Crude Oil Market Tightens

Crude Oil Market Tightens

Lower inventories have front-month crude futures prices increasing at a faster rate

- Crude oil futures (/CL) rise as oil eyes its fourth weekly climb.

- The WTI prompt spread widens, signaling market tightness.

- U.S. inventories fell as signs point to production shortfalls.

WTI crude oil futures (/CL) are set to close out their fourth weekly gain after rising over 1% to $76.69 per barrel on Friday, through mid-day trading. Signs of a tighter oil market are flagging a signal to energy bulls. Friday’s move sets up prices to challenge levels not traded at since April, while July is on track for the largest monthly percentage gain since October.

Several factors are underpinning the strength in oil markets. First, the Organization of the Petroleum Exporting Countries (OPEC) and its ally Russia have initiated a series of production cuts. Speaking of OPEC’s eastward ally, Moscow has recently injected new geopolitical uncertainty into commodity markets surrounding the grain deal, indirectly benefiting oil prices by increasing headline risk.

The production cuts have likely encouraged traders to refrain from purchasing downside protection on oil positions. This belief stems from the expectation that OPEC will not tolerate a sustained drop in prices. As a result, oil volatility, as measured by the Chicago Board Options Exchange’s Crude Oil Volatility Index, has fallen to multi-year lows this month.

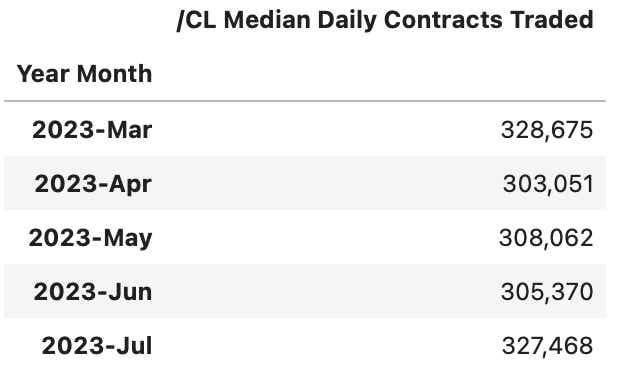

Simultaneously, contract volumes of crude oil have reached their highest point since March. These data points suggest that many traders hold a bullish view on the market. Last week, the Commodity Futures Trading Commission (CFTC) Commitments of Traders reported a 21,770 increase in long contracts among money managers for the week ending July 11. An update on this data is expected this afternoon.

Prompt spread signals market tightening

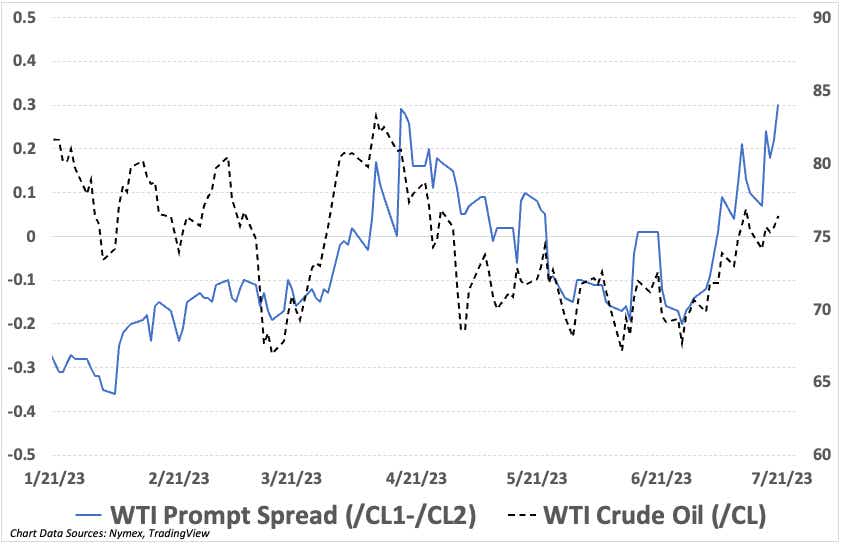

Now, the oil futures market is indicating a potential increase in prices. The time spread between the front-month WTI contract and the follow-on month experienced a surge on Friday, reaching its highest level since November at 0.33 after surpassing the April high mark.

The expansion of the time spread typically suggests a perceived supply/demand imbalance in the market. In this case, it is driven by front-month prices increasing at a faster rate than the next month's price. This indicates a higher demand for oil in the present compared to the future. The correlation between the spread and underlying oil prices is depicted in the chart below.

Earlier this month, the U.S. Energy Information Administration released its short-term energy outlook, which forecasted higher prices starting this month through the end of the year due to higher petroleum consumption and modest inventory drawdowns.

That said, oil inventories have started to decline. For the week ending July 14, U.S. crude stocks fell by 2.9 million barrels at the Cushing storage hub, and gasoline stocks declined by 1.06 million barrels. Headline risk and inventory data will likely drive oil prices over the coming weeks, but the price bias, for now, is angled upward.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices