U.S. Dollar Drops as Euro and Yen Gain in Trade War

U.S. Dollar Drops as Euro and Yen Gain in Trade War

By:Ilya Spivak

The trade war and the resulting uncertainty are taking a toll on the greenback

- The U.S. dollar is suffering steep losses as the global trade war heats up.

- The dollar’s ongoing loss of market share is likely to proceed, if not in a straight line.

- The euro and the Japanese yen will probably continue to outperform.

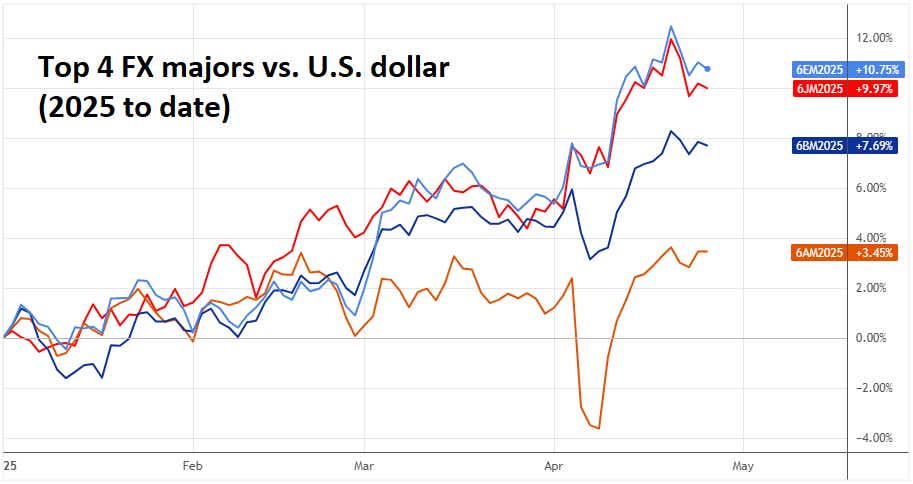

The U.S. dollar is attempting to stabilize after slumping to the lowest level in nearly seven months against an average of its major counterparts. Nevertheless, the greenback has lost nearly 10% of its value since the beginning of the year. This already puts 2025 on pace to be the worst year for the currency since 2017, and the second quarter has only begun.

Perhaps most critically, the dollar’s troubles mark a break from the trading patterns that have guided its performance for nearly 50 years. In April, it pointedly failed to find support from yield appeal as Treasury bond rates surged or from haven demand as the S&P 500 sank to 15-month lows.

Surging term premium—the cost of compensation for duration risk embedded in U.S. government debt—explains why the country’s stocks, bonds and currency have dropped in tandem. It speaks to acute concern about the U.S. fiscal trajectory. It’s a matter of rising sovereign risk after the rocky rollout of a new tariff regime by President Donald Trump.

U.S. dollar will probably keep falling

Flashes of moderation from the White House have helped anchor things a bit for now. Treasury Secretary Scott Bessent said a trade deal with China is inevitable because an embargo at both ends of the world’s most critical supply chain is untenable. In other welcome news, President Trump clarified that he will not try to fire Federal Reserve Chair Jerome Powell.

Nevertheless, the dollar’s troubles are probably not over, even if speculative forces help engineer a rebound in the near term. That’s because the undoing of global trade norms—a goal loudly championed by the Trump administration—will almost certainly reduce cross-border commerce and leave foreigners holding fewer greenbacks.

Growing trade incentivized countries exporting into the world’s largest consumer market to recycle dollar-denominated profits back into U.S. financial markets. That kept the dollar strong and fortified its purchasing power of foreign goods, underpinning demand for imports. With current trends, these inflows may become a trickle.

The euro and the yen seem primed to capture market share

The euro and the Japanese yen have stood apart as the main beneficiaries of dollar weakness so far this year. This seems to make sense: The two currencies occupy the distant second and third place after the dollar in terms of their share of global monetary transactions, according to the Bank of International Settlements (BIS).

_-_2022.png?format=pjpg&auto=webp&quality=50&width=900&disable=upscale)

This relatively deep liquidity is likely to keep the two currencies at the forefront as the dollar loses market share. It will almost certainty retain the top spot on the league tables, thanks to the peerless depth of U.S. financial markets—but with a narrower lead against its rivals.

Friendly central banks may help. The markets are flirting with the possibility of interest rate hikes from the European Central Bank (ECB) next year as a blistering buildout of defense capacity spurs growth and inflation. The Bank of Japan (BOJ) is alone among its peers in hiking rates this year, and markets expect it to continue in 2026.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.