EUR/USD: German Inflation Data May Give the Euro a Lifeline. It Won't Last

EUR/USD: German Inflation Data May Give the Euro a Lifeline. It Won't Last

By:Ilya Spivak

The euro may bounce if German disinflation is less dramatic than expected, but any gains are likely to be short-lived

- The euro has suffered the worst bout of selling pressure in nearly three decades.

- A rebound may be in the cards if German CPI drops less than economists expect.

- Any gains the euro makes against the U.S. dollar are likely to be short-lived as yield spreads lock in.

The euro is sinking.

The currency is on track for an eleventh consecutive week of losses. That matches the longest streak of declines on record and the only other comparable episode of persistent weakness, from the first quarter of 1997.

What’s more, selling pressure seems to be strengthening.

The most recent part of the down move is a seven-day run of back-to-back losses. That’s the worst performance since December 2017. The latest drop comes after data from the European Central Bank (ECB) showed the drag on economic growth from tighter credit conditions is the most pronounced since the global financial crisis and greater than during the subsequent Eurozone debt crisis.

Base effects to cool German inflation, keep the ECB on pause

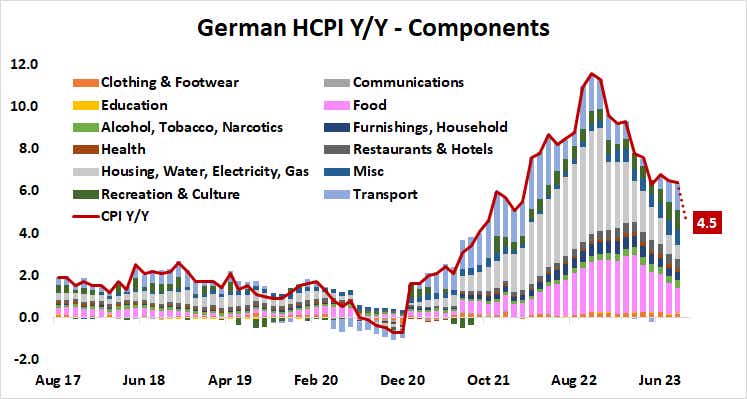

Incoming German inflation data seems unlikely to offer much of a counter-narrative. The headline consumer price index (CPI) measure of price growth is projected to slow from 6.4% year-on-year in August to 4.5% in September. That would be the lowest reading in two years. That will foreshadow a similarly emphatic downswing expected in regional-wide figures due a day later.

Most of the decline is expected to come from base effects. The influence of Germany’s subsidy public transportation subsidy as well as a host of assorted statistical distortions coming from changes in the composition of the CPI basket are due to fall out of year-on-year calculations. The seasonal uplift in recreation and other summertime spending categories is also likely to weaken. Food inflation looks to be on a declining path as well.

This seems to give the ECB a straightforward way to justify a pause in interest rate hikes. The euro plunged after the central bank’s mid-September policy meeting where it signaled that this month’s 25-basis-point (bps) increase may have capped the tightening cycle.

The markets price in no further rate hikes. The probability of another increase in 2023 has dropped to just 20%. Officials are expected to throw the process in reverse in the second half of 2024. The first 25bps cut is penciled in to appear no later than July, despite ECB President Christine Lagarde saying the bank isn’t even thinking about easing.

Euro may bounce but trend change is unlikely

On balance, this means that – absent dramatic and thereby inherently improbable undershoot – the downswing in German CPI is unlikely to change investors’ outlook in a way that demands still more euro selling. An upside surprise in the event that base effects add up to less disinflation than economists anticipate seems like a more plausible market mover.

That might arrest euro weakness if traders reckon that the ECB might hold off on rate cuts for a bit longer than investors’ current thinking. Conveniently enough, prices have arrived at chart support marked by the low for the year set in January, making this a natural place for the selloff to pause for a rethink.

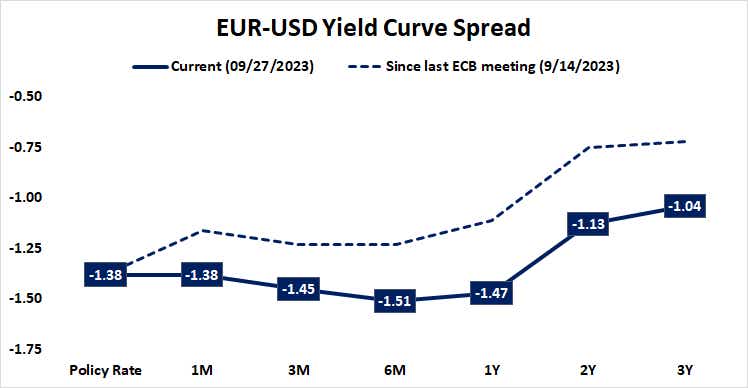

If the currency does manage a rebound, the up move will probably amount to a correction rather than an outright change of trend. The Federal Reserve and the ECB are both in a holding pattern after their latest policy updates. Implied market pricing suggests this has locked in a US dollar yield advantage of 140-150bps over its Eurozone counterpart for at least a year, making it broadly unattractive to own euro relative to the greenback.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices