How Low Can Volatility Go?

How Low Can Volatility Go?

Movie sequels have never been a certain path to box office success. Case in point, Police Academy 4. But, they do offer a worthy metaphor for the markets.

- S&P 500 (SPY) volatility in 2023 is beginning to look a lot like 2017.

- A ratio of VVIX-to-VIX helps to determine if the current volatility environment is one of complacency or fear.

- Covered calls, long puts and calendar spreads are a few potential strategies to deploy in a low vol environment.

Hollywood loves sequels. If a movie has been a huge box office hit and the storyline has the potential to be extended, then a sequel is an absolute no-brainer.

Markets are more complicated. But sequels happen there as well.

In Hollywood, sequels have proven successful. While they have come a long way since The Fall of a Nation (1916), the first-ever feature length sequel in movie history, the formula remains the same. Studios typically choose a franchise they know will make money based on the success of the first (or previous) movie. Even better than that, the studio is essentially guaranteeing itself a profit by producing a sequel.

A sequel is certainly not assured of being better than the original. However, some do eclipse their predecessor in dollars and entertainment factor. Some of my favorite sequels that fit the bill: Return of the Jedi (1980), Star Trek II: The Wrath of Khan (1982), The Dark Knight (2008), The Godfather Part II (1974) and Rocky III (1982)—don't judge me.

But a sequel does not offer a magic formula for box office success. Movie series eventually run out of steam and must still display sufficient story originality with each new episode to keep audiences interested.

Volatility could remain low for the next few months

Why all the talk about sequels? Well, there is a ton of debate over whether the stock market is heading for a sequel of sorts. Since the regional banking crisis in March, equity volatility has been waning with each trading day that passes. Recently, the Volatility Index (VIX) has been flirting with the 13 to 15 range, which is well below the long-term average of 19.

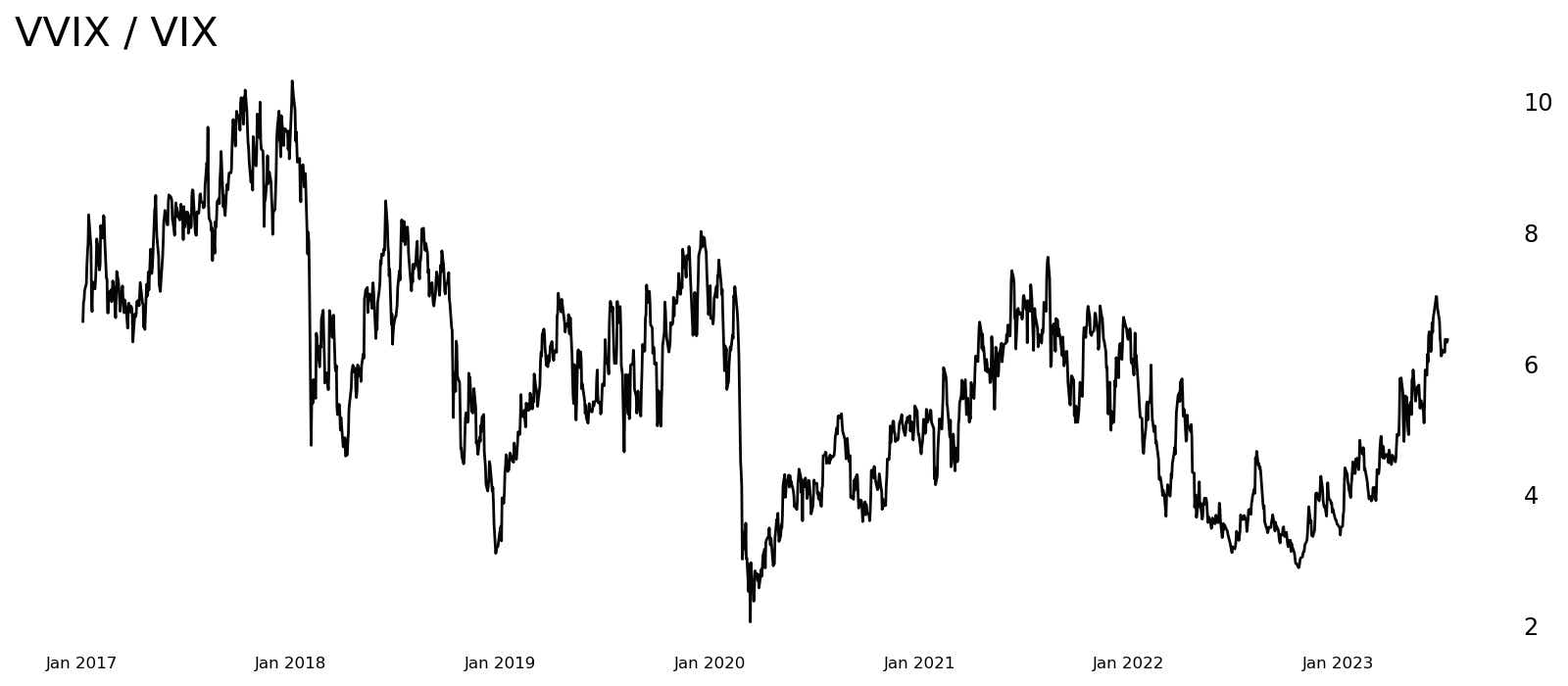

These low levels are reminiscent of the 2017 trading year in which the VIX saw a high of 17.28 and a low of 8.56, both intraday numbers, along with a yearlong average of 11.75. The lack of volatility and its potential trajectory can best be viewed in the chart above. Dividing the volatility of the VIX (VVIX index) by the VIX index itself immediately displays the level of fear (2020) or complacency (2017) in the market.

The current ratio level of seven is above average and could be heading higher as the year progresses.

How do you trade in a low volatility environment?

While current market volatility is not that low (yet), many traders are pondering the go-to strategy to trade this environment. Are covered calls the way to go?

If the market is going to continue to grind higher, then this makes sense. Maybe long puts are the answer? If the market has a sudden, violent fall, then this provides short deltas as well as a benefit should volatility rise again. Perhaps calendar spreads are in order? This is a strategy that traders can deploy in the absence of volatility, but they should remain patient regarding direction.

The best strategy to trade a low volatility environment might remain elusive or it simply might require trading restraint until the next volatility spike. Whatever it might be, just know that the sequel is not always better than the original.

Jermal Chandler, tastylive head of options strategy, has been in the market and trading for 20 years. He hosts Engineering the Trade, airing Monday, Tuesday, Thursday and Friday. @jermalchandler

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.