Dow Futures, US Dollar Brace for Impact as ISM Data Shapes Fed Views

Dow Futures, US Dollar Brace for Impact as ISM Data Shapes Fed Views

By:Ilya Spivak

Rising Fed rate hike odds are keeping US stocks are under pressure and lifting the US Dollar. ISM manufacturing- and service-sector data is now in focus for clues about next steps.

- Rising Fed rate hike bets hurt stocks and lifted the US Dollar in February

- ISM manufacturing- and service-sector data in focus to guide next steps

- Measures of employment within the ISM surveys may be most impactful

Fed rate hike rethink sends markets scrambling

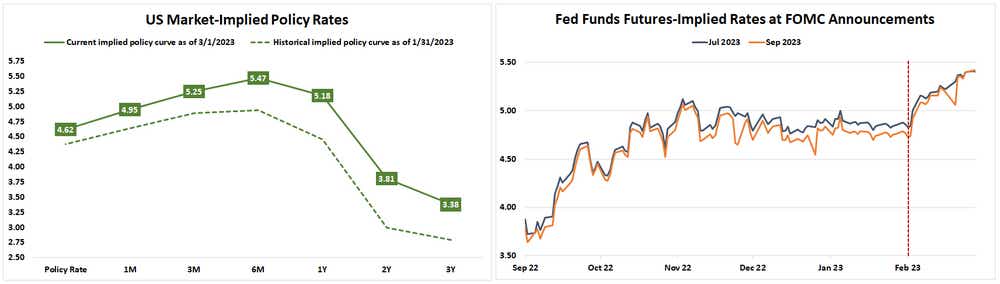

Stock markets fell alongside gold while the US Dollar enjoyed a spirited recovery in February as the markets upgraded Fed rate hike expectations. The priced-in rates path now envisions the end of the rate hike cycle in September with a peak reading in the 525-550 basis-point range (5.25-5.50 percent). That’s up from a midyear stoppage point below 500 basis points seen as recently as a month ago.

That the Fed may push rates higher and hold them there longer has understandably spooked investors. Much of the story from November 2022 through January 2023 was about investors rushing to buy beaten-up assets hurt amid last year’s brisk rate increases, on the premise that the end of the US central bank’s inflation-fighting program was in sight. The February rethink came thanks to some telltale economic data – strong jobs growth and hotter-than-expected CPI inflation – along with combative rhetoric from Fed officials.

Data source: Bloomberg

All eyes on ISM data as Fed speculation continues to churn

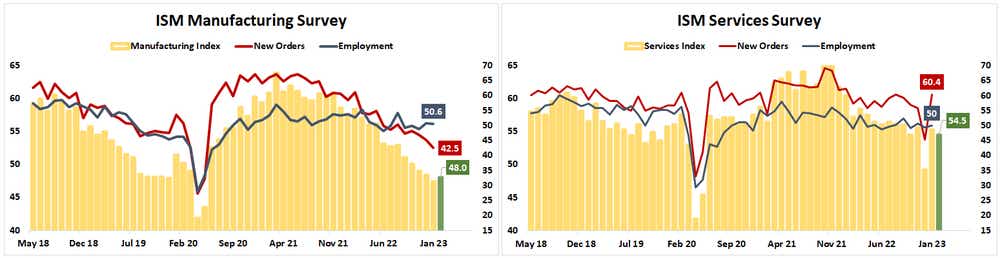

The next chapter in this story comes by way of February’s economic activity surveys from the Institute of Supply Management (ISM). These indicators are centered around “50”. Readings above this level mark expanding activity in the economic sector being tracked – either manufacturing or services – while values below it indicate contraction. The greater the distance from 50 in either direction, the faster the process underway.

Expectations point to a slight improvement on the manufacturing side, with a rise from 47.7 to 48.0 marking a slowdown in the pace of retrenchment. Meanwhile, the pace of activity in the services sector is seen slowing a bit, with the index ticking down from 55.2 to 54.5. Surprising on the upside in either case may strengthen hawkish Fed speculation, hurting stocks and pushing the US Dollar upward. Alternatively, a notable miss might offer the bulls a lifeline.

How the employment component fares in either case may be of particular interest in shaping traders’ thinking. While manufacturing has struggled even as the service sector mounts a spirited recovery, the hiring picture has looked remarkably steady on both fronts. Resilience here is much of the reason why the Fed feels it must press on with tightening. Loosening the reins now risks locking in higher wages, turning inflation into a much longer-term concern. A pickup in hiring may thus prove unsettling, whereas signs of the long-awaited break in labor market strength may lift risk appetite.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices