Stocks at Risk as Weak Data from China Stokes Fear of Global Recession

Stocks at Risk as Weak Data from China Stokes Fear of Global Recession

By:Ilya Spivak

China is set to release a slew of data showing the world’s second-largest economy remains anemic. That’s troubling as global recession looms.

- Chinese lending and credit data will underscore tepid monetary stimulus efforts.

- A pickup in exports growth leaves a worrying trend intact for Chinese trade data.

- China’s deepening deflation speaks to the growing risk of a global recession.

Chinese lending and credit: much ado about nothing?

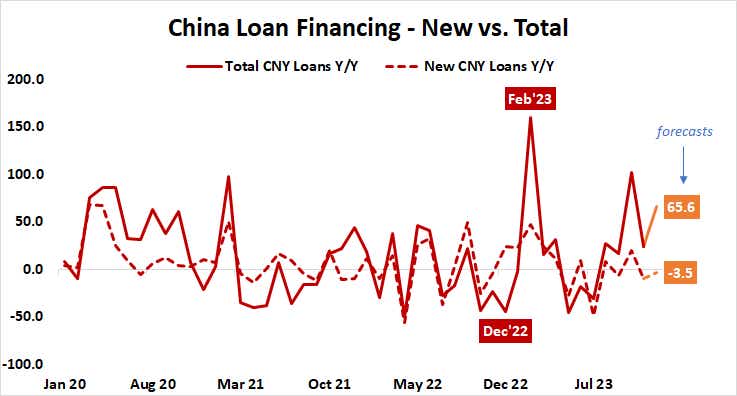

Credit and loan growth figures are first up. A modest increase in new loans from 1.09 trillion to 1.23 trillion Chinese yuan (CNY) is expected for December. Nevertheless, aggregate financing is seen ticking lower, from 2.45 trillion to 2.2 trillion yuan. While this would amount to a seemingly large rise of over 65% year-on-year, such swings seem to be within normal volatility.

On balance, the outcomes expected would amount to little more than ongoing tinkering at the margins. More broadly, Chinese financial conditions have stabilized in restrictive territory since mid-2023, and policymakers in Beijing seem disinclined to do much to loosen them. That may be a lingering headwind to economic growth.

China trade: who’s buying?

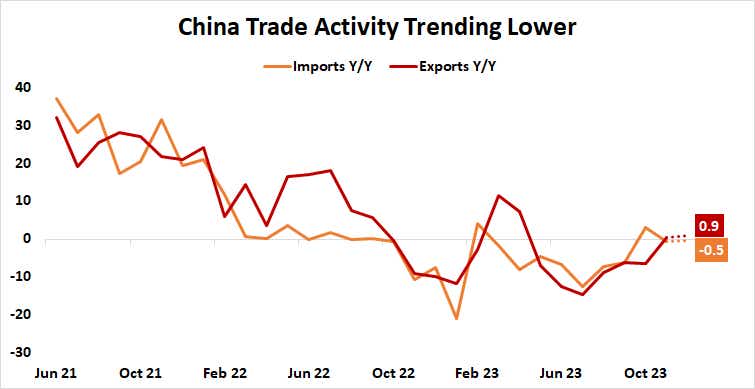

From there, the spotlight turns to trade and inflation figures. Forecasts for the former see exports growth accelerating to post the largest rise since March 2023 at 0.9% year-on-year. Imports are expected to fall 0.5% as domestic demand remains soft but at a slower pace than the 0.6% decline in November.

A pickup in cross-border sales would be welcome news, but it will take more than the tepid results penciled in by economists to dislodge a three-year slide in bilateral trade amid the COVID-19 pandemic. In fact, leading purchasing managers’ index (PMI) data has the economy nearly stopping in December, with the weakest growth in a year.

Chinese inflation: going the wrong way

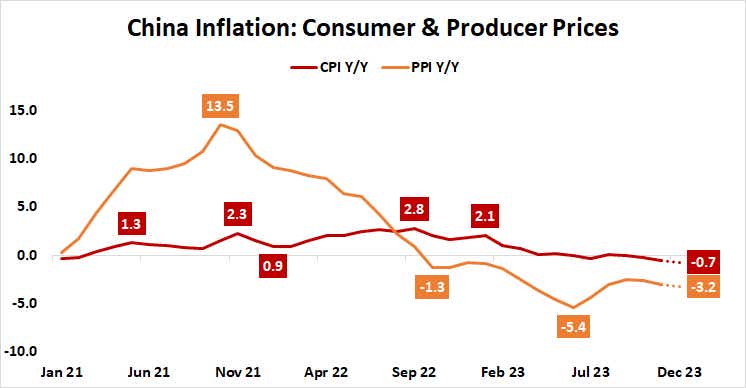

The signaling from price growth data is far more troubling. Consumer price index (CPI) and producer price index (PPI) numbers are expected to show deepening deflation in December, sliding 0.7% and 3.2% year-on-year, respectively. Falling prices speak to anemic demand, implying acute underlying weakness in the world’s second-largest economy.

That’s bad news for the world economy, of which China is a hefty 16%. Global economic activity is already near standstill as the U.S. has slowed to a crawl while the Eurozone is probably in recession already. Persisting weakness in China may be just the thing to tip the scales into a system-wide contraction.

Analytics from Citigroup show that Chinese economic data outcomes have converged on baseline forecasts in recent months. Stock markets may wobble if this suggests incoming results that stoke fears of broad-based business cycle weakness. Meanwhile, bonds may diverge higher while the anti-risk U.S. dollar and Japanese yen trade higher.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices