyed by a robust labor market. Given that /6C futures are significantly influenced by the dollar, this development exerted pressure on the Loonie.

What do traders need to know

The divergence between oil prices and /6C is no longer a reliable indicator for trading Canadian dollar direction. While Canada exported roughly 3.97 million barrels per day (Mbbl/d) in June, up from 3.85 Mbbl/d from a year ago, it hasn’t helped /6C from plummeting over the past 5 months.

Instead, traders may want to focus more on the U.S., its currency and influencing factors there such as Treasury yields, economic data and monetary policy decisions until the correlation returns to positive territory.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwaterFor live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices