S&P 500 Briefly Hits Fresh June High; Bonds Rally as Inflation Cools

S&P 500 Briefly Hits Fresh June High; Bonds Rally as Inflation Cools

Also, 10-year T-note, silver, crude oil and euro futures

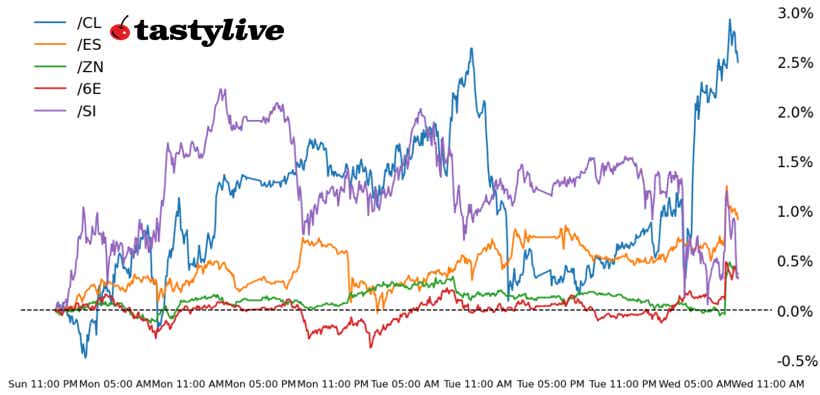

- S&P 500 E-mini futures (/ES): -0.07%

- 10-year T-note futures (/ZN): +0.28%

- Silver futures (/SI): -1%

- Crude oil futures (/CL): +2.15%

- Euro futures (/6E): +0.42%

The May US inflation report came in cooler than anticipated, much to the delight of traders this morning. The consumer price index grew by 0.1% month-over-month (m/m) and 2.4% year-over-year (y/y), below forecasts of 0.2% m/m and 2.5% y/y. Core inflation missed as well, at 0.1% m/m and 2.8% y/y vs. 0.2% m/m and 2.9% y/y expected. Traders reacted by pushing up the odds of Federal Reserve cuts in interest rates for July and September; a June hold remains the most likely outcome by a wide margin. Benign inflation figures aside, news of a US-China trade deal agreement — basically, “we’re going to do what we said we would back in Geneva” — is doing little to spark any significant price action.

| Symbol: Equities | Daily Change |

| /ESM5 | -0.07% |

| /NQM5 | +0.1% |

| /RTYM5 | +0.31% |

| /YMM5 | -0.11% |

S&P 500 futures (/ESM5) rose after this morning’s inflation report showed tariffs aren’t resulting in higher prices so far. Tensions between the US and China also cooled after Commerce Secretary Howard Lutnick said there is an outline of a deal with China after two days of negotiations in London. GameStop (GME) fell over 2% in pre-market trading after reporting a miss on its Q1 revenue. Quantum Computing (QUBT) rose over 13% after Nvidia (NVDA) CEO Jensen Huang said the industry was reaching an inflection point. Gitlab (GTLB) fell 13% after reporting poor Q2 results.

| Strategy: (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 6000 p Short 6025 p Short 6175 c Long 6200 c | 18% | +900 | -350 |

| Short Strangle | Short 6025 p Short 6175 c | 48% | +9525 | x |

| Short Put Vertical | Long 6000 p Short 6025 p | 61% | +362.50 | -887.50 |

| Symbol: Bonds | Daily Change |

| /ZTM5 | +0.09% |

| /ZFM5 | +0.22% |

| /ZNM5 | +0.28% |

| /ZBM5 | +0.28% |

| /UBM5 | +0.27% |

10-year T-note futures (/ZNU5) rose 0.24% this morning with the softer-than-expected inflation report. The drop in yields came as fears of higher prices subsided, a view bolstered by the conclusion of trade negotiations in London between the US and China . Investors are waiting for the results of the Treasury’s 10-year note auction today. However, tomorrow’s 30-year bond auction will likely serve as the prime event for the week. Traders are keen to see how foreign demand will hold up as the United States pushes a new tax and spending package forward that is expected to raise the deficit.

| Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 109.5 p Short 110 p Short 111 c Long 111.5 c | 26% | +359.38 | -140.63 |

| Short Strangle | Short 110 p Short 111 c | 52% | +1312.50 | x |

| Short Put Vertical | Long 109.5 p Short 110 p | 69% | +187.50 | -312.50 |

| Symbol: Metals | Daily Change |

| /GCQ5 | +0.43% |

| /SIN5 | -1% |

| /HGN5 | -1.95% |

Silver prices (/SIN5) fell for a second day, dropping about 0.6% this morning. The decline follows a multi-day surge in the metal that saw prices rise to the highest level since 2012. Still, the metal is holding above recent swing highs from March and October of last year. If bulls can hold prices above the 36 handle, it might provide a new base for the next move higher, especially if we see the dollar continue to weaken.

| Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 35.5 p Short 35.75 p Short 37.75 c Long 38 c | 23% | +915 | -335 |

| Short Strangle | Short 35.75 p Short 37.75 c | 54% | +9900 | x |

| Short Put Vertical | Long 35.5 p Short 35.75 p | 58% | +545 | -705 |

| Symbol: Energy | Daily Change |

| /CLN5 | +2.15% |

| /HON5 | +0.95% |

| /NGN5 | +1.81% |

| /RBN5 | +1.2% |

Crude oil prices (/CLN5) rose over 2% after President Donald Trump said the deal with China is done. If the deal is formalized, it would remove a major headwind from the energy market. Meanwhile, negotiations with Iran remain contentious, supporting a geopolitical risk premium in the price of crude. The American Petroleum Institute said that crude stockpiles dropped last week. Traders are waiting for data from the Energy Information Administration (EIA) to confirm the drawdown in inventories.

| Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 62 p Short 62.5 p Short 67 c Long 67.5 c | 20% | +370 | -130 |

| Short Strangle | Short 62.5 p Short 67 c | 52% | +4940 | x |

| Short Put Vertical | Long 62 p Short 62.5 p | 56% | +210 | -290 |

| Symbol: FX | Daily Change |

| /6AM5 | -0.05% |

| /6BM5 | +0.13% |

| /6CM5 | +0.14% |

| /6EM5 | +0.42% |

| /6JM5 | +0.01% |

Euro futures (/6EM5) advanced this morning, rising about 0.38% in early trading. Rate cut expectations for the European Central Bank (ECB) remain subdued. Olli Rehn, governor of the Bank of Finland, warned that the bank should not be complacent over inflation, aligning with ECB President Christine Lagarde’s sentiment on the rate outlook. The softer-than-expected inflation report in the US fueled expectations of a possible policy divergence between the two central banks, lifting the Euro.

| Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 1.14 p Short 1.145 p Short 1.165 c Long 1.17 c | 28% | +437.50 | -187.50 |

| Short Strangle | Short 1.145 p Short 1.165 c | 55% | +2325 | x |

| Short Put Vertical | Long 1.14 p Short 1.145 p | 69% | +237.50 | -387.50 |

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.