FOMC Minutes Preview: Do Stock Markets Need to Worry About Rates?

FOMC Minutes Preview: Do Stock Markets Need to Worry About Rates?

By:Ilya Spivak

Stock markets may come under pressure if minutes from January’s Federal Reserve policy meeting hint that interest rate cuts this year are not as assured as investors hope.

- Stocks are struggling in February after hot CPI data and hawkish Federal Reserve rhetoric.

- The January Federal Open Market Committee meeting minutes are in focus as rate-cut expectations cool.

- Wall Street is at risk if the interest rate easing autopilot seems less likely than before.

Stock markets shuddered in the wake of January’s Federal Reserve monetary policy meeting. Signaling they are reticent about declaring victory over inflation, central bank officials pushed back on runaway interest rate cut expectations that fueled a blistering Wall Street rally in November and December 2023.

The selloff would not prove to be lasting. Buyers reclaimed the upper hand within just 24 hours despite the S&P 500 suffering its worst one-day loss in four months, pushing the bellwether equity index up over 4% to hit a record high over the subsequent week and a half.

Do stocks care about Fed rate cut plans?

Perhaps markets concluded that Fed Chair Jerome Powell and company would change their tune as new inflation data continued to show progress. As it happens, the markets were forced to rethink what’s next. January’s consumer price index (CPI) data showed core price growth unexpectedly held at 3.9%, disappointing bets on a decline to 3.7%.

That sent another chill down investors’ spines. The S&P 500 dropped 1.39%, erasing half of the recovery carved out after the Fed’s policy meeting. This time, attempts at rekindling the rally have met with stiffer resistance. Seesawing price action over the following four trading days has brought stocks back to where they landed in the CPI data’s wake.

The spotlight now turns to minutes from that fateful meeting of the central bank’s policy-steering Federal Open Market Committee (FOMC). The release is an editorial description of proceedings instead of a strict stenographic transcript. That means the Fed can use it to steer investors’ expectations despite its being seemingly backward-looking.

FOMC meeting minutes: old news is new again

With that in mind, traders will keenly parse the document for clues. Market pricing implied in Fed Funds futures reveals that rate cut expectations almost halved in a mere month. Traders now bet on 85 basis points (bps) in easing this year, down from 158 bps in mid-January and 137 bps before that month’s FOMC meeting.

This brings the markets into broad alignment with what the Fed officials signaled with their latest update of official rate projections, issued in December. They envisioned the Fed Funds rate declining from 5.4% in 2023 to 4.6% this year, implying 80 bps in rate cuts.

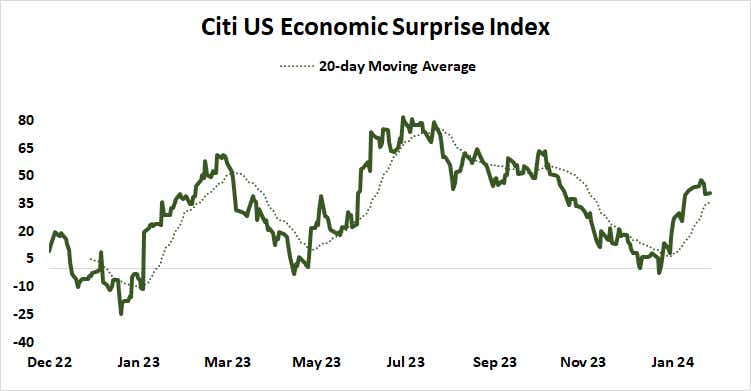

The U.S. economy has turned out stronger than expected. Analytics from Citigroup show data outcomes have increasingly outperformed relative to baseline forecasts over the past month. The Fed’s resistance to commit to stimulus over the same period makes sense against this backdrop.

Should stock markets be worried?

January’s FOMC statement argued that rate cuts are not on the menu “until [the FOMC] has gained greater confidence that inflation is moving sustainably toward 2%.” It went on to warn that officials are “prepared to adjust the stance of monetary policy as appropriate” if reaching its goals is threatened, implying that cuts are not guaranteed.

This probably puts the question of symmetry front and center. If Fed officials truly seem prepared to jettison rate cuts altogether and even consider the unlikely step of tightening further as the buoyant economy stymies disinflation, stock markets may be in for a rude awakening.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.