EUR/USD Traders: What You Should Know Ahead of the ECB Meeting

EUR/USD Traders: What You Should Know Ahead of the ECB Meeting

By:Ilya Spivak

Will the Euro fall as the ECB softens its hawkish stance amid the sustained economic downturn?

- July ECB rate hike all but certain, markets more focused on what follows.

- Lagarde and company grappling with economic malaise, sticky inflation.

- Softening hawkish rhetoric may be inescapable, pushing the euro lower.

Christine Lagarde, the European Central Bank (ECB) president, faces another difficult sales job as the rate-setting Governing Council prepares to make its latest policy announcement.

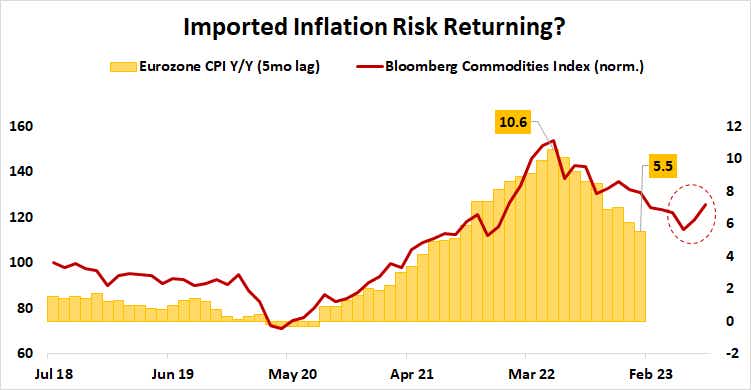

The ECB has been at pains to convince financial markets that it is serious about beating back runaway inflation. It has had some success. Growth in the headline consumer price index (CPI) peaked at 10.6% year-on-year in October 2022, climbing down to 5.5% by June 2023.

Nevertheless, the markets are dubious. Inflation expectations priced into the bond and swap markets are trending defiantly higher, implying that the brisk rate hike cycle that the ECB has mounted and the on-coming tightening already priced into asset valuations will be insufficient to deliver on the central bank’s objectives.

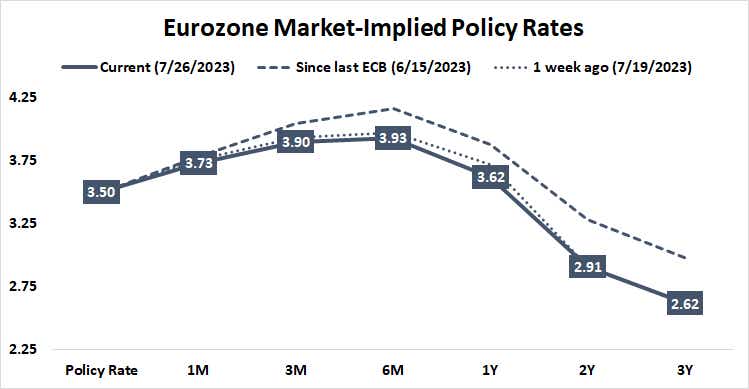

As it stands, a rate hike is all but fully priced in for July’s meeting with an implied probability of 96%. The likelihood of a second move to follow by year-end is penciled in at 74%. The markets then anticipate a period of standstill through mid-2024, with an easing cycle commencing thereafter.

The Eurozone economy is shrinking

That traders question the ECB’s resolve seems to reflect the dire economic backdrop.

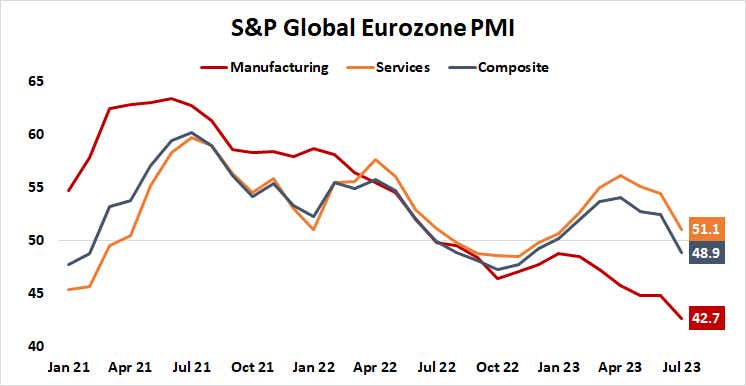

July’s edition of purchasing manager index (PMI) data from S&P Global—a set of leading indicators foreshadowing the trajectory of GDP growth—showed the Euro area manufacturing sector shrinking at the fastest pace in over three years. Services grew, but at the slowest rate in six months. Taken together, that implied that the overall economy contracted for a second consecutive month.

The ECB might have credibly argued that such weakness will continue to power disinflation in the months ahead. Making that case now looks difficult as imported price pressures threaten to return.

The decline in CPI achieved so far has come overwhelming from the goods side of the equation, aided along by a concurrent drop in global commodity prices, while price growth on the service side continues to trend higher. A Bloomberg index tracking raw materials costs is now on course to rise for a second consecutive month. It has tended to lead CPI by about five months, implying a rebound in goods inflation may be on the horizon.

In all, this means that Lagarde will have to manage to impress upon investors that the ECB remains wholeheartedly committed to slowing prices even as she placates the doves on the 25-member Governing Council bemoaning economic hardship and pulling for a turnaround.

Euro at risk on ECB guidance update

Lagarde had taken to all but preannouncing future rate hikes at the central bank’s recent meetings to advertise officials’ inflation-fighting mettle. Updating the language to take tightening off autopilot and signal a pivot to “data dependence” may be next. The euro is a likely casualty in such a scenario as traders reprice for a less-hawkish ECB.

In fact, that process may be underway already. The single currency has shed nearly 2% from a week ago while the priced-in path for policy rates has flattened.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.