Recession Handicappers See Three Possible Outcomes. Here is the Data The Forecasters are Relying On.

.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Recession Handicappers See Three Possible Outcomes. Here is the Data The Forecasters are Relying On.

The prevailing consensus recession outcome implies the greatest potential risk for active investors

- The U.S. economy has avoided a recession despite the Federal Reserve’s aggressive tightening efforts.

- The odds of a U.S. recession in 2023 are shrinking rapidly as time runs off the calendar.

- Nevertheless, forward-looking indicators remain bearish, suggesting that a recession might arrive some time in 2024.

The most widely anticipated in perhaps all of U.S. history has … not arrived. Despite the Federal Reserve’s aggressive rate hike efforts, the world’s largest economy has chugged along just fine. Continued supply disruptions? Regional banks failing? A potential U.S. default? None of these things have mattered thus far.

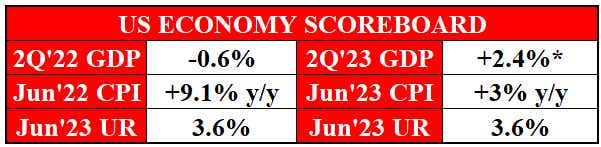

As we like to say on Futures Power Hour (Monday-Friday, 1 p.m. ET/12 p.m. CT) and Overtime (Monday-Thursday, 4:30 p.m. ET/3:30 p.m. CT), “check the scoreboard.” The fact of the matter is that not only has the U.S. economy avoid a recession, but it’s evolved in a healthy manner over the past year:

The forthcoming release of the 2Q’23 U.S. GDP report (Thursday, July 27 at 8:30 a.m. ET/7:30 a.m. CT) will likely solidify the narrative around a “soft landing,” or “immaculate disinflation” as some call it–the idea that the U.S. economy will be able to defeat inflation without sacrificing growth or the labor market. As farfetched an idea that may have seemed during the summer months of 2022, here we are.

Even if the U.S. economy is in the midst of a soft landing, that doesn’t mean that the situation will remain sanguine for the rest of the year. However, the window with which a recession could appear is rapidly shrinking and the odds of one emerging at any point in the next 12 months appear to have been diminished.

Let's look at the three most probable recession outcomes to consider.

- Not now, not immediately

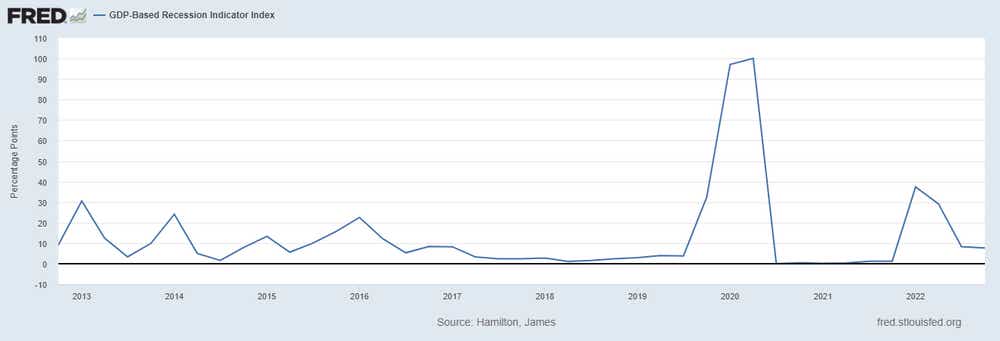

Consider the GDP-based Recession Indicator Index:

This index measures the probability that the U.S. economy was in a recession during the indicated quarter, and it corresponds to the probability (measured in percent) that the underlying true economic regime is one of recession based on the available data.

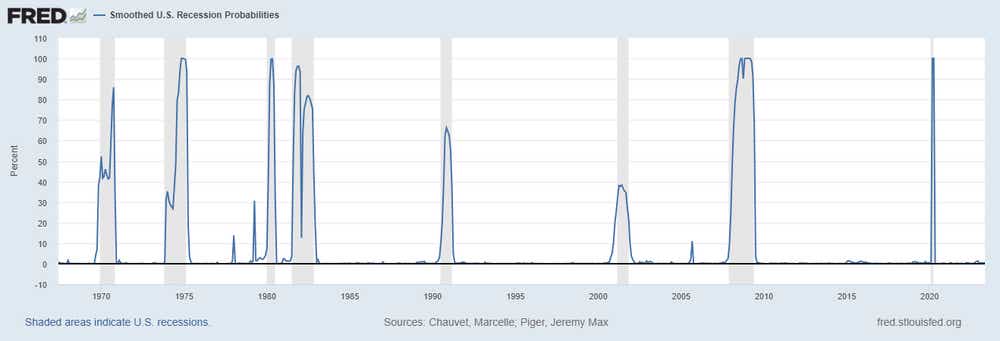

2. A smoothed U.S. recession

Smoothed recession prob for the U.S. are derived using four monthly coincident variables: NFP employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.

Consider the Real-time Sahm Rule Recession Indicator:

The Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50% or more relative to its low during the previous 12 months.

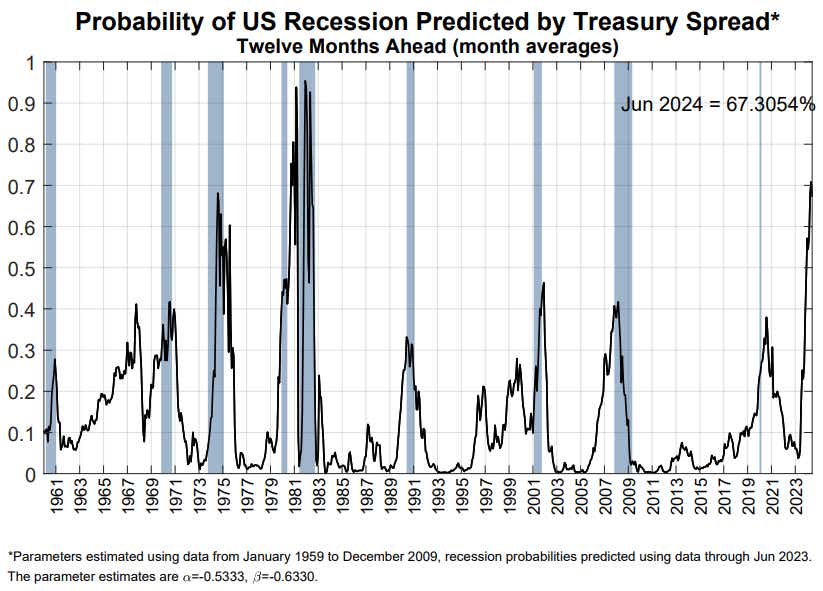

3. Recession likely: A matter of when (not if)

Consider the New York Fed's 3-month/10-month treasury yield spread:

Parameters re estimated using data from January 1959 to December 2009, recession probabilities predicted using data through June 2023. The parameter estimates are α=-0.5333, β=-0.6330.

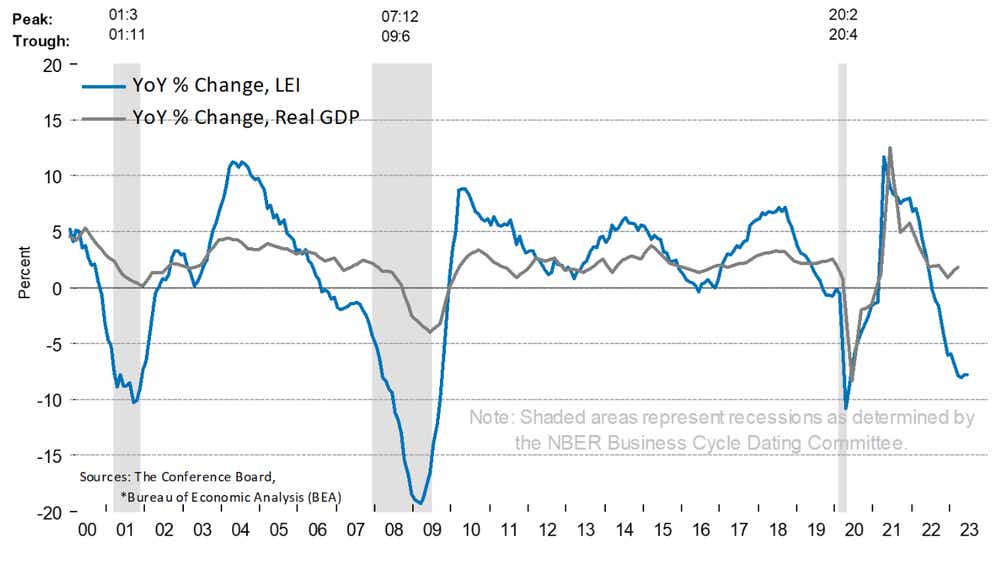

Consider the Conference Board Leading Economic Index:

The LEI is comprised of 10 indicators that cover a wide range of economic activity, including job growth, housing construction, and stock prices. The index is designed to provide a broad-based look at the health of the economy and can be used to predict turning points in the business cycle.

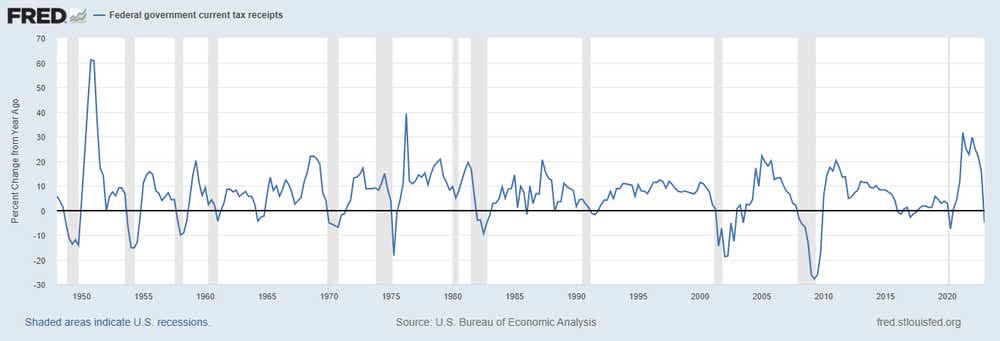

Consider federal government tax receipts:

Taxes collected by the federal government on a year-over-year basis. Shaded areas indicate recessions.

Signal or noise?

In the prior U.S. recession watch, we noted that “/ES futures positioning is the most net-short since October 2011, per the CFTC’s COT report; the bear side is extremely crowded already. If the U.S. economy does prove resilient, then traders expecting a recession–and there appears to be quite a few–may find themselves on the wrong side of tedious, slow-moving short covering rally in stocks over the coming months, marked by low volatility and low trading volumes.”

Similarly, the U.S. economy continues to chug along, hurdling any obstacles thrown in its way. While net-short /ES positioning has been mostly cleared out, there are still a significant number of market participants that continue to express disbelief in the state of the U.S. economy. While the easy money may have already been made in betting against a recession in the near term, it makes sense that, at least for the next few months, betting against a recession may still be the best choice traders have.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofxFor live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices