Macro Week Ahead: U.S. Jobs Data, Fed and Bank of England Meetings, Eurozone GDP and CPI

Macro Week Ahead: U.S. Jobs Data, Fed and Bank of England Meetings, Eurozone GDP and CPI

By:Ilya Spivak

Wall Street may continue to struggle and the dollar might retreat as markets fearing the risk of global recession push capital to underperforming markets outside the U.S. where monetary stimulus may come sooner

- Eurozone growth and inflation data may spur gains in European stocks and the euro.

- The Federal Reserve and the Bank of England are seen backing away from rate hikes.

- U.S. jobs data will help inform how long traders have to wait for a Fed easing cycle.

Financial markets continued to struggle last week.

The bellwether S&P 500 stock index suffered the largest drop in six weeks, hitting the lowest level since March. A lukewarm third-quarter reporting season has shown earnings topping forecasts by a narrower margin than the prior period to the tune of about 2%. A sharp jump in U.S. gross domestic product (GDP) was viewed with suspicion.

Meanwhile, a dark geopolitical backdrop kept gold prices elevated as Israel pressed on with its offensive against Hamas, a Gaza-based terrorist group that carried out a historically murderous attack against civilians on Oct. 7. Crude oil oscillated as markets weighed up scope for the conflict to spread, disrupting supplies from the region.

Bond markets managed a narrow rise as interest rates inched lower. The U.S. dollar idled against its major peers.

Here are the key macro waypoints for traders in the week ahead.

Eurozone GDP and consumer price index data

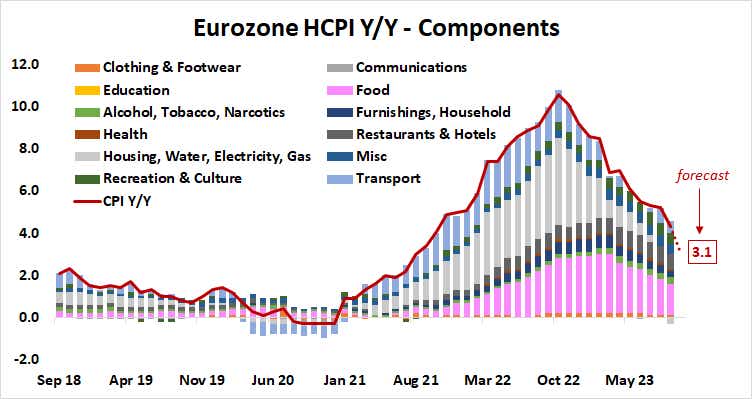

Eurozone economic growth is expected to have stalled in the third quarter. GDP data due this week is set to show a flat result, matching the standstill in the six months through March. The economy grew 0.2% in the second quarter. At the same time, October consumer price index (CPI) data is set to show inflation fell to 3.1% from 4.3% in September, a 26-month low.

Taken together, these outcomes appear likely to underpin last week’s signaling from the European Central Bank (ECB) suggesting its interest rate hike cycle has ended (as expected). Indeed, the markets are pricing in no further tightening from here. The probability of a rate cut by April is over 80%. It is fully baked in by June, with at least three 25 basis-point (bps) reductions on the menu for 2024.

This might prove to be supportive for European stocks and the euro as capital flows search for bargains in battered corners of the markets where a policy pivot seems closest to delivering a lifeline.

Federal Reserve monetary policy announcement

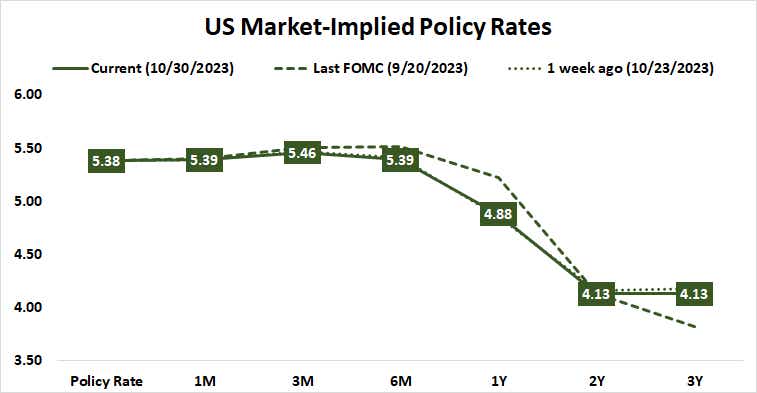

The U.S. central bank’s rate-setting Federal Open Markets Committee (FOMC) is expected to remain in a holding pattern at this week’s conclave. The probability of another rate hike following the last increase in June has dropped to just 33%, with markets increasingly convinced that the tightening cycle has ended. The first cut is expected no later than July, with 75bps in cumulative easing on the menu by January 2025.

That appears to align with the message Fed Chair Jerome Powell offered to financial markets in a speech at the Economic Club of New York two weeks ago. He seemed to suggest the jump in bond yields after September’s FOMC sit-down spooked investors with a promise of “higher-for-longer” rates may have done enough to tighten financial conditions without further action.

More of the same in the FOMC policy statement and the post-meeting press conference with Mr. Powell this week might reinforce the sense that the central bank has shifted into wait-and-see mode. Still, a commitment to disinflation is likely to remain, with policymakers wanting to see a wave of wage agreement resets (i.e., layoffs) to squeeze sticky inflation out of the labor market. That might encourage rotation out of U.S. markets into those where monetary relief seems closer at hand.

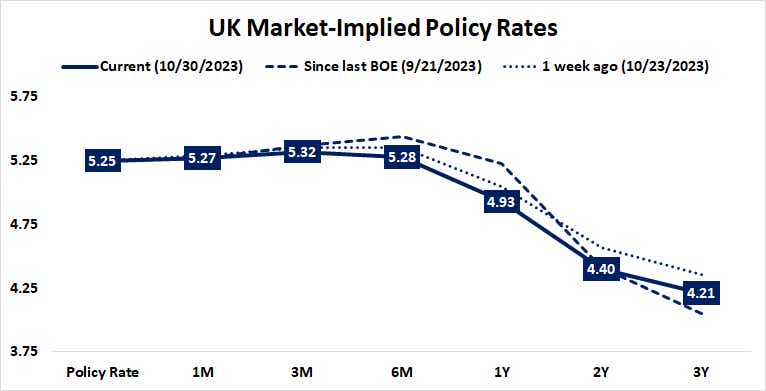

Bank of England monetary policy announcement

The Bank of England (BOE) is expected to keep its target rate on hold this month. As with the ECB, a deep economic downturn appears to give cover to Governor Andrew Bailey and company to end their fight against inflation and refocus on growth. The first 25bps rate cut is priced in to appear no later than September.

Whether U.K. markets and the British pound are able to capitalize on capital rotation will probably depend on how quickly the easing looks likely to appear relative to the U.S. and the Eurozone. With a global recession in the offing, traders may be moved to go where risk appetite will find the most support sooner rather than later.

U.S. employment report

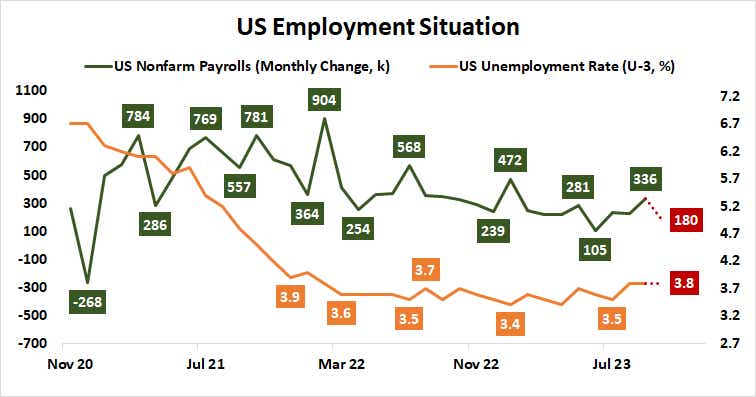

The U.S. economy is forecast to have added 180,000 jobs in October. That would be a climb-down from the heavy-duty 336,000 rise the prior month. The unemployment rate is seen holding steady at 3.8%. Average hourly earnings, a measure of wage inflation, are expected to slow to a growth rate of 4%, the lowest since June 2021.

Financial markets will probably assess the data in the context of the message from the FOMC earlier in the week. Broadly speaking, a soft result that brings the arrival of stimulus closer into view may help Wall Street but seems likely to punish the U.S. dollar.

An outcome that appears to delay rate cuts may weigh on stocks. Last week’s lukewarm reception of white-hot GDP data warns that the greenback may struggle to capitalize, however.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.