U.S. Jobs Report, Fed Chair Powell Speech, ECB Meeting, China NPC: Macro Week Ahead

U.S. Jobs Report, Fed Chair Powell Speech, ECB Meeting, China NPC: Macro Week Ahead

By:Ilya Spivak

Stock and the dollar are at risk as fear of global recession grows

- China’s annual NPC meeting is eyed with hope for more fiscal stimulus.

- A hamstrung ECB may boost the euro but also amplify recession fears.

- Key U.S. data and Fed Chair Powell’s speech may leave markets wanting.

Financial markets were in liquidation mode last week as signs of a slowdown in the U.S. economy fueled fear of global recession. Stocks fell alongside commodities as interest rates plunged across the yield curve, marking a sharply dovish shift in Federal Reserve policy bets. Haven-seeking capital flows broadly buoyed the U.S. dollar alongside bonds.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

China National People’s Congress (NPC)

China’s legislature will come together for its annual meeting this week to rubber-stamp the Chinese Communist Party (CCP) agenda for the year ahead. Clues about the government’s priorities for the next five-year plan—running from 2026 to 2030—will also interest investors.

The target for economic growth is expected to remain at 5% but markets will be keen to see if revising the fiscal deficit objective to call for more spending will set the stage for a stimulus to revive the anemic economy. So far, measures to ease credit conditions have been mostly disappointing.

The last three months of 2024 marked the seventh consecutive quarter when nominal growth of gross domestic product (GDP) lagged behind the rate of “real” output expansion, where inflation has been factored out. This implies economy-wide deflation, which speaks to near-total absence of demand.

.png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

European Central Bank (ECB) meeting

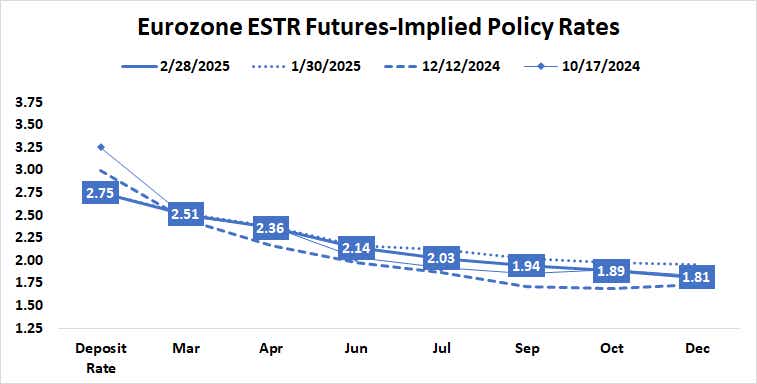

The European Central Bank is widely expected to deliver another 25-basis-point (bps) interest rate cut after the Governing Council meets this week. The move is fully priced into benchmark ESTR interest rate futures. On the whole, traders have discounted 81bps in rate cuts this year. That amounts to three full cuts and a 24% probability of a fourth one.

Eurozone economic growth has struggled to build momentum while inflation has been stubbornly sticky. Consumer price index (CPI) data put headline inflation at 2.4% year-on-year in February, a bit higher than the 2.3% expected by the markets. That may cap scope for further dovish repositioning, helping to underpin the euro.

More broadly, the absence of a more forceful stimulus push bodes ill for overall sentiment in that it hardly encourages a return to faster growth that might counterbalance weakness in China and stumbles in the U.S. The currency may well draw support from a hamstrung ECB, but fear of a global recession may become more acute as well.

U.S. economic data and Fed Chair speech

A flurry of high-profile macro news shaping U.S. economic growth expectations will probably take top billing. The service sector purchasing managers’ index (PMI) survey from the Institute of Supply Management (ISM) is first in focus, with traders eager to see if the numbers confirm the dispiriting weakness in the analog report from S&P Global.

The spotlight then turns to the closely watched monthly labor market update. The economy is expected to have added 133,000 jobs in February, marking the smallest rise in four months. The unemployment rate is expected to remain at 4%, matching the eight-month low recorded in January.

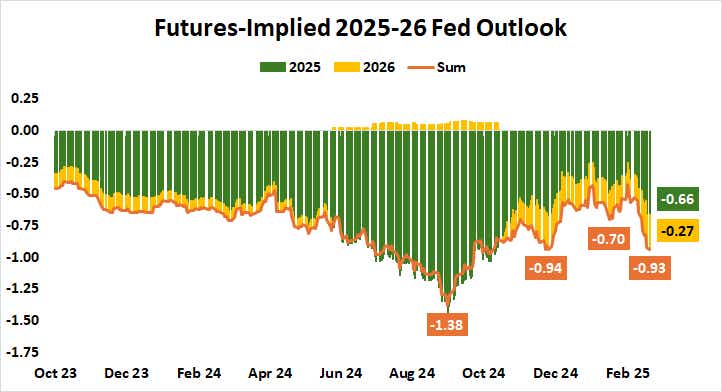

Finally, Fed Chair Jerome Powell is scheduled to discuss the economic outlook in a speech at the University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum. Fear about growth has triggered a sharp dovish turn in policy bets for this year and next. Traders will want to gauge whether the central bank chief is prepared to endorse it.

Analytics from Citigroup show U.S. economic data outcomes have increasingly deteriorated relative to baseline expectations, so much so that the tendency now favors disappointment. If this brings soft outcomes alongside familiar slow-and-steady incrementalism from Powell, bonds may go higher as stocks and the dollar weaken.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices