Crude Oil Spreads Point to More Upside as Russia Cuts Exports

Crude Oil Spreads Point to More Upside as Russia Cuts Exports

Prices remain supported as time spread backwardation increases

Crude oil prices remain supported as time spread backwardation increases.

Russia export cuts will support inventory drawdowns in the coming months.

Chinese crude buying may rebound in the coming months following OSP cuts.

The broader Organization of Petroleum Exporting Countries (OPEC) alliance, known as OPEC+, is moving toward tighter compliance with the group’s production cut targets. Bloomberg reported Russian crude exports measured on a four-week average fell to the lowest since January.

Russian oil flows to China have come under pressure as soft demand from refiners over the last couple of months continues. The reductions in Russia come after the end of maintenance for refiners in the country, suggesting the weakness stems from compliance with OPEC instead of operational issues.

China’s crude appetite may improve in the coming months after Saudi Arabia’s cuts to the official selling price (OSP). More OSP cuts are expected, which could incentivize China to ramp up purchases in the coming months.

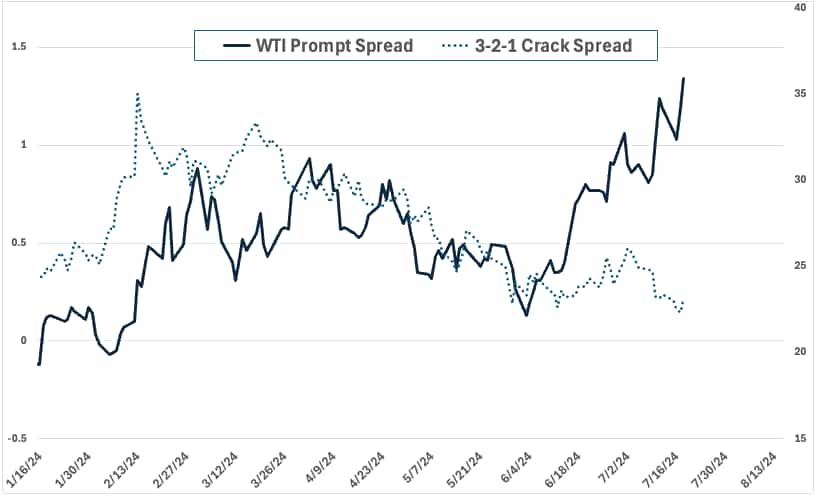

That should support the global crude complex, which has shifted into deeper backwardation over the past couple of weeks. The West Texas Intermediate (WTI) prompt spread rose to $1.47 this week, the steepest since October 2023. Brent crude oil time spreads accelerated sharply this week, rising to $1.18.

The cause of the backwardation is likely OPEC supply cuts. If China ramps up its buying, the physical market will likely underpin strength in time spreads, which promotes inventory withdrawals. The case for bulls relies heavily on Russia keeping exports low. A rebound in Chinese demand would also bolster the long view.

Crack spreads, which represent refining margins, remain subdued, not only in the U.S. but in China as well. That poses a threat to the outlook but not an immediate one. If refining margins remain weak for more than a couple of months, it could cause refiners to cut run rates, reducing throughput of crude oil.

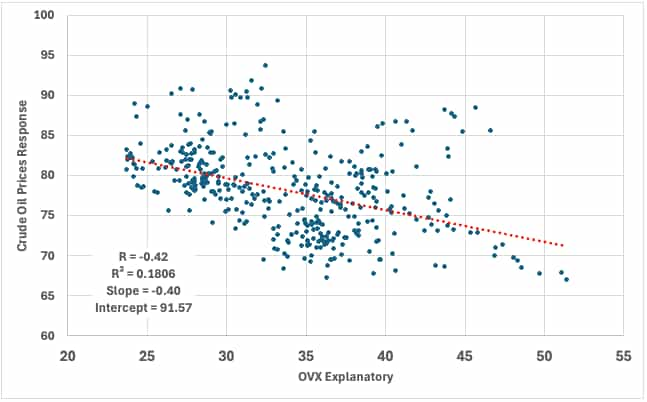

Meanwhile, oil volatility—as measured by the Chicago Board of Options Exchange’s oil volatility index (OVX)—is at levels not traded at since late 2018. That makes it cheaper to buy protective puts for oil, although we haven’t seen heavy buying for out-of-the-money (OTM) options on crude oil. That indicates market participants are confident oil prices have more upside. Regression analysis shows the OVX doesn’t have a great influence on crude oil prices—with 88% of the influence outside of the volatility indicator.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.