EVs From China, Lithium Prices and Why Vertiv Needs a Good Q1

EVs From China, Lithium Prices and Why Vertiv Needs a Good Q1

By:James Melton

BYD: Tesla’s worst nightmare

Twelve years ago, Elon Musk scoffed at Chinese EV manufacturers. Asked about China’s BYD (BYDDY), Musk chuckled and responded, “Have you seen their car?” But he isn’t laughing anymore.

In fact, Musk recently sounded the alarm on the growing influence of Chinese EV makers, saying, “If there are no trade barriers established, they will pretty much demolish most other companies in the world.”

In 2023, BYD made 3 million vehicles, of which 1.6 million were battery-electrics. In comparison, Tesla manufactured 1.8 million BEVs in 2023, barely edging out BYD on a full-year basis. However, in Q4 of 2023, BYD finally surpassed Tesla (TSLA) in terms of total deliveries in a single quarter. Read the whole story.

Lithium lethargy

For a commodity once celebrated as “the new oil,” lithium has fallen hard—its stock price plunging 80% from the December 2022 all-time high. Blame the soft metal’s soft prices on the slowdown in demand for electric vehicles.

But is it a case of peak pessimism? The EV market’s decline has slowed. Despite a 26% monthly drop in January, global sales grew by 69% from the previous year, according to the EV analytical firm Rho Motion.

In February, the investment bankers at Goldman Sachs forecasted EVs would account for half of global new car sales by 2035. If motorists buy EVs in sufficient numbers and no new battery technology supplants lithium, companies that deal with the metal—like Arcadium Lithium (ALTM)— should be on your watch list. Read the whole story.

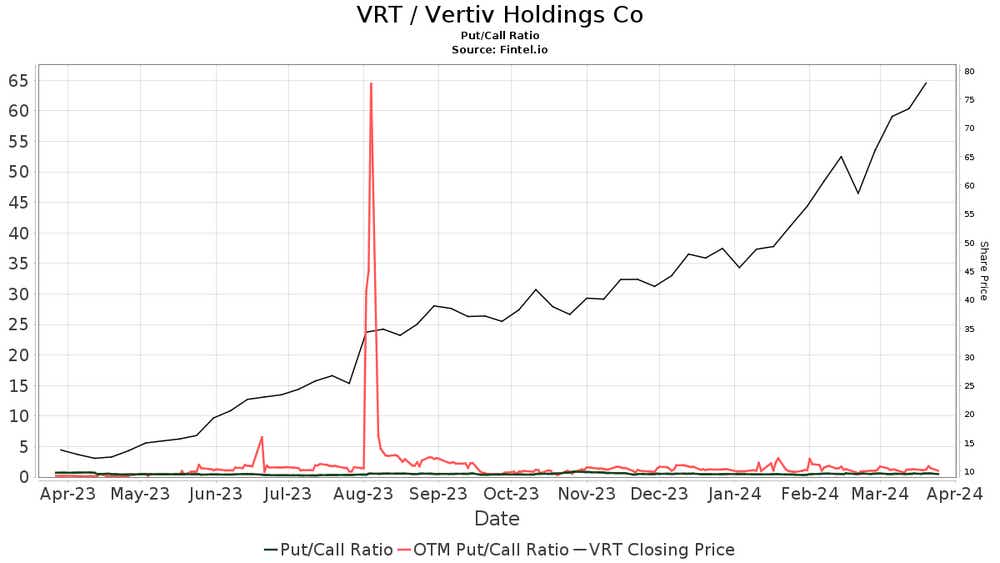

Vertiv Holdings has a lot to prove in Q1

Shares of Vertiv Holdings (VRT) have skyrocketed nearly 500% over the last 52 weeks because of investor euphoria linked to artificial intelligence.

Vertiv offers data center infrastructure products suited to the heavy computing workloads required by AI platforms. The company might ultimately be a winner in the AI niche. But, based on the company’s disappointing earnings outlook for 2024, the current valuation looks overextended.

Potential drives valuation in the marketplace but if it never materializes, shares usually get punished. Looking ahead, shares of Vertiv look susceptible to a potential pullback, especially if the company delivers another earnings disappointment in Q1. Read the whole story.

Get Luckbox

Read the latest edition of Luckbox magazine here.

Not receiving Luckbox? Subscribe for free at getluckbox.com.

James Melton is managing editor of Luckbox magazine. @JDMeltonWriter

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices