S&P 500 Grapples with Return of ‘Higher for Longer’ Treasury Yields

S&P 500 Grapples with Return of ‘Higher for Longer’ Treasury Yields

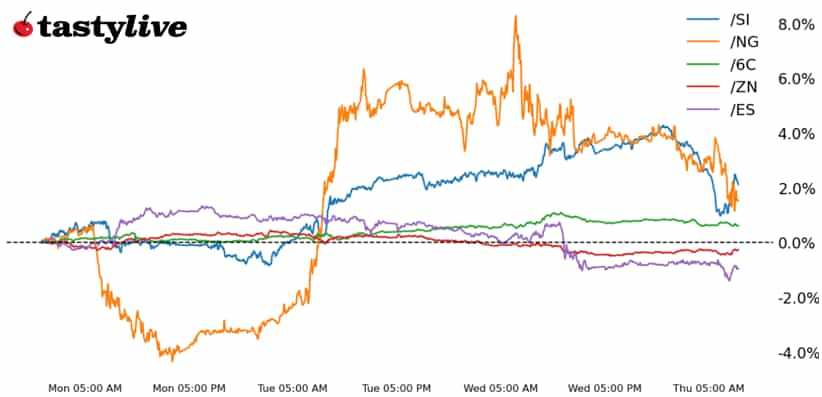

Also 10-year T-Note, Silver, Natural Gas, and Canadian Dollar Futures

- S&P 500 E-mini futures (/ES): -0.13%

- 10-year T-Note futures (/ZN): +0.06%

- Silver futures (/SI): -1.67%

- Natural Gas futures (/NG): -2.14%

- Canadian Dollar futures (/6C): -0.3%

The turn into the second half of the week is being defined by the latest push higher in U.S. Treasury yields. With the 10-year yield above 4.5% and the 30-year yield above 5%, traders are dusting off their 2022-2023 playbook. Small cap stocks are trailing their mega cap brethren, while interest rate-sensitive sectors like regional banking and real estate are lagging tech stocks. The passage of Trump’s tax bill on the thinnest of margins (215-214-1) advances the deficit-widening legislation to the Senate, where it faces the prospect of significant markdowns.

Symbol: Equities | Daily Change |

/ESM5 | -0.13% |

/NQM5 | +0.04% |

/RTYM5 | -0.69% |

/YMM5 | -0.11% |

Stocks are oscillating between gains and losses on Thursday, although the performance hierarchy today looks a lot like yesterday: the Nasdaq 100 (/NQM5) is the best performer while the Russell 2000 (/RTYM5) is trailing. Curiously, while most sectors are underwater, it’s the tariff-sensitive, growth names that are proving most resilient: Retail (XRT), Technology (XLK), Semiconductors (SMH), and Consumer Discretionary (XLY) are all in the green.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5500 p Short 5600 p Short 6300 c Long 6400 c | 65% | +1050 | -3950 |

Short Strangle | Short 5600 p Short 6300 c | 71% | +3687.50 | x |

Short Put Vertical | Long 5500 p Short 5600 p | 82% | +687.50 | -4312.50 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.04% |

/ZFM5 | +0.11% |

/ZNM5 | +0.06% |

/ZBM5 | -0.31% |

/UBM5 | -0.52% |

The Trump tax bill has officially passed the House, and a brief push higher by yields at the long-end of the curve is unwinding as the session has progressed. Is this a ‘buy the rumor, sell the news’ moment for the bond market? As noted yesterday, the bond market has returned to yields consistent with a ‘higher for longer’ outlook; as long as 10s remain above 4.5% and 30s hold above 5%, Treasuries will remain an obstacle for U.S. equity markets.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 107 p Short 113 c Long 114 c | 63% | +250 | -750 |

Short Strangle | Short 107 p Short 113 c | 69% | +687.50 | x |

Short Put Vertical | Long 106 p Short 107 p | 84% | +171.88 | -828.13 |

Symbol: Metals | Daily Change |

/GCM5 | -0.08% |

/SIN5 | -1.67% |

/HGN5 | -0.62% |

For the growth impulse making its way through sector allocation in equity markets on Thursday, there’s no evidence of such optimism in commodity markets. The “growthier” metals, silver (/SIN5) and copper (/HGN5), are both struggling on the other side of the tax bill legislation that would eliminate or reduce tax credits and grants around electric vehicles and other ‘green’ technologies that use copper and/or silver as significant inputs. Volatility across the metals has perked up over the past few days.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 30 p Short 30.5 p Short 35.5 c Long 36 c | 63% | +690 | -1810 |

Short Strangle | Short 30.5 p Short 35.5 c | 71% | +2925 | x |

Short Put Vertical | Long 30 p Short 30.5 p | 82% | +345 | -2155 |

Symbol: Energy | Daily Change |

/CLN5 | -1.51% |

/HOM5 | -1.5% |

/NGN5 | -2.14% |

/RBM5 | -1.39% |

Like the metals, energy futures are not offering an optimistic view of the world as we make our way into the second half of the week. But there’s also the angle that crude oil (/CLN5) has been artificially boosted by geopolitical concerns around Russia-Ukraine and Israel-Iran, so the optimist’s interpretation of price action is that geopolitical fears are fading. Natural gas (/NGN5) may have the most compelling chart of all, however: a right shoulder in a major head and shoulders pattern may be developing, which would setup a structurally bearish market for natural gas for the rest of 2025.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.6 p Short 2.7 p Short 4.6 c Long 4.7 c | 68% | +250 | -750 |

Short Strangle | Short 2.7 p Short 4.6 c | 76% | +1860 | x |

Short Put Vertical | Long 2.6 p Short 2.7 p | 85% | +110 | -890 |

Symbol: FX | Daily Change |

/6AM5 | -0.43% |

/6BM5 | -0.11% |

/6CM5 | -0.3% |

/6EM5 | -0.37% |

/6JM5 | -0.02% |

FX markets are mixed on Thursday, with neither the buy nor sell America theme taking root. For all the attention on U.S. Treasury market, little has been said about the rise in long-end yields globally in recent sessions. The Japanese Yen (/6JM5) is of interest in this regard, as the shifts in the Japanese bond market may ultimately force the Bank of Japan to return to yield curve control (as from September 2016 to March 2024). Elsewhere, struggles in the Canadian Dollar (/6CM5) are worth watching in context of the fact that it has a higher IVR than all of its other peers.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.705 p Short 0.71 p Short 0.735 c Long 0.74 c | 63% | +120 | -380 |

Short Strangle | Short 0.71 p Short 0.735 c | 69% | +310 | x |

Short Put Vertical | Long 0.705 p Short 0.71 p | 84% | +40 | -460 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.