Nasdaq 100 Rebound Falters; Tariffs Dominate Commodity Flows

Nasdaq 100 Rebound Falters; Tariffs Dominate Commodity Flows

Also, 30-year T-bond, copper, crude oil and euro futures

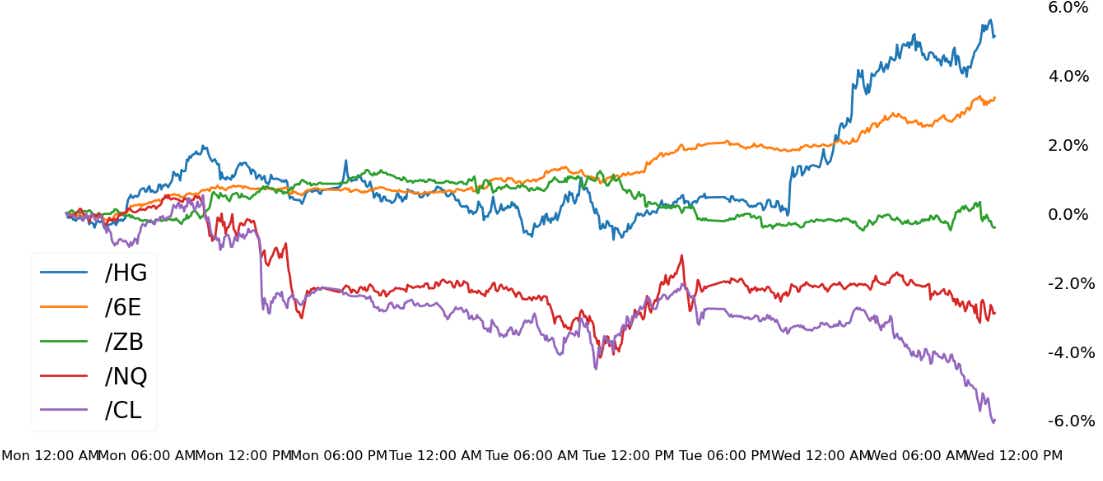

- Nasdaq 100 E-mini futures (/NQ): -0.25%

- 30-year T-bond futures (/ZN): -0.32%

- Copper futures (/HG): +5.53%

- Crude oil futures (/CL): -3.03%

- Euro futures (/6E): +1.35%

Nasdaq futures moderated this morning after a positive purchasing managers' index (PMI) print from S&P Global showed the U.S. services sector expanded to 51, beating the expected 49.7 figure. Still, the rebound was cautious and equity indexes remained lower on the week following earlier losses. Traders see downside risk to economic growth as the United States continues to ramp up tariff threats. Last night’s address to Congress by President Trump did little to calm fears that trade tensions could spiral out of control. The question now is how long the levies will last and what the damage to the global economy will be.

Symbol: Equities | Daily Change |

/ESH5 | -0.17% |

/NQH5 | -0.25% |

/RTYH5 | -0.09% |

/YMH5 | +0.15% |

U.S. equity markets advanced today as fear of an economic slowdown cooled following the latest reading on the services sector released earlier this morning. Nasdaq 100 futures (/NQH5) rose 0.31% in early trading. Still, prices remain near the lowest levels traded since early November as concern over tariffs creates uncertainty in the market. Yesterday, Howard Lutnick, U.S. Commerce Secretary, said he expected an agreement on trade with Canada and Mexico to come as soon as today. Abercrombie & Fitch (ANF) fell over 15% after the clothing brand provided soft forward guidance. Campbell’s (CPB) trimmed about 3% after the company reduced its full-year guidance for earnings.

Strategy: (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 20200 p Short 20250 p Short 21200 c Long 21250 c | 19% | +770 | -230 |

Short Strangle | Short 20250 p Short 21200 c | 53% | +20860 | x |

Short Put Vertical | Long 20200 p Short 20250 p | 58% | +330 | -670 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.05% |

/ZFM5 | +0.01% |

/ZNM5 | -0.08% |

/ZBM5 | -0.32% |

/UBM5 | -0.40% |

Treasuries slipped in early trading, pushing bond yields higher across the curve. The move comes despite strong buying in Treasuries in Europe, as Germany advances a plan to boost spending on defense following the U.S. withdrawal of support for Ukraine. The 30-year T-bond futures (/ZBM5) fell 0.3%, which pushed the underlying yield to 4.551% early today. Bond traders will shift their focus to Friday’s jobs report after the ADP private payroll report showed a gain of 77,000 jobs for February, the smallest increase since July.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 115 p Short 116 p Short 120 c Long 121 c | 40% | +625 | -375 |

Short Strangle | Short 116 p Short 120 c | 62% | +2390.63 | x |

Short Put Vertical | Long 115 p Short 116 p | 71% | +312.50 | -687.50 |

Symbol: Metals | Daily Change |

/GCJ5 | +0.27% |

/SIK5 | +1.90% |

/HGK5 | +5.53% |

Copper prices (/HGK5) surged over 5% after China signaled more stimulus is likely after setting its economic growth target at 5% for this year. According to Bloomberg, China also raised its deficit target to about 4%, reinforcing the view the country is ready to increase support to its economy. The news is a positive for the industrial metal because China is the largest consumer of copper in the world. For now, the growth targets are overshadowing the concerns of tariffs and a potentially prolonged trade war.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.7 p Short 4.71 p Short 4.94 c Long 4.95 c | 24% | +200 | -50 |

Short Strangle | Short 4.71 p Short 4.94 c | 65% | +6600 | x |

Short Put Vertical | Long 4.7 p Short 4.71 p | 62% | +125 | -125 |

Symbol: Energy | Daily Change |

/CLJ5 | -3.03% |

/HOJ5 | -2.96% |

/NGJ5 | +0.05% |

/RBJ5 | -3.17% |

Concern about growth and uncertainty around tariffs remain a net negative for crude oil prices. Traders expect the trade measures to lower consumption in the economy via slower economic growth. The recent move by OPEC+ to move forward with unleashing more supply in April to the tune of about 130,000 barrels per day is also weighing on crude oil prices (/CLJ5), which were down over 3% in early trading. The Energy Information Administration (EIA) will release weekly inventory data later today.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 63.5 p Short 64 p Short 67.5 c Long 68 c | 24% | +380 | -120 |

Short Strangle | Short 64 p Short 67.5 c | 58% | +3910 | x |

Short Put Vertical | Long 63.5 p Short 64 p | 61% | +170 | -330 |

Symbol: FX | Daily Change |

/6AH5 | +0.94% |

/6BH5 | +0.59% |

/6CH5 | +0.71% |

/6EH5 | +1.35% |

/6JH5 | +0.55% |

Euro futures (/6EH5) surged to the highest levels traded since early November after increasing about 1.5% this morning. Germany plans to create an infrastructure fund to revamp the country’s energy grid. Chancellor-in-waiting Friedrich Merz, along with government partners, announced the plan last night to ease the country’s constitutional borrowing restrictions to free up capital for infrastructure and defense spending. The plan would likely boost growth in Europe at a critical time.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.07 p Short 1.075 p Short 1.09 c Long 1.095 c | 34% | +437.50 | -187.50 |

Short Strangle | Short 1.075 p Short 1.09 c | 65% | +1950 | x |

Short Put Vertical | Long 1.07 p Short 1.075 p | 69% | +250 | -375 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.