Nasdaq 100 Shrugs Off Trump-Musk Drama; May US NFP Doesn’t Miss

Nasdaq 100 Shrugs Off Trump-Musk Drama; May US NFP Doesn’t Miss

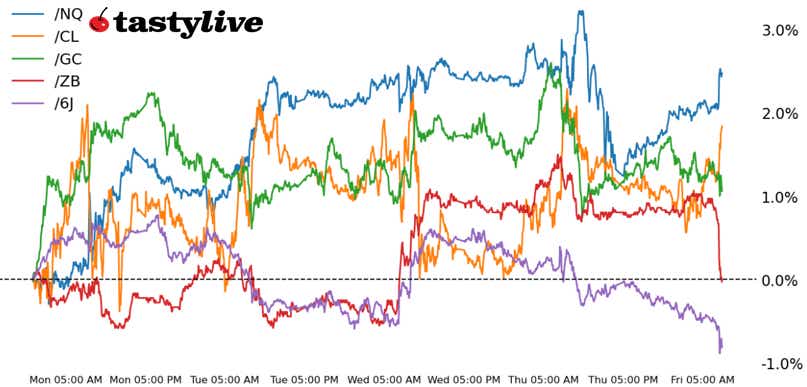

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +0.93%

- 30-year T-bond futures (/ZB): -0.74%

- Gold futures (/GC): +0.1%

- Crude oil futures (/CL): +0.44%

- Japanese yen futures (/6J): -0.78%

Linguists have yet to conceive of the words to describe what unfolded across traditional and social media yesterday between the world’s most powerful man and the world’s richest man. Not that it mattered for stocks — taking Tesla and the Trump/Musk feud out of the equation, stocks traded higher yesterday. And with signs of cooling off by this morning, traders have started to look past the drama and instead shift their attention back to more orthodox catalysts.

One such catalyst was the May US non-farm payrolls report released this morning. Jobs growth is solid if not slowing, with the headline figure coming in at 139,000 vs. the expected 130,000. But the previous two months were revised lower by 95,000, taking some sheen off the beat. The unemployment rate (U3) held stead at 4.2%, but a look below the hood shows a 4.244% reading; not barely falling below the line where it would have been rounded up to 4.3%. Wages, on the other hand, were stronger with an increase 3.9% year over year vs. the 3.7% expected.

Overall, the May US jobs report was a mixed bag: firmer wages may have to do with kinks around the tariffs, with workers decidedly negative in the household employment survey: They reported a drop of 696,000 jobs, the largest decline since December 2023.

| Symbol: Equities | Daily Change |

| /ESM5 | +0.81% |

| /NQM5 | +0.93% |

| /RTYM5 | +1.15% |

| /YMM5 | +0.69% |

A strong jobs report dispelled fears of a recession, pushing US equity prices higher this morning. S&P 500 futures (/ESM5) rose over 1% to hit the highest levels traded since early March. Broadcom (AVGO) fell almost 3% after the chipmaker reported a drop in free cash flow. Lululemon (LULU) fell over 20% after the retailer cut its guidance for the year.

| Strategy: (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 21600 p Short 21700 p Short 22500 c Long 22600 c | 19% | +1480 | -520 |

| Short Strangle | Short 21700 p Short 22500 c | 50% | +18250 | x |

| Short Put Vertical | Long 21600 p

Short 21700 p | 59% | +635 | -1365 |

| Symbol: Bonds | Daily Change |

| /ZTM5 | -0.15% |

| /ZFM5 | -0.35% |

| /ZNM5 | -0.45% |

| /ZBM5 | -0.74% |

| /UBM5 | -0.83% |

The strong jobs report saw traders pull back on interest rate cut bets for the Federal Reserve, which sent yields higher in the Treasury market. 30-year T-bond futures (/ZBU5) fell 0.74% in early trading. The move today pushed prices into negative territory for the month. Next week will bring inflation data and consumer confidence figures, but the downward calculus for Treasuries may last more than a couple of days, given the jobs report strength.

| Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 110 p Short 111 p Short 114 c Long 115 c | 29% | +671.88 | -328.13 |

| Short Strangle | Short 111 p Short 114 c | 53% | +2703.13 | x |

| Short Put Vertical | Long 110 p Short 111 p | 66% | +312.50 | -687.50 |

| Symbol: Metals | Daily Change |

| /GCQ5 | +0.1% |

| /SIN5 | +1.66% |

| /HGN5 | -0.77% |

Gold is giving up some ground following the jobs report. /GCQ5 is trading down to its 21-day exponential moving average (EMA), which has supported prices several times over the past several weeks. The move higher in yields and the dollar are putting a firm headwind on gold prices. Still, technical structure is holding, and bulls can hinge their hopes on escalating trade tensions.

| Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3300 p Short 3305 p Short 3415 c Long 3420 c | 19% | +390 | -110 |

| Short Strangle | Short 3305 p Short 3415 c | 54% | +12550 | x |

| Short Put Vertical | Long 3300 p Short 3305 p | 60% | +220 | -280 |

| Symbol: Energy | Daily Change |

| /CLN5 | +0.44% |

| /HON5 | -0.03% |

| /NGN5 | +0.63% |

| /RBN5 | +0.09% |

Crude oil prices (/CLN5) pushed higher after the jobs report, rising about 1.89% an hour into US trading. Prices are now trading at the highest level since early April. For the week, prices are on track to record the largest weekly gain since December. Besides the jobs report, bulls cheered positive headlines on the trade front, with President Xi and President Trump making progress after a phone call this week. Meanwhile, geopolitical premium remains in the price as some anticipate a possible Israeli strike against Iran.

| Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 61.5 p Short 62 p Short 64.5 c Long 65 c | 17% | +400 | -100 |

| Short Strangle | Short 62 p Short 64.5 c | 51% | +4160 | x |

| Short Put Vertical | Long 61.5 p Short 62 p | 58% | +190 | -310 |

| Symbol: FX | Daily Change |

| /6AM5 | -0.22% |

| /6BM5 | -0.35% |

| /6CM5 | -0.14% |

| /6EM5 | -0.35% |

| /6JM5 | -0.78% |

It’s a bad day for the Japanese yen after the jobs report fueled US dollar gains and improved market sentiment. /6JM5 fell 0.78% in early trading. The Treasury’s exchange-rate report to Congress supported further tightening in monetary policy for the Bank of Japan. The Treasury noted that Japan is on its monitoring list for foreign exchange scrutiny but didn’t label Japan as a currency manipulator.

| Strategy (66DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.00685 p Short 0.0069 p Short 0.0071 c Long 0.00715 c | 29% | +425 | -200 |

| Short Strangle | Short 0.0069 p Short 0.0071 c | 54% | +2100 | x |

| Short Put Vertical | Long 0.00685 p Short 0.0069 p | 65% | +250 | -375 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices