India Bans Rice Exports, Russia and Ukraine Escalate

India Bans Rice Exports, Russia and Ukraine Escalate

By:Ilya Spivak

India—the world's largest rice supplier—has banned some exports. Is a food crisis on the menu?

- Worries about a “food crisis” are spreading as various supply disruptions mount.

- India has banned some rice exports, lifting prices amid the global inflation fight.

- It is probably premature to panic about food shortages, at least for the moment.

Worries about a looming “food crisis” appear to be spreading, at least editorially. The number of stories mentioning the phrase surged in July to hit the highest volume since November 2022, according to news flow tracked by Bloomberg.

That seems to make sense. Russia has pulled out of the Black Sea Grain Initiative (BSGI), a United Nations- and Turkey-brokered scheme to get seaborne Ukrainian grain exports out to global markets safely. Escalation followed. Moscow’s forces have taken to bombing storage silos in Ukrainian port cities. Meanwhile, Ukraine has attacked Russian tankers with sea drones.

India announces white rice export ban

India waded into the mix last month, announcing a ban on exports of some white rice. Notable exceptions were made for parboiled and basmati varieties, which have accounted for over 60% of shipments in the past five years. The action marks an escalation to secure domestic supplies in anticipation of possible output disruptions amid the return of El Niño weather patterns. India imposed a 20% tariff on white rice exports in September 2022.

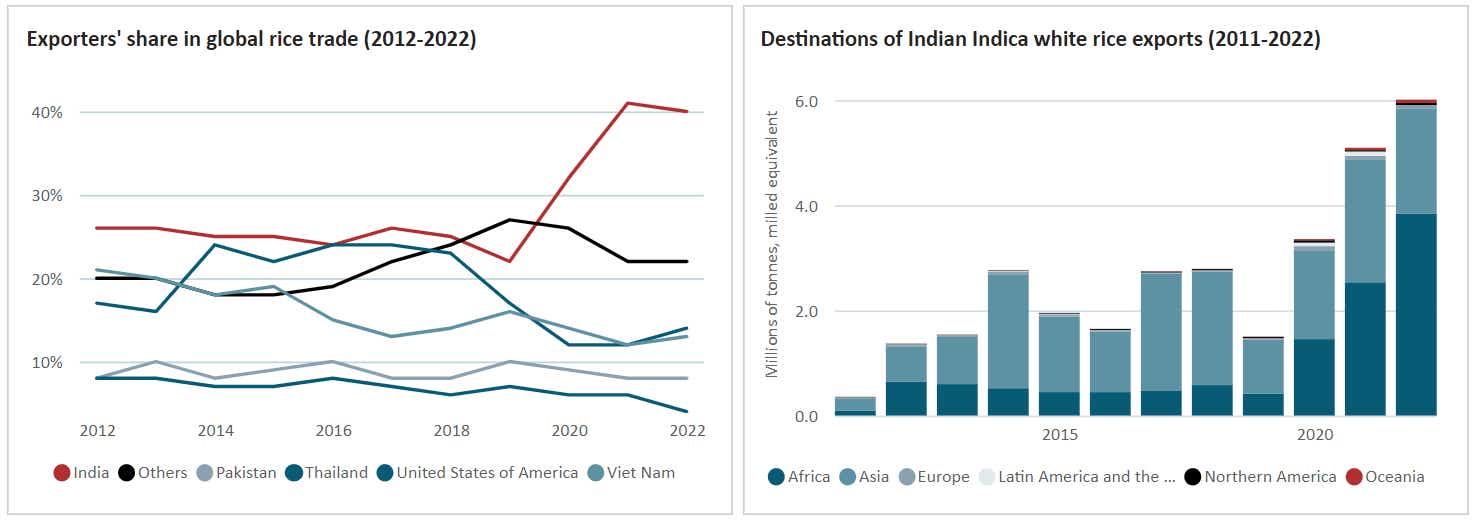

The country is the world’s largest rice exporter with a market share of close to 40%. Prices were up a hefty 19.7% year-over-year in July, according to the latest data from the United Nations Food and Agriculture Organization (FAO) released early this month, with “indica”–India’s native long-grain varietal that is commonly grown in tropical Asia–showing up as the main driver.

India’s actions seem to be boosting prices in substitute markets. Thailand and Vietnam stand out, which together account for 27% of the market. Some of this reflects demand substitution. Reports of some supplies being held back in anticipation of higher prices on the horizon have also emerged.

All this risks boosting global food inflation at a time when central banks are busy trying to cool price growth, which might keep interest rates higher for longer than previously expected. That might translate into a broader headwind for global growth.

Priced-in inflation expectations for the major economies are already signaling that progress might be stalling, and knock-on effects from Indian trade policy—in this case, sugar export caps—have already shown up as a major driver of imported inflation in countries like Japan.

Not a crisis … yet

Panicking now would probably be premature.

The FAO critically points out that world rice output faltered in only two of the six recorded El Niño episodes since the turn of the century, so the shortages feared by India’s government may not actually occur. Furthermore, New Delhi has pledged to provide carve-outs in the export ban to support food security, with as-yet unknown impact.

Finally, the importers most impacted by the ban—mainly African and Middle Eastern countries like Benin and Iran, respectively—amount to a relatively small share of global GDP. While yet another price shock compounding already high food prices there may be very detrimental locally, its impact on global inflation trends – and thereby top central banks’ monetary policy— might be limited.

As it happens, the breakdown of the Russia-Ukraine grain deal has not prevented wheat prices from falling after a brief, news-driven spike.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.