How to Trade a Yentervention

How to Trade a Yentervention

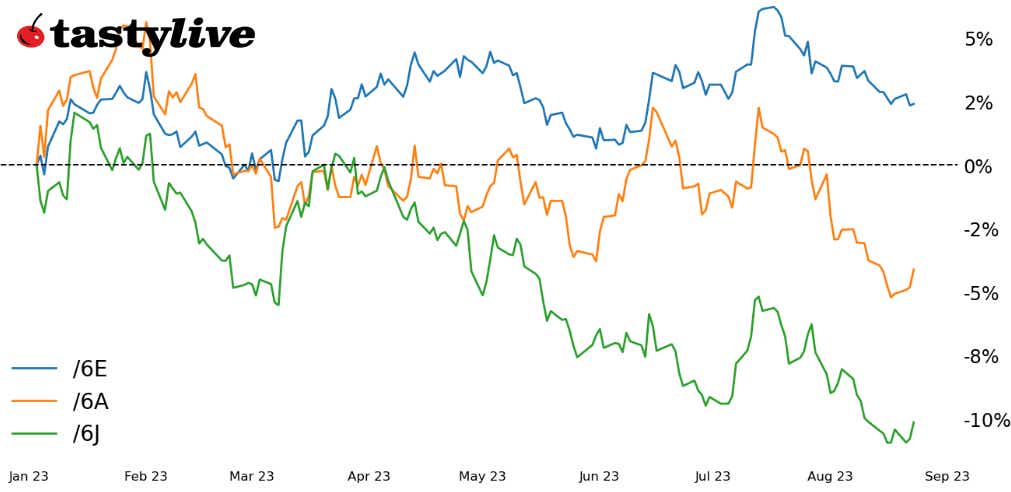

The Japanese yen (/6J) is down -2.14% month-to-date. Looking for a trade idea? Read on.

- The Japanese yen has weakened considerably in recent weeks, back to levels in November 2022 that prompted intervention by the Japanese Ministry of Finance.

- Getting long USD/JPY spot rates or short /6J may be akin to picking up pennies in front of a steamroller.

- Eroding confidence in global growth, particularly around China and the Eurozone, make short AUD/JPY (long /6J, short /6A) and short EUR/JPY (long /6J, short /6E) more appealing.

Shorting the Japanese yen has been a popular trade for many months now, dating back to early 2022.

Rising commodity prices undermine Japanese terms of trade, which in turn erodes purchasing power for Japanese businesses and consumers.

The Bank of Japan’s ultra-loose monetary policy, backstopped by quantitative and qualitative easing with yield curve control (or QQE with YCC, for short), has meant that the yen has been at a significant disadvantage to its peers in a world of rising interest rates in the United States, Europe, and elsewhere.

/6J Japanese yen technical analysis

The declines in the yen in 2023, particularly USD/JPY spot rates or /6J, have become so severe that we now find ourselves trading right around the November 2022 level that led to the Japanese Ministry of Finance intervening to halt the yen decline.

While yield differentials cater to continuing to short the Japanese yen, having arrived at the prior intervention levels, attempting to trade long USD/JPY spot rates or short /6J may be akin to picking up pennies in front of a steamroller.

There may be two ways, however, to take advantage of a yen intervention–a yetervention, if you will.

Growth concerns are escalating in Europe, as the latest batch of PMI figures show; a recession has arrived in the Eurozone and will continue to get worse over the next few months. This leaves the European Central Bank in a lurch, facing down stagflationary conditions at present time (even though disinflation, if not outright deflation is beginning to show up in the data). Weakness in EUR/USD spot rates and /6E is apparent, even though it hasn’t showed up in EUR/JPY spot rates or a long /6J, short /6E pair trade yet.

If Chinese property market debt issues are accelerating–and they are–then China-proxies will likely remain under pressure as well. The poster child for a China proxy in markets is the Australian dollar, and /6A has reflected the dour sentiment, no doubt. But thanks to yen weakness, AUD/JPY spot rates haven’t moved all that much since early June.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices