Crude Oil Stages Comeback After Prices Drop to Six-Month Low

Crude Oil Stages Comeback After Prices Drop to Six-Month Low

Rallies as broader market sentiment Improves: sees upside after unchanged OPEC demand forecast

- Crude oil prices are rallying amid a broader uptick in market sentiment.

- OPEC+ is holding steady on its demand forecast, breaking with other forecasters.

- The crude oil prompt spread backwardation signals that there is still some tightness in the market.

Crude oil futures (/CLJ5) were trading near the lowest levels since September earlier this week. Today, prices are up over 2% as buyers come back into the commodity that has been beaten down by increasing trade tension between the U.S. and global trading partners. A revival in sentiment in the equity market accompanied the rally in crude oil prices.

After an initial rally at the start of the year that saw crude oil prices rise to $77.68 per barrel, traders have aggressively sold the commodity as enthusiasm over the new Trump administration faded and attention shifted to U.S. trade measures that many fear would affect global demand.

So far, tariffs haven’t specifically targeted oil, but trade measures on Canadian oil could go into effect on April 2 if a deal among the U.S., Canada and Mexico isn’t reached by then. Currently, a 10% tariff on Canadian energy products is in place, but ongoing talks between trade representatives could see the level drop to zero or near it.

While tariffs aren’t directly impacting global oil trade yet, the broader concern about slowing economic growth has punished prices because traders expect lower demand for the commodity because of trade measures that are expected to slow global growth.

OPEC+ to start releasing more oil

The Organization of Petroleum Exporting Countries, or OPEC, and its broader alliance, OPEC+, kept its demand growth forecast unchanged at +1.45 million barrels a day for 2025. However, other industry groups have lowered their forecasts recently, including the International Energy Agency (IEA), which pegs growth at +1.1 million barrels a day this year.

OPEC also kept its forecast for economic growth the same at +3.1% for 2025. The cartel did mention tariffs but assumed the influence on growth would be outdone by strong consumer demand. OPEC’s Monthly Oil Market Report (MOMR) stated:

“The industrial sector is projected to pick up gradually as well, although uncertainties remain, especially as it remains to be seen how and to what extent potential tariffs and other policy measures will play out. So far, they are not anticipated to materially impact current underlying growth assumptions, but the outcome of potentially further rising uncertainties and the scope and significance of potential tariffs and other policy measures will need close monitoring.”

Earlier this month, OPEC signaled it would allow more oil onto the market starting in April by rolling back some voluntary production cuts. The move would release an additional 138,000 barrels a day onto the market in April. That is a rather small amount of global consumption, but it hints that OPEC could be playing a political angle under pressure from the Trump administration. Still, Russia’s Deputy Prime Minister, Alexander Novak, said that the group could reverse the decision if market conditions turn against oil.

Prompt spread remains resilient amid the sell-off

The prompt spread for U.S. prices remains in backwardation, with the front-month contract holding a premium of 30 cents over the next month’s contract. That structure is typically seen as a bullish signal for oil traders because it reflects a tight physical market where demand for oil now is higher than demand for oil further out in time.

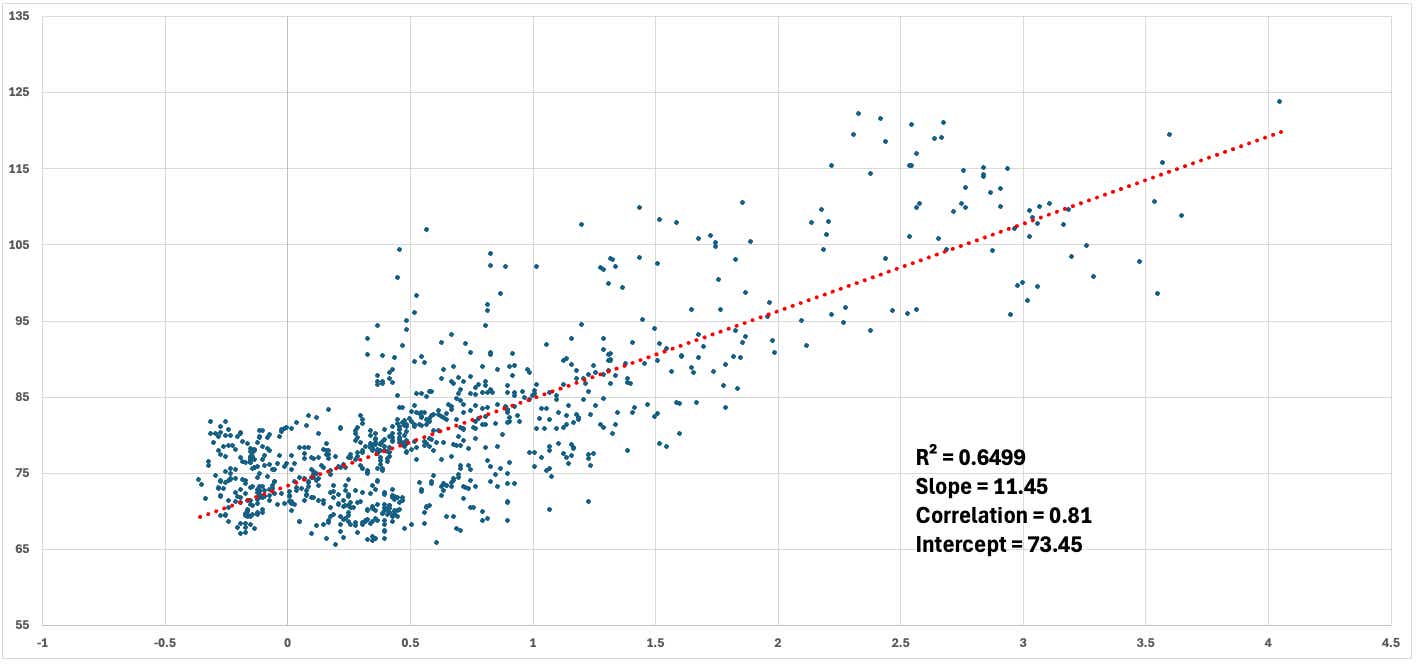

A regression analysis on crude oil and the prompt spread going back to 2019 reveals that oil prices should be trading at about $77 per barrel based on the current prompt spread. While other factors are likely influencing oil outside of that relationship, it does suggest oil prices have some upside assuming the prompt spread holds in backwardation.

Trading crude oil

Crude oil prices have traded in a steady downward range since mid-January. Today’s move shows a likely close above the nine-day exponential moving average (EMA), which marks the first close above the trendline since Feb. 20. That provides some evidence that the downtrend may be over for now. Prices also held support at the September swing low.

Crude oil futures trade with an implied volatility rank (IVR) of 24.5, meaning volatility is low relative to the past 12 months of trading. That said, buying a call spread may offer a better trade than selling a put spread, given the volatility profile in the product. Alternatively, a short trade would likely be better suited to buying a put spread.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.