Nasdaq 100 Gyrates on Monday, and Dollar Softens as Bonds Twist

Nasdaq 100 Gyrates on Monday, and Dollar Softens as Bonds Twist

Also, 10-year T-note, silver, crude oil and Australian dollar futures

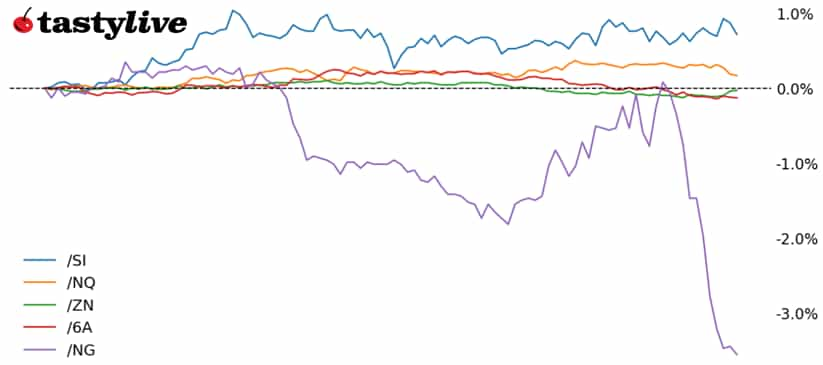

- Nasdaq 100 E-mini futures (/NQ): +0.25%

- 10-year T-note futures (/ZN): +0.17%

- Silver futures (/SI): +1.52%

- Crude oil futures (/CL): +0.09%

- Australian dollar futures (/6A): +0.25%

A relatively quiet week is off to a relatively quiet start. Stocks are trading modestly higher today, unbothered by the weekend’s news and images from Los Angeles. The May US consumer price index (CPI) due mid-week is the most important macro event on the board as the Federal Reserve is in its communications blackout window before the June 18 meeting. Elsewhere, silver prices have continued their surge into fresh yearly highs, while the US dollar is modestly weaker amongst the majors.

| Symbol: Equities | Daily Change |

| /ESM5 | +0.03% |

| /NQM5 | +0.25% |

| /RTYM5 | +0.39% |

| /YMM5 | -0.21% |

S&P 500 futures (/ESM5) were little changed today morning after posting a second weekly win. Traders are waiting to hear how talks between the US and China turn out, with negotiators set to meet in London today. Apple (AAPL) was up about 0.7% as its Worldwide Developers Conference starts. Robinhood (HOOD) fell over 5% after losing a bid to join the S&P 500 in its quarterly rebalancing. Warner Bros. Discover (WBD) rose over 7% after management said it would split into two separate companies by the end of next year.

| Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 20250 p Short 20500 p Short 23500 c Long 24000 c | 64% | +1140 | -3860 |

| Short Strangle | Short 20500 p Short 23500 c | 70% | +5415 | x |

| Short Put Vertical | Long 20250 p Short 20500 p | 85% | +570 | -4430 |

| Symbol: Bonds | Daily Change |

| /ZTM5 | +0.06% |

| /ZFM5 | +0.11% |

| /ZNM5 | +0.17% |

| /ZBM5 | -0.08% |

| /UBM5 | -0.22% |

10-year T-note futures (/ZNU5) were up about 0.11% in early trading as investors wait for inflation data due later this week. Yields surged on Friday when US jobs data impressed expectations. Outside of the inflation data, traders are watching this week’s 30-year bond auction due on Thursday. Meanwhile, the Senate is expected to make considerable changes to President Trump’s tax and spending plan. We’ll also see a 10-year note auction cross the wires on Wednesday.

| Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 107 p Short 107.5 p Short 113 c Long 113.5 c | 70% | +109.38 | -390.63 |

| Short Strangle | Short 107.5 p Short 113 c | 75% | +406.25 | x |

| Short Put Vertical | Long 107 p Short 107.5 p | 88% | +62.50 | -437.50 |

| Symbol: Metals | Daily Change |

| /GCQ5 | -0.15% |

| /SIN5 | +1.52% |

| /HGN5 | +1.3% |

Silver prices (/SIN5) continued to climb on today, rising about 1.52% in early trading. Strong investor demand for precious metals is helping to push prices higher, but silver is expected to remain in a supply deficit this year despite softening demand for jewelry. The gold/silver ratio is now trading near the lowest levels since March as silver prices outpace gold, a long-awaited shift in the fundamental landscape for the metals. Strong industrial demand is helping to boost the appeal of silver prices.

| Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 32 p Short 32.5 p Short 40.5 c Long 41 c | 66% | +630 | -1870 |

| Short Strangle | Short 32.5 p Short 40.5 c | 74% | +4030 | x |

| Short Put Vertical | Long 32 p Short 32.5 p | 85% | +225 | -2275 |

| Symbol: Energy | Daily Change |

| /CLN5 | +0.09% |

| /HON5 | 0% |

| /NGN5 | -4.76% |

| /RBN5 | +0.05% |

Natural gas prices (/NGN5) fell to start the week, slipping over 5% in early trading. Traders trimmed some of those losses once the US started trading, but reduced flows for liquified natural gas (LNG) are weighing sentiment. Meanwhile, weather forecasts remain unremarkable. Prices in Europe slipped over the weekend, further reducing pressure on US gas export demand. European gas storage has improved recently but remains below last year.

| Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 2.7 p Short 2.85 p Short 4.3 c Long 4.45 c | 66% | +430 | -1070 |

| Short Strangle | Short 2.85 p Short 4.3 c | 74% | +1790 | x |

| Short Put Vertical | Long 2.7 p Short 2.85 p | 83% | +160 | -1340 |

| Symbol: FX | Daily Change |

| /6AM5 | +0.25% |

| /6BM5 | +0.03% |

| /6CM5 | -0.07% |

| /6EM5 | +0.02% |

| /6JM5 | +0.1% |

The Australian dollar (/6AM5) is emerging as the top performer early in the week amid a slew of positive headlines circulating around its major trading partner, China. Chinese data with respect to trade and inflation was mostly in line with expectations, but the data may be overshadowed by news that the Sino-American trade teams have resumed negotiations in London. Overall, the US dollar is mostly weaker on the day, but only marginally: the Dollar Index ($DXY) is off by a mere 0.06%.

| Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.62 p Short 0.625 p Short 0.675 c Long 0.68 c | 65% | +140 | -360 |

| Short Strangle | Short 0.625 p Short 0.675 c | 71% | +520 | x |

| Short Put Vertical | Long 0.62 p Short 0.625 p | 87% | +60 | -440 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.