Engineering the Trade: Microsoft

Engineering the Trade: Microsoft

We may be experiencing a short term pullback on AI stocks—setting up for some bullish trading opportunities for MSFT.

- Artificial intelligence stocks have been the talk of the town in 2023.

- The "engineering the trade mentality" is to generate trade ideas based on things seen in everyday life.

- If the A.I.-related stock pullback is expected to be short-lived, then selling a Microsoft put option could be in order.

Have you ever seen the movie White Heat? The flick ends with bad guy Cody Jarrett (played by James Cagney) going out in a blaze of glory, exclaiming, "Made it Ma! Top of the world!"

If you listen hard enough, you'll hear me saying that while I am writing the first in a series of blogs dedicated to the Engineering the Trade show on the tastylive network. You should also know that the host (that would be me) often calls it the "most dangerous show" on the network. Why? Well, we attempt to help you become the type of trader who sees things in everyday life and tries to make sense of it all through the lens of trading. This can arguably become a wild way of generating trade ideas.

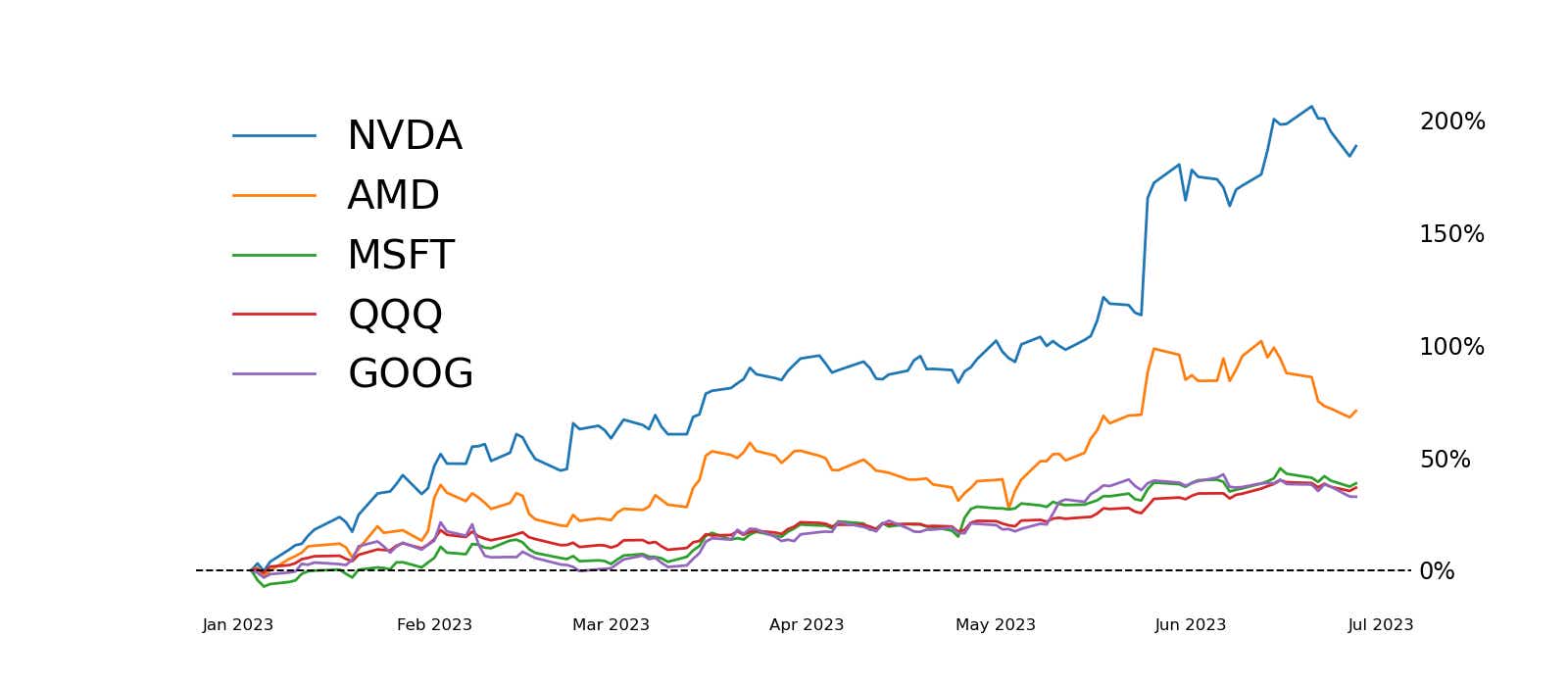

What do I mean? For example, let's take a look at the artificial intelligence (AI) stock revolution. Stocks like Nvidia (NVDA), Advanced Micro Devices (AMD), Microsoft (MSFT), Alphabet (GOOGL) and others have been the subject of much discussion in 2023 as their shares have powered higher because of the idea that eventually AI will take everybody's job. Like most fears, this is an exaggeration. However, if you were paying attention at the beginning of the year, you could easily see this coming.

As the months of 2023 have passed, many articles in the financial arena were about AI or how much it is already being used in everyday life. Many public companies started to discuss AI on their conference calls, which caused shares to skyrocket. Heck, even at tastylive, we have found ways to harness the power of AI in many tasks that we do on a day-to-day basis. I mean, everyone wants to make their job easier, right?

Currently, AI-related stocks are in the midst of a pullback, which is always a good thing for stocks that seem to be rising like a muffins in an Easy-Bake Oven. The real question: Is this a pullback or the beginning of a breakdown? That all depends on whether or not you believe this whole thing is legit or overhyped. Note that many of these names will be delivering third-quarter earnings over the next month or two, which should provide more data to help answer many of the questions we all have about this niche area of the technology sector. If you believe this pullback is short-lived, then perhaps a bullish trade is in order.

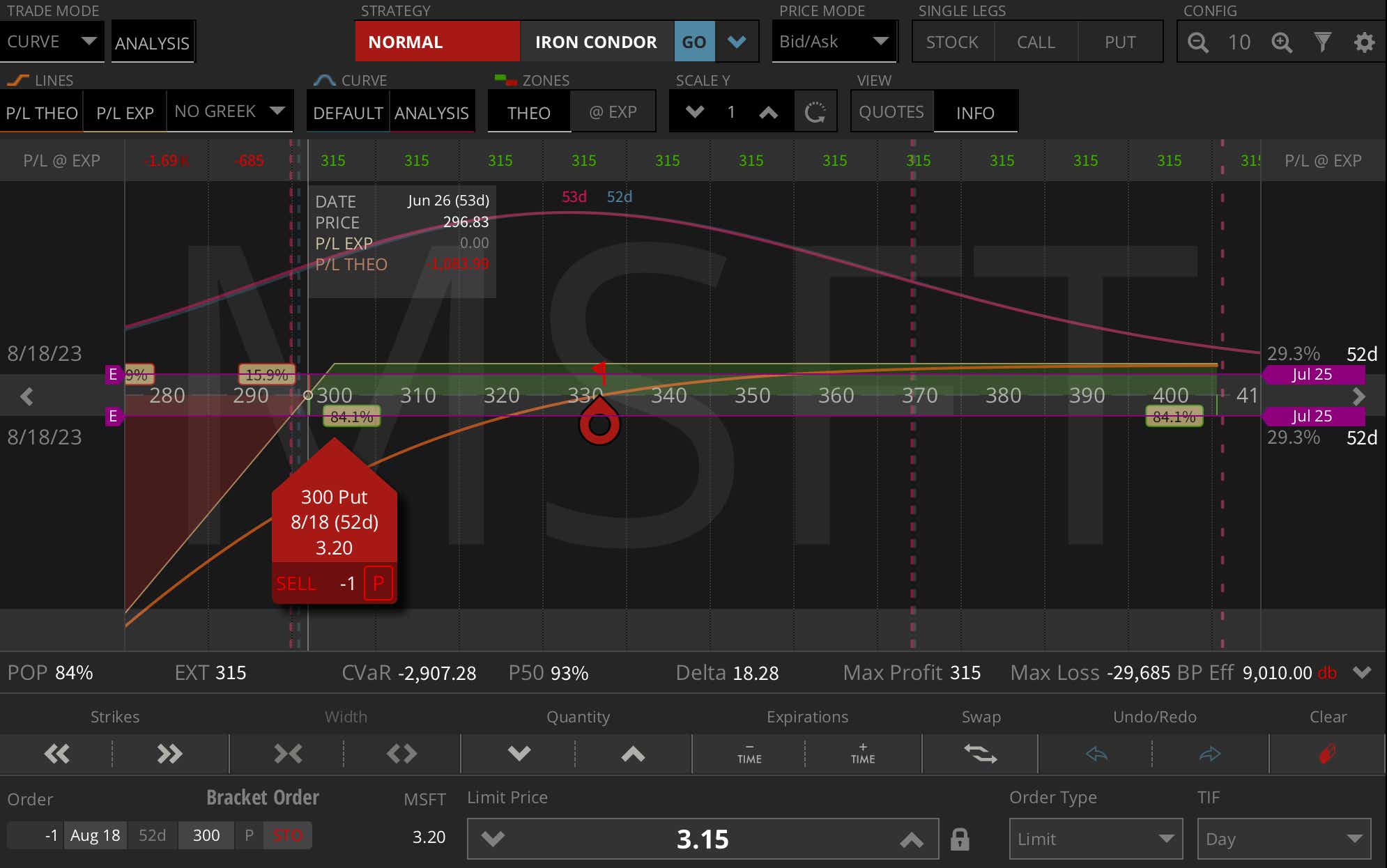

As I type this article, MSFT has an implied volatility rank (IVR) of 37. There are many ways to do bullish trades and, for the sake of discussion, let's analyze selling one August 300 strike put for 3.15 with MSFT stock trading $332.65. This trade would set you back $8,995 in a margined account. Your risk is to the downside on this trade. Your expiration breakeven occurs with MSFT trading $296.85. Below that, you lose money on the trade, and your max loss occurs with MSFT trading $0—the chance of which is low but not impossible. You win on the trade if MSFT continues to move higher in price and away from the 300 strike.

It might be a pullback, or it might be the beginning of a breakdown. Whatever it may be, let's go out in a blaze of statistically advantageous glory—just like Cody Jarrett.

Jermal Chandler, tastylive head of options strategy, has been in the market and trading for 20 years. He hosts Engineering the Trade, airing Monday, Tuesday, Thursday and Friday.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.