IV Rank vs. IV Percentile | Skinny on Options Data Science

IV Rank vs. IV Percentile | Skinny on Options Data Science

Today on the blog we are "geeking out” about IV Rank and IV Percentile with Dr. Data.

Dr. Data is of course Dr. Mike Rechenthin - our resident expert on options data and modeling - who joined hosts Tom Sosnoff and Tony Battista for an episode of The Skinny on Options Data Science.

Those of you who have followed Dr. Data in the past will know that the "Skinny" series is dedicated to making the underlying math and data of options trading more accessible to the average trader.

The "Skinny" branch of programming on the tastylive financial network encompasses a range of shows that are easily accessible under the "Find Shows" link on the tastylive website.

We invite you to explore the series in greater depth if you are searching for more information on math, data, and modeling topics.

On this particular episode, Dr. Data helps viewers better understand the difference between Implied Volatility Rank (IVR) and Implied Volatility Percentile.

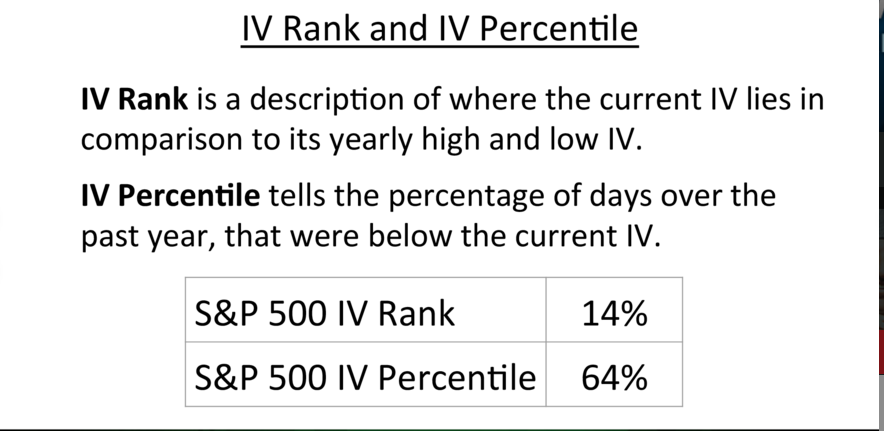

Implied Volatility Rank is a favored volatility measure at tastylive. IVR tells us whether implied volatility is high or low in a specific underlying based on the past year of implied volatility (aka “IV”) data.

For example, if XYZ has had an IV between 30 and 60 over the past year and IV is currently trading at 45, XYZ would have an IV rank of 50%. Since all underlyings have unique IV ranges, stating an arbitrary IV number does not help us decide how we should proceed with a strategy - that's where IVR comes into play.

Understanding where current implied volatility is trading compared to recent history can give a trader a better sense of whether the price of volatility is cheap or expensive given current conditions.

Implied Volatility Percentile (IVP), a totally different calculation, provides traders with another metric by which they can analyze the price of an option. IVP tells us the percentage of days over the last year that implied volatility traded below the current level.

For instance, if IVP is 90%, the understanding is that implied volatility traded below the current level for 90% of the past year’s data. This indicates that implied volatility at the current price is higher than usual.

On the other hand, if IVP is 10%, the understanding is that implied volatility has only traded below current levels 10% of the time over the past year. This second case might indicate that volatility is relatively cheap as compared to the last 12 months of data.

The slide below illustrates visually the differences between IVR and IVP:

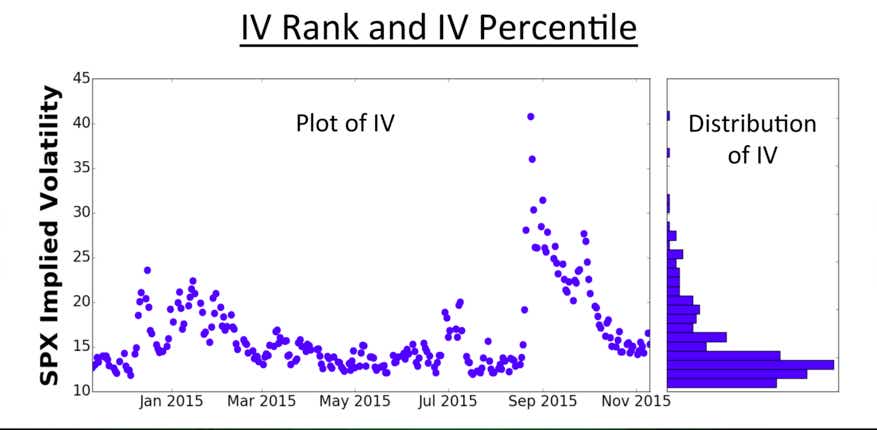

Another chart that helps conceptualize these concepts is a plot of SPX implied volatility over the last 12 months. Note the outlying data point that occurred in late summer/early fall as well as how the distribution of implied volatility (right side of graphic) is clustered under 20 for the SPX:

If you want to get a better understanding of the variables that go into the calculations of IVR and IVP, Dr. Data walks viewers through this process during the full episode of The Skinny on Options Data Science. We invite you to watch that at your convenience for a comprehensive look at this information.

Across the trading spectrum, market participants rely on different metrics to help them make trading decisions. Like any system or process, one key is to be consistent in your approach.

Those same principles hold true for utilizing Implied Volatility Rank (IVR) and Implied Volatility Percentile (IVP) in options trading. Both metrics can help a trader evaluate the price of an option relative to recent historical implied volatility in a particular underlying and option.

However, it’s important to be consistent in utilizing these metrics across a portfolio. For example, it wouldn’t make a lot of sense to sell an option based on a high IVR, while buying another one against it based on a low IVP.

Each and every trader finds success by following a unique path.

In the case of IVR vs. IVP it’s key to understanding the difference between the two measurements and then interpreting them in a consistent manner.

We hope you will take the time to review the entire episode on IVR and IVP when your schedule allows.

Please don’t hesitate to follow up with any questions or comments at support@tastylive.com or by leaving a comment below.

Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices