S&P 500 Dives as 1Q’25 U.S. GDP Contracts Thanks to Trump’s Tariffs

S&P 500 Dives as 1Q’25 U.S. GDP Contracts Thanks to Trump’s Tariffs

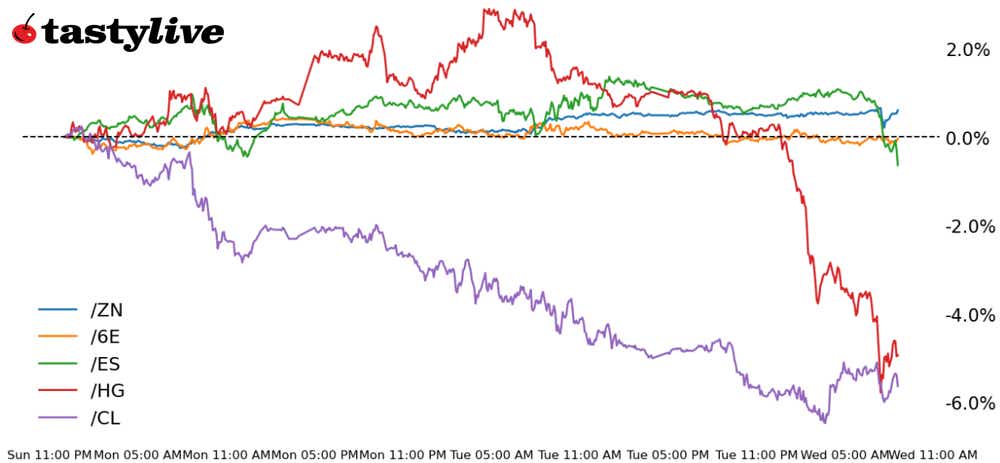

Also, 10-year T-note, copper, crude oil and euro futures

- S&P 500 E-mini futures (/ES): -2.24%

- 10-year T-note futures (/ZN): +0.1%

- Copper futures (/HG): -6.5%

- Crude oil futures (/CL): -1.75%

- Euro futures (/6E): -0.18%

The growth sun has started to set for the American economy, with stagflation starting to cast a long shadow. 1Q’25 U.S. gross domestic product (GDP) contracted by 0.3% in annualized real terms, while inflation (GDP price index) increased by 3.7%. And that’s before the tariffs really started to bite.

The GDP dataset show a clear impact from tariffs: This was the largest negative contribution from net exports in recorded data (since 1947). Further to this point, companies pulled forward production ahead of the tariffs, with private inventory growth surging to its highest level since 2021. “Final sales of domestic product” (GDP less inventory), was down 2.5% annualized.

Some will point to the pullback in government spending as evidence of DOGE’s success in helping to trim the federal budget; instead, it was the sharpest drop in defense spending since the start of 2022 that drove the decline. That’s not a silver lining, but perhaps this is: “final sales to private domestic producers” (GDP less inventory, net-trade and government spending) grew by 3% annualized.

One must conclude that the underlying U.S. economy remained resilient in 1Q’25, and would be performing much better were it not for the tariff-induced chaos coming out of Washington. How long the private sector remains resilient is another story. But with President Donald Trump quickly blaming his predecessor for the weak data, the deterioration in U.S. economic data thanks to the tariffs may still have some room to run.

Symbol: Equities | Daily Change |

/ESM5 | -2.24% |

/NQM5 | -2.5% |

/RTYM5 | -2.55% |

/YMM5 | -1.54% |

The downbeat GDP report put the hurt on sentiment as April trading looks to wrap up, sending S&P 500 futures (/ESM5) lower by over 2% in early trading. Labor market indicators are also stressing the market, with signs now pointing toward a recession in the U.S. economy. First Solar (FSLR) fell 10% this morning after the company warned tariffs would hurt the its profits. Snap (SNAP) fell over 16% after the company withheld guidance in its earnings report. The server maker Super Micro Computer (SMCI) dropped by over 16% after missing estimates. That dragged other semiconductor stocks lower, with Nvidia (NVDA) down 4% this morning. Meta Platforms (META) and Microsoft (MSFT) are set to report earnings after the close today.

Strategy: (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4975 p Short 5025 p Short 5975 c Long 6025 c | 66% | +575 | -1925 |

Short Strangle | Short 5025 p Short 5975 c | 72% | +3750 | x |

Short Put Vertical | Long 4975 p Short 5025 p | 84% | +350 | -2150 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.08% |

/ZFM5 | +0.15% |

/ZNM5 | +0.1% |

/ZBM5 | +0.03% |

/UBM5 | 0% |

The rally in bonds moderated as traders digested the latest economic data. 10-year T-note futures (/ZNM5) were up 0.05% this morning in early trading, while the underlying yield traded around 4.185%, near the lowest levels since April 8. Earlier this week, the U.S. Treasury said it would increase its borrowing estimate for the current quarter because of a smaller cash balance at the start of the year. Meanwhile, lawmakers continue to debate the debt ceiling, which will likely need to be raised. Some analysts believe the $850 billion cash projection for the end of June is unrealistic. Friday’s jobs report is in focus for bond traders now.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 109.5 p Short 115.5 c Long 117 c | 67% | +312.50 | -1187.50 |

Short Strangle | Short 109.5 p Short 115.5 c | 72% | +625 | x |

Short Put Vertical | Long 108 p Short 109.5 p | 85% | +171.88 | -1328.13 |

Symbol: Metals | Daily Change |

/GCM5 | -0.25% |

/SIN5 | -2.18% |

/HGN5 | -6.5% |

Copper prices responded sharply to this morning’s data, with futures (/HGN5) dropping over 5% in early trading. The metal is now down 9% from the start of the month despite a significant recovery from the April lows when it traded near the 4 handle. Tariffs and the now disappointing economic data have put a lot of pain on the metal. A modest rebound in the dollar today isn’t helping.

Strategy (D56TE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.51 p Short 4.52 p Short 4.8 c Long 4.81 c | 20% | +212.50 | -37.50 |

Short Strangle | Short 4.52 p Short 4.8 c | 57% | +8025 | x |

Short Put Vertical | Long 4.51 p Short 4.52 p | 57% | +200 | -50 |

Symbol: Energy | Daily Change |

/CLM5 | -1.75% |

/HOM5 | -1.14% |

/NGM5 | -1.65% |

/RBM5 | -0.88% |

Crude oil futures (/CLN5) are looking at the worst monthly performance since November 2021 following today’s 1.5% drop that accelerated following the GDP report. Traders fear tariffs and a slowing economy in addition to more supply from OPEC+ members will shift the market balance to an oversupply as soon as this summer. The backwardation in the futures structure has weakened on the longer side of the curve, reflecting the oversupply worries. British Petroleum (BP) reported a 48% drop in net profit yesterday, sending the stock 1% lower. The company announced plans to reduce spending and share buybacks over the next couple of years. It’s not what you want to see from a major oil producer and signals a weak outlook for the oil and fuel complex.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 57 p Short 57.5 p Short 62 c Long 62.5 c | 20% | +380 | -120 |

Short Strangle | Short 75.5 p Short 62 c | 53% | +5220 | x |

Short Put Vertical | Long 57 p Short 57.5 p | 55% | +180 | -320 |

Symbol: FX | Daily Change |

/6AM5 | -0.31% |

/6BM5 | -0.5% |

/6CM5 | +0.07% |

/6EM5 | -0.18% |

/6JM5 | -0.16% |

Euro futures (/6EM5) were slightly lower this morning after inflation readings from major European economies showed price pressures may have increased recently. German Harmonized Index of Consumer Prices (HICP) came in above estimates for April, while France’s Consumer Price Index (CPI) rose 0.8% in April. While those readings were above estimates, they were lower than the previous month, which may support the case for rate cuts from the European Central Bank (ECB). Meanwhile, ECB members have started to sound the alarm on growth as the U.S. trade war takes impact in the global economy.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.13 p Short 1.135 p Short 1.16 c Long 1.165 c | 26% | +450 | -175 |

Short Strangle | Short 1.135 p Short 1.16 c | 55% | +3050 | x |

Short Put Vertical | Long 1.13 p Short 1.135 p | 66% | +250 | -375 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.