Nasdaq 100 Gyrates on Monday, and Dollar Softens as Bonds Twist

Nasdaq 100 Gyrates on Monday, and Dollar Softens as Bonds Twist

Also, 10-year T-note, silver, crude oil and Australian dollar futures

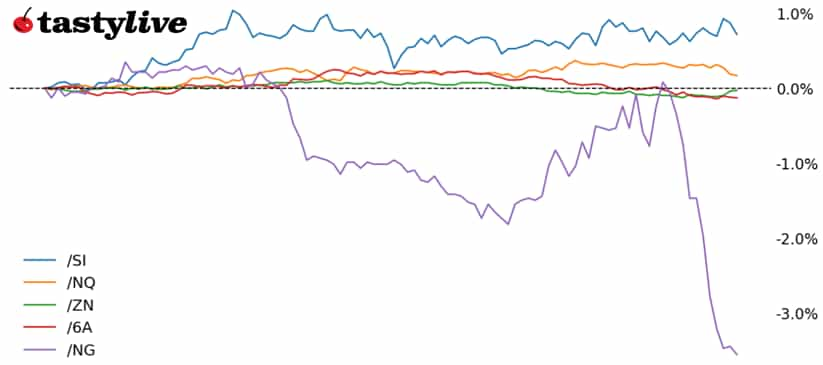

- Nasdaq 100 E-mini futures (/NQ): +0.25%

- 10-year T-note futures (/ZN): +0.17%

- Silver futures (/SI): +1.52%

- Crude oil futures (/CL): +0.09%

- Australian dollar futures (/6A): +0.25%

A relatively quiet week is off to a relatively quiet start. Stocks are trading modestly higher today, unbothered by the weekend’s news and images from Los Angeles. The May US consumer price index (CPI) due mid-week is the most important macro event on the board as the Federal Reserve is in its communications blackout window before the June 18 meeting. Elsewhere, silver prices have continued their surge into fresh yearly highs, while the US dollar is modestly weaker amongst the majors.

| Symbol: Equities | Daily Change |

| /ESM5 | +0.03% |

| /NQM5 | +0.25% |

| /RTYM5 | +0.39% |

| /YMM5 | -0.21% |

S&P 500 futures (/ESM5) were little changed today morning after posting a second weekly win. Traders are waiting to hear how talks between the US and China turn out, with negotiators set to meet in London today. Apple (AAPL) was up about 0.7% as its Worldwide Developers Conference starts. Robinhood (HOOD) fell over 5% after losing a bid to join the S&P 500 in its quarterly rebalancing. Warner Bros. Discover (WBD) rose over 7% after management said it would split into two separate companies by the end of next year.

| Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 20250 p Short 20500 p Short 23500 c Long 24000 c | 64% | +1140 | -3860 |

| Short Strangle | Short 20500 p Short 23500 c | 70% | +5415 | x |

| Short Put Vertical | Long 20250 p Short 20500 p | 85% | +570 | -4430 |

| Symbol: Bonds | Daily Change |

| /ZTM5 | +0.06% |

| /ZFM5 | +0.11% |

| /ZNM5 | +0.17% |

| /ZBM5 | -0.08% |

| /UBM5 | -0.22% |

10-year T-note futures (/ZNU5) were up about 0.11% in early trading as investors wait for inflation data due later this week. Yields surged on Friday when US jobs data impressed expectations. Outside of the inflation data, traders are watching this week’s 30-year bond auction due on Thursday. Meanwhile, the Senate is expected to make considerable changes to President Trump’s tax and spending plan. We’ll also see a 10-year note auction cross the wires on Wednesday.

| Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 107 p Short 107.5 p Short 113 c Long 113.5 c | 70% | +109.38 | -390.63 |

| Short Strangle | Short 107.5 p Short 113 c | 75% | +406.25 | x |

| Short Put Vertical | Long 107 p Short 107.5 p | 88% | +62.50 | -437.50 |

| Symbol: Metals | Daily Change |

| /GCQ5 | -0.15% |

| /SIN5 | +1.52% |

| /HGN5 | +1.3% |

Silver prices (/SIN5) continued to climb on today, rising about 1.52% in early trading. Strong investor demand for precious metals is helping to push prices higher, but silver is expected to remain in a supply deficit this year despite softening demand for jewelry. The gold/silver ratio is now trading near the lowest levels since March as silver prices outpace gold, a long-awaited shift in the fundamental landscape for the metals. Strong industrial demand is helping to boost the appeal of silver prices.

| Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 32 p Short 32.5 p Short 40.5 c Long 41 c | 66% | +630 | -1870 |

| Short Strangle | Short 32.5 p Short 40.5 c | 74% | +4030 | x |

| Short Put Vertical | Long 32 p Short 32.5 p | 85% | +225 | -2275 |

| Symbol: Energy | Daily Change |

| /CLN5 | +0.09% |

| /HON5 | 0% |

| /NGN5 | -4.76% |

| /RBN5 | +0.05% |

Natural gas prices (/NGN5) fell to start the week, slipping over 5% in early trading. Traders trimmed some of those losses once the US started trading, but reduced flows for liquified natural gas (LNG) are weighing sentiment. Meanwhile, weather forecasts remain unremarkable. Prices in Europe slipped over the weekend, further reducing pressure on US gas export demand. European gas storage has improved recently but remains below last year.

| Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 2.7 p Short 2.85 p Short 4.3 c Long 4.45 c | 66% | +430 | -1070 |

| Short Strangle | Short 2.85 p Short 4.3 c | 74% | +1790 | x |

| Short Put Vertical | Long 2.7 p Short 2.85 p | 83% | +160 | -1340 |

| Symbol: FX | Daily Change |

| /6AM5 | +0.25% |

| /6BM5 | +0.03% |

| /6CM5 | -0.07% |

| /6EM5 | +0.02% |

| /6JM5 | +0.1% |

The Australian dollar (/6AM5) is emerging as the top performer early in the week amid a slew of positive headlines circulating around its major trading partner, China. Chinese data with respect to trade and inflation was mostly in line with expectations, but the data may be overshadowed by news that the Sino-American trade teams have resumed negotiations in London. Overall, the US dollar is mostly weaker on the day, but only marginally: the Dollar Index ($DXY) is off by a mere 0.06%.

| Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.62 p Short 0.625 p Short 0.675 c Long 0.68 c | 65% | +140 | -360 |

| Short Strangle | Short 0.625 p Short 0.675 c | 71% | +520 | x |

| Short Put Vertical | Long 0.62 p Short 0.625 p | 87% | +60 | -440 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices