Ethereum 2.0. Merge Explained: What Is It and Why Does It Matter?

Ethereum 2.0. Merge Explained: What Is It and Why Does It Matter?

By:Mike Martin

Highlights:

- The predominant reason for the Ethereum Merge is to increase transaction throughput on the network.

- Ethereum will accomplish the Merge by shifting from a proof-of-work to a proof-of-stake network.

- The immediate effect of the Merge will be a 99.95% reduction in the network's energy consumption.

- In 2023, sharding will be introduced, dramatically increasing transaction throughput and reducing transaction fees on the network.

- Holders of ETH do not need to take action: ETH will automatically migrate to the Ethereum 2.0 network while the ETH symbol will remain the same post-merge.

What Is Ethereum?

Ethereum is the world's second-largest cryptocurrency (and blockchain) by market capitalization.

Unlike Bitcoin, the Ethereum network is Turing complete. This “Turing” capability allows the Ethereum network to store both transactions and code. This is in contrast to the Bitcoin network, which can only store transactions.

The code stored on the Ethereum network allows programs, or “smart contracts”, to run on the Ethereum network. These contracts are the lifeblood of decentralized applications and Web3.

However, the current state of the Ethereum network leaves a massive carbon footprint. Additionally, the fees to transact on the networks are high and the transactional output is low.

What is the Ethereum Merge?

The upcoming Ethereum Merge, known colloquially as the “The Merge”, will represent the most significant upgrade ever to the Ethereum network. The goal of this upgrade is to Merge Ethereum’s current proof-of-work consensus mechanism with a new proof-of-stake mechanism called the Beacon Chain.

Let’s first explore the principle differences between these two consensus mechanisms:

- In proof-of-stake, nodes are chosen at random to validate transactions and secure a network. To become an eligible validator, you must delegate coins to be staked within a network.

- In proof-of-work networks (e.g., bitcoin), transactions are validated by “miners” around the globe racing to solve a cryptographic puzzle to secure a network. A major concern with proof-of-work lay in its massive energy consumption - on an annual basis, bitcoin uses more energy than Argentina.

This marked change in the plumbing of the world's second-largest blockchain network comes not without risks - so why did the Ethereum community agree on a transition to proof-of-stake?

Let’s find out.

Why is the Ethereum Merge happening?

The Merge is chiefly happening to increase transaction throughput on the Ethereum network. This increase in throughput, however, will mainly be realized down the road in 2023. The Merge is simply opening the door for these later upgrades to happen.

One of the immediate benefits of the Merge will be a reduction in the amount of energy required to secure the network. Under the current proof-of-work consensus mechanism, Ethereum uses ~112 TWh of energy per year. That's on par with the Netherlands.

Post Merge, the energy required to run Ethereum will be reduced by 99.95%.

This dramatic reduction in energy consumption will also make Ethereum ESG compliant. This may help give regulators the push they need to provide much-needed regulation in the crypto industry.

Ethereum Post-Merge

As we said before, the Merge will open the door to further Ethereum upgrades down the road. The more prominent of these planned upgrades include “sharding”.

Sharding will work with layer 2 rollups to dramatically increase transaction output and reduce the “gas fees” users pay to transact on the Ethereum network. The high gas fees at Ethereum today are a hindrance to the wide-scale adoption of cryptocurrency and decentralized finance (DeFi).

Moreover, sharding will democratize the process of validating, allowing anyone with a computer (or even a phone) to validate transactions and reap the benefits of staking.

When will the Ethereum Merge happen?

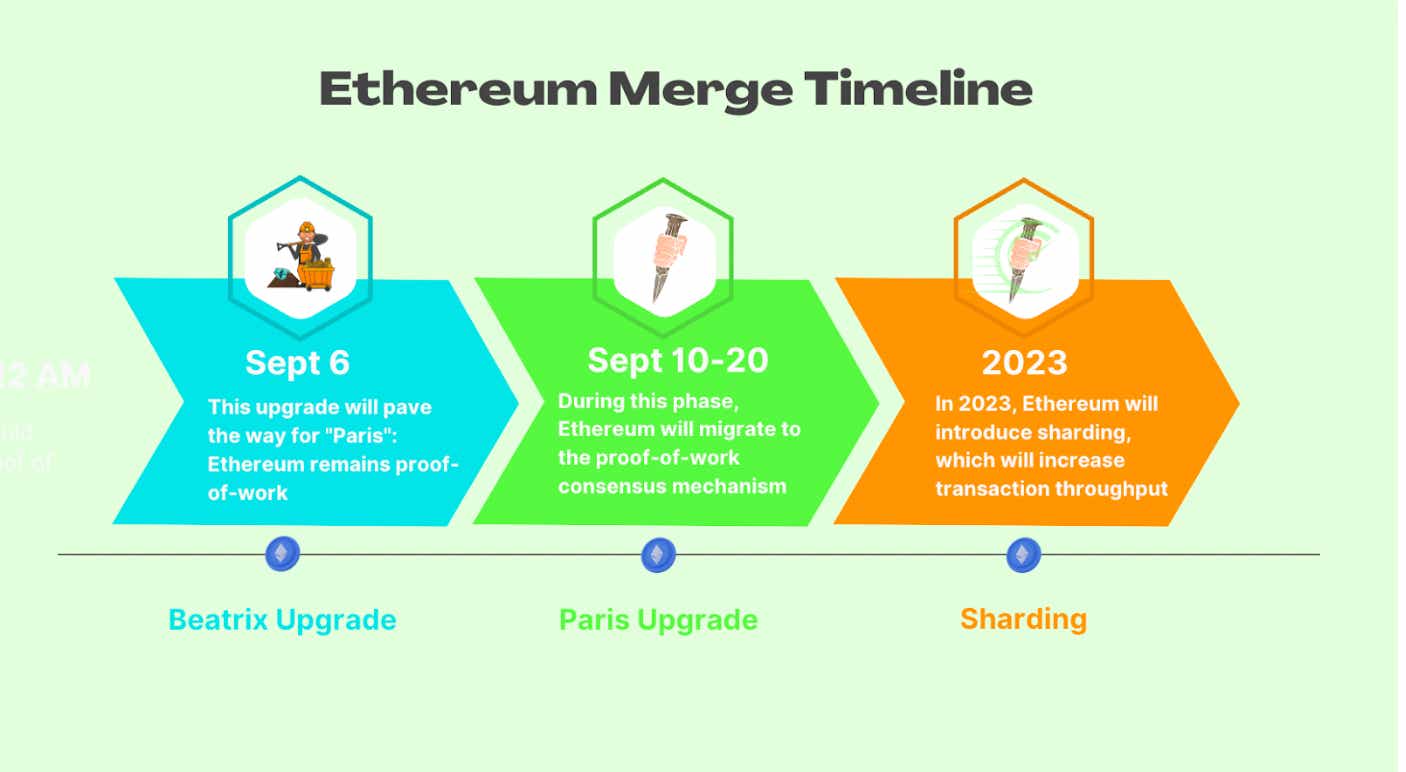

The Ethereum shift to proof-of-stake will take place in two stages:

- Sept. 6: The “Bellatrix” upgrade will activate.

- Sept. 10 - 20: The “Paris” upgrade will activate, effectively switching the network from proof-of-work to proof-of-stake.

The sharding of the Ethereum network is expected to take place sometime in 2023. This will be the main value-add of the transition as it will be the mechanism that allows for higher transaction output and lower gas fees.

What Are The Risks Of The Ethereum Merge?

The main risk of the Merge is that it does not go smoothly. Even if this does indeed happen, the network can simply revert to a previous state.

Jack Niewold, the founder of Crypto Pragmatist, tweeted that this outcome would require Ethereum to, “...restart pre-Merge. It’d be a real headache, but not the end of the world.”

Though Jack does not see the Merge as all roses. He went on to liken the Merge to, “...changing your car’s engine from gas to electric, all while speeding down the highway.”

Jack’s main concern was a “civil war” like outcome within the Ethereum ecosystem.

Current Ethereum miners have invested a lot of resources into hardware to mine Ethereum in its current state. If the Merge goes ahead as planned, this may render their investments obsolete as anyone with a computer will be able to validate.

In this scenario, Jack says “Ethereum has one chain that goes forward on Proof of Work, while the Merge goes straight ahead, effectively splitting it into two.”

This potential (albeit unlikely) outcome would certainly be unfavorable to Ethereum.

How Will The Ethereum Merge Affect You?

Assuming everything goes smoothly, the Merge will represent a positive change to the Ethereum network. However, this does not necessarily imply that the price of Ethereum will rise in value.

It is important to remember that, aside from insiders, nobody can predict what will happen in any market. Be suspect of any scams that may try to get you to “invest” during the Merge.

Additionally, if you hold crypto in a non-custodial/self-custody wallet, never reveal your private key or seed phrase to anyone.

Will My ETH change to ETH 2.0?

Only hard forks produce new coins. The Ethereum Merge is simply an upgrade. Therefore, no new coins will be created. Your ether will remain under the ETH symbol post-Merge.

The actual name of the network, however, will change from Ethereum to Ethereum 2.0.

Will Bitcoin (BTC) be affected?

Though Bitcoin will not be directly affected by the Ethereum Merge, the network may indeed experience elevated volatility while the Merge is taking place. This may also be true of all cryptocurrencies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices