The Aussie Dollar Seesaw: Down, Then Up, Then Back Again

The Aussie Dollar Seesaw: Down, Then Up, Then Back Again

By:Ilya Spivak

Australian dollar gains may fizzle as local inflation data is overwhelmed by the Fed

- The Aussie dollar gains evaporate as Fed re-pricing swamps the local jobs report.

- More of the same may be on the menu as Australian inflation data looms.

- Seesaw price action is likely, if the FOMC pushes back on 2024 rate cut bets.

It was all going according to plan when Australian employment data crossed the wires last week.

The results topped baseline market forecasts, as expected. Traders responded in textbook fashion: local two-year bond yields rose reflecting the outcome’s supportive implications for Reserve Bank of Australia (RBA) rate-hike prospects and pulled Australian dollar higher in tandem.

Mere hours later the currency’s advance was all but totally undone. It finished the day with a meager 0.08% rise against its U.S. counterpart, having been up as much as 1.1% intraday.

What happened?

The Aussie found itself caught in the wake of a broad-based repricing of Fed policy expectations. Traders got busy undoing the heady moves in the wake of June’s softer-than-expected U.S. inflation figures. Treasury yields rebounded, the bellwether S&P 500 stock index back-pedaled a 15-month high, gold backed away from the $2,000-per-ounce figure, and the U.S. dollar perked up against its major peers.

Australian CPI data may boost RBA rate hike chances

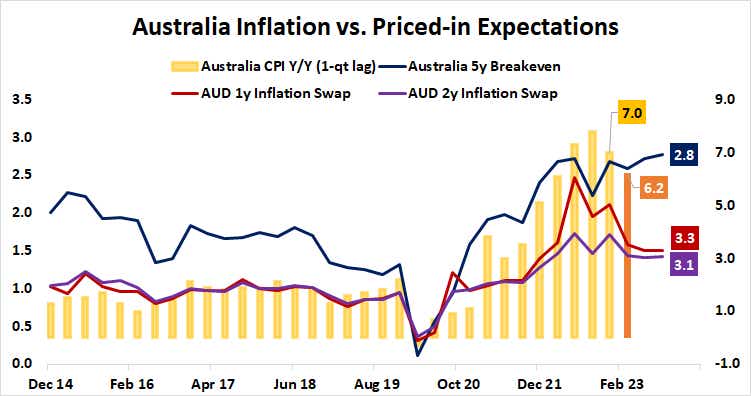

A replay may be on the menu this week as Australia reports second-quarter consumer price index (CPI) inflation data. Median forecasts collated by Bloomberg show that market-watchers expect price growth to have cooled from 7% to 6.2%, clocking the second consecutive decline.

Australian economic data has skewed toward outperforming relative to baseline forecasts in recent weeks, according to data from Citigroup. This implies that analysts’ models are understating the economy’s vigor, which may be setting the stage for an upside surprise when CPI numbers are released.

Coupled with stubbornly sticky inflation expectations, such a result might make an August RBA rate hike appear likelier than the 44% probability of a rise now priced in by the markets. One- and two-year AUD inflation swaps are stalling, and the five-year breakeven rate is trending higher, implying investors are dubious about ongoing progress.

Australian dollar seesaw, round two: enter the Fed

The Aussie dollar is likely to catch another lift in this scenario. Whether such gains prove to be lasting will once again depend on the markets’ view of U.S. monetary policy.

The Federal Reserve is due to deliver a widely expected 25-basis-point (bps) interest rate hike this week. Interest rate futures price in the outcome with a commanding probability of 96%. Where policy goes thereafter is the more important question.

Rates futures are tuned for a “one-and-done” way forward. The likelihood of another increase after this one is priced at a less-than-even 44%. Easing is seen commencing in March 2024, with 75-100bps in rate cuts to follow.

If Fed officials credibly push back with “higher-for-longer” messaging and force a hawkish rethink across markets, the Aussie is likely to retreat alongside stocks and gold prices while U.S. yields and the greenback rise.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.