Fear of Recession Increases as GDP Contracts

Fear of Recession Increases as GDP Contracts

By:Ilya Spivak

Stocks may struggle to resist selling pressure after soggy U.S. manufacturing data

- Economic data from China, Europe and the U.S. points to rising risk of recession.

- Stocks sank as U.S. GDP contracted and then rebounded sharply to erase the sell-off.

- But market resilience may struggle to hold up on soft U.S. manufacturing data.

Macroeconomic data from the world’s most consequential economies is signaling the march toward recession is accelerating. Figures from China, the Eurozone and the U.S.—which together account for 58% of global gross domestic product (GDP)—suggest a broad-based downturn may now be inescapable.

First, official purchasing managers’ index (PMI) data from China showed the economy slowed to near-standstill in April, marking a three-month low for activity growth. Perhaps most critically, the manufacturing sector shrank at the fastest pace since December 2023 as efforts to front-run incoming U.S. tariffs ran out of runway.

Next, a slightly better than expected Eurozone GDP print left the currency bloc in an anemic state. Output grew 0.4% in the first quarter, topping consensus forecasts calling for a rise of 0.2%. The outcome falls near the top of the soggy range in place since the start of 2024, but no more.

Moreover, PMI data flag a slowdown underway in April.

U.S. GDP data disappoints, stoking fear of recession

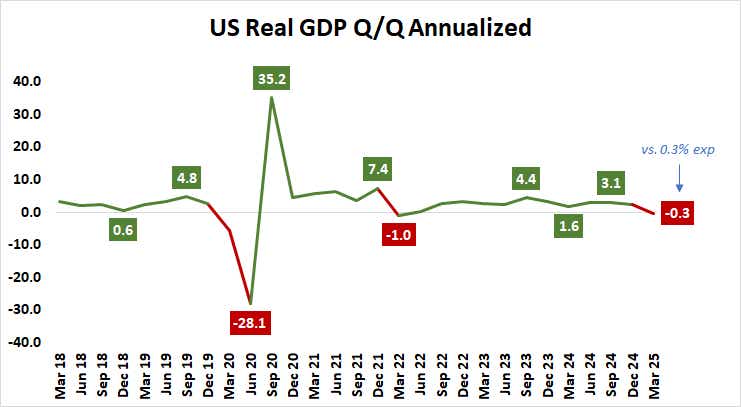

First-quarter U.S. GDP data posted the first contraction in three years. The world’s largest economy shrank at an annualized pace of 0.3%.

Economists anticipated a 0.3% rise ahead of the release. A dramatic surge in imports helped explain the disappointment, demonstrating once again the rush to stockpile goods ahead of tariff hikes.

Still, there was more to the numbers than an unusually volatile external sector. Growth of consumption also cooled to 1.8%, the slowest pace since the second quarter of 2023. Government spending fell 5.1%, marking the steepest drop since the three months ending March 2022.

Last year, weakness in Europe and China was offset by a buoyant U.S. service sector that powered the North American behemoth to its best performance since early 2022. That momentum has now fizzled while the other two powerhouse economies have been unable to accelerate, leaving global growth without a safety net.

Stocks try to resist selling pressure, but for how long?

Stock markets swooned as the U.S. GDP report came across the wires, with the S&P 500 dropping as much as 2.2%. However, a snappy rebound began less than two hours later, erasing the bellwether index’s daily loss and flipping it to a narrow rise. A similar dynamic played out for the tech-tilted Nasdaq 100 and the small-cap Russell 2000.

Meanwhile, cycle-sensitive crude oil and copper prices are trading near intraday lows as the session’s end approaches after plunging alongside stocks in the GDP data’s aftermath. This hints that recession fears are firmly in play, suggesting that stock markets’ resilience may have more to do with a reluctance to commit ahead of key earnings reports.

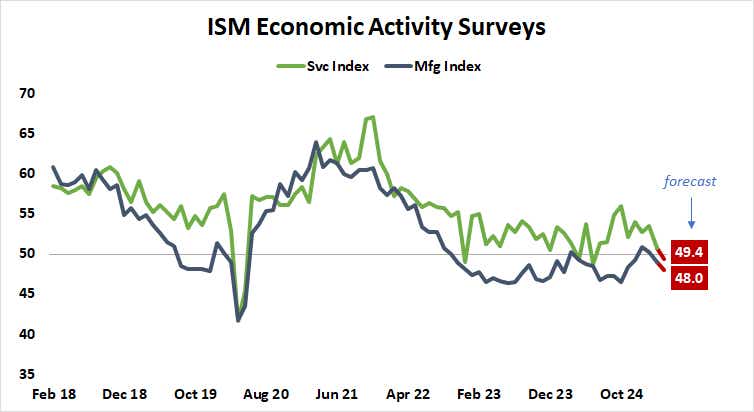

The spotlight now turns to a survey of the U.S. manufacturing sector from the Institute of Supply Management (ISM). It is expected to show the second consecutive month of contraction. Moreover, the pace of decline is seen accelerating to the fastest in seven months. A soft result may help wear down stocks’ capacity to resist selling pressure.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices