S&P 500 Continues to Churn, While an Oil Rally Stunts a Bond Rebound

S&P 500 Continues to Churn, While an Oil Rally Stunts a Bond Rebound

Also, 10-year T-note, gold, crude oil, and Japanese yen futures

- S&P 500 E-mini futures (/ES): +0.2%

- 10-year T-note futures (/ZN): +0.08%

- Silver futures (/SI): -0.14%

- Crude oil futures (/CL): +2%

- Euro futures (/6E): -0.47%

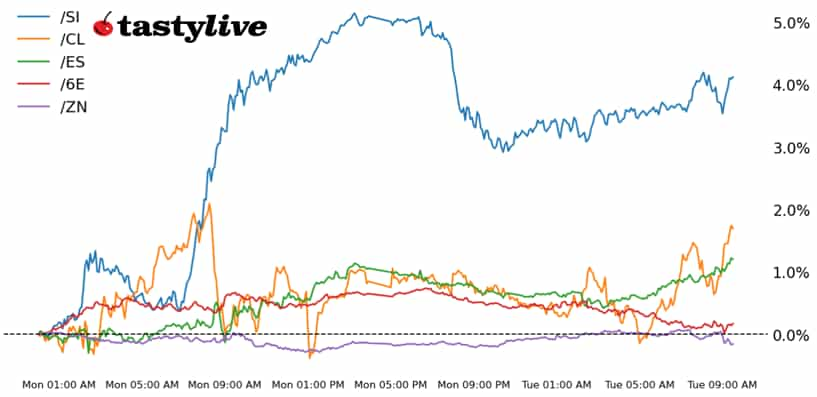

A quiet start to June continues for US equity markets, with a slight push higher developing on this morning. For all the consternation (mostly our own) about the divergence between stocks and everything else yesterday (bonds, metals, FX), the rest of the market is settling down today: Bonds are mostly up across the curve; metals are lower in unison and the US dollar is perking up after its third-lowest close of the year. The April Job Openings and Labor Turnover Survey (JOLTs) report showed job openings rose to 7.39 million, the latest sign of resiliency in the economy as it managed tariff volatility post-Liberation Day. (Note: the Atlanta Federal Reserve GDPNow 2Q ’25 growth tracker is up 4.6% annualized.)

Symbol: Equities | Daily Change |

/ESM5 | +0.2% |

/NQM5 | +0.35% |

/RTYM5 | +0.86% |

/YMM5 | +0.02% |

S&P 500 futures (/ESM5) rose slightly in early trading today as investors awaited more news on potential trade deals. Dollar General (DG) rose over 12% after the dollar store operator raised its sales outlook for the year despite anticipating tariffs will stick around until late summer. Hims & Hers Health (HIMS) gained 3% after announcing it will acquire Zava, a European competitor. Constellation Energy (CEG) rose after signing a 20-year deal with Meta (META) to provide nuclear energy for AI data centers.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5550 p Short 5600 p Short 6375 c Long 6425 c | 66% | +450 | -2050 |

Short Strangle | Short 5600 p Short 6375 c | 71% | +2525 | x |

Short Put Vertical | Long 5550 p Short 5600 p | 87% | +250 | -2250 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.02% |

/ZFM5 | +0.04% |

/ZNM5 | +0.08% |

/ZBM5 | +0.31% |

/UBM5 | +0.49% |

The 10-year T-note futures (/ZNM5) were slightly higher today. Yields along the curve remain higher than a month ago. Traders are waiting to see how the trade war will play out and are anticipating a phone call between President Trump and President Xi. Meanwhile, the Trump administration is challenging a second court ruling that blocked reciprocal tariffs. Meanwhile, yields in Australia and Japan fell overnight as traders seek out diversification of their bond portfolios.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108 p Short 113 c Long 114 c | 62% | +234.38 | -765.63 |

Short Strangle | Short 108 p Short 113 c | 67% | +562.50 | x |

Short Put Vertical | Long 107 p Short 108 p | 87% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCQ5 | -0.75% |

/SIN5 | -0.14% |

/HGN5 | -0.26% |

Silver futures (/SIN5) were slightly lower this morning after trimming deeper losses from overnight. The gold/silver ratio is pushing lower for a second day, moving to about 97, the lowest level since early April. A stronger dollar is posing a headwind for precious metals prices after jumping at the start of the week. Any news concerning trade talks between the US and China could be consequential for gold and silver prices.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 30.5 p Short 31 p Short 38.5 c Long 39 c | 67% | +625 | -1875 |

Short Strangle | Short 31 p Short 38.5 c | 74% | +3580 | x |

Short Put Vertical | Long 30.5 p Short 31 p | 84% | +260 | -2240 |

Symbol: Energy | Daily Change |

/CLN5 | +2% |

/HON5 | +1.91% |

/NGN5 | +0.03% |

/RBN5 | +0.92% |

Crude oil prices (/CLN5) jumped after reports revealed Iran was set to reject a US proposal to end the nuclear dispute. Reuters reported an Iranian diplomat called the proposal a “non-starter.” The move comes after prices jumped yesterday following an OPEC+ decision to release more crude oil onto the market in July. The additional 411,000 barrels per day avoided traders’ worse fears. Inventory data from the American Petroleum Institute (API) is in focus for today.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 60 p Short 60.5 p Short 64 c Long 64.5 c | 20% | +380 | -120 |

Short Strangle | Short 60.5 p Short 64 c | 53% | +4260 | x |

Short Put Vertical | Long 60 p Short 60.5 p | 61% | +170 | -330 |

Symbol: FX | Daily Change |

/6AM5 | -0.38% |

/6BM5 | -0.1% |

/6CM5 | +0.01% |

/6EM5 | -0.47% |

/6JM5 | -0.67% |

Euro futures (/6EM5) slipped after Eurozone CPI data fell below the European Central Bank’s target of 2%, which invites the possibility of additional rate cuts by the central bank later this year. Despite today’s pullback, the Euro is maintaining its positive momentum, with prices remaining above the 9- and 21-day exponential moving averages.

Strategy (66DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.13 p Short 1.135 p Short 1.16 c Long 1.165 c | 28% | +425 | -200 |

Short Strangle | Short 1.135 p Short 1.16 c | 56% | +2625 | x |

Short Put Vertical | Long 1.13 p Short 1.135 p | 70% | +237.50 | -387.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.