US Jobs Data Puts Markets on Recession Watch: Nonfarm Payrolls Preview

US Jobs Data Puts Markets on Recession Watch: Nonfarm Payrolls Preview

By:Ilya Spivak

Financial markets are bracing for the release of April’s US employment report as soggy lead-in data and a change of tack at the Federal Reserve stoke increasingly acute recession fears.

- Recession risk in focus after the Fed confirms a pause on interest rate hikes

- April’s US jobs market data eyed as traders weigh leading signs of weakness

- Soft readings may hurt stocks and yields as the US Dollar, Yen and gold rise

Markets left spooked after the Fed pauses rate hikes

Anxiety about on-coming recession seems to be building across global markets. The Federal Reserve signaled this week that its blistering rate hike cycle has been paused after one last 25-basis-point (bps) increase, as widely expected. Traders took this as confirmation that policymakers now think they have delivered enough tightening to bring inflation back to target. This points to economic weakness ahead.

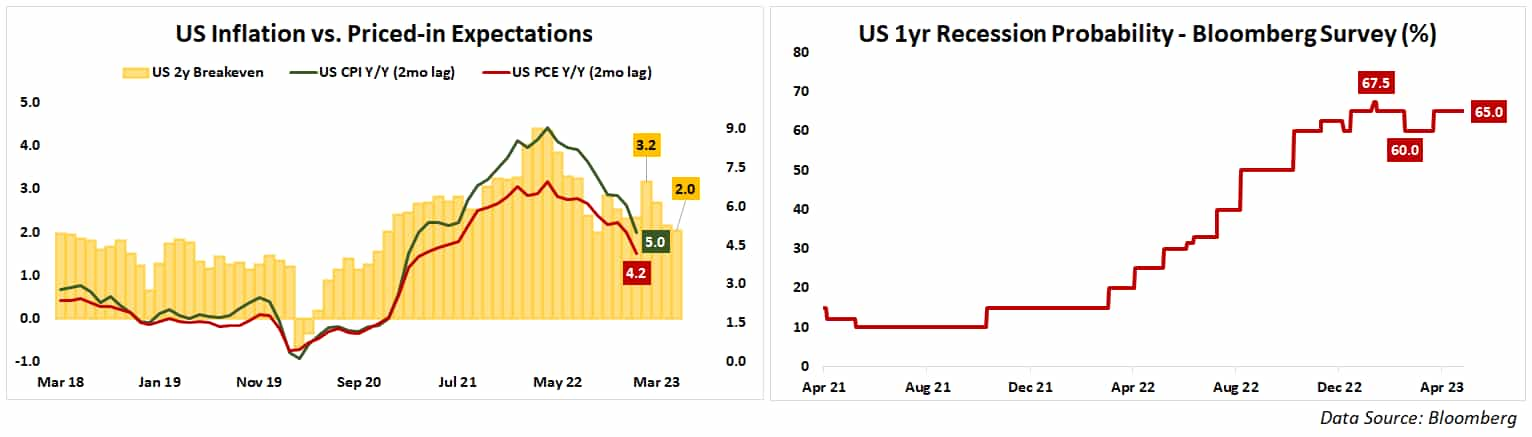

Headline CPI inflation is now running at an annual rate of 5 percent. The Fed’s favored PCE price growth gauge tracks a bit lower at 4.2 percent. Regardless of which benchmark one considers, there is some way to go yet to the Fed’s 2 percent objective. The markets now expect success: the two-year breakeven rate – a measure of inflation expectations implied in bond yields – has tellingly dropped to just a hair above that level.

Rate hikes can take several quarters to be fully absorbed into the economy. The Fed’s move into wait-and-see mode implies that building pressure from already-delivered rate hikes will apply the brakes on economic activity to such an extent over the coming quarters that inflation will fall by a further 2-3 percent. A Bloomberg survey of professional market-watchers puts the odds of a recession within one year at a better-than-even 65 percent.

Naturally, it is all but impossible to precisely dial in policy settings to slow growth just enough for a return to price stability without overloading on excess economic pain. So, it is no wonder that markets are now keenly focused on just how deep of a downturn has been put on autopilot by the Fed’s inflation-fighting efforts. That this incoming storm is set to be amplified by fiscal tightening amid a Congressional fight about the federal debt limit makes it scarier still.

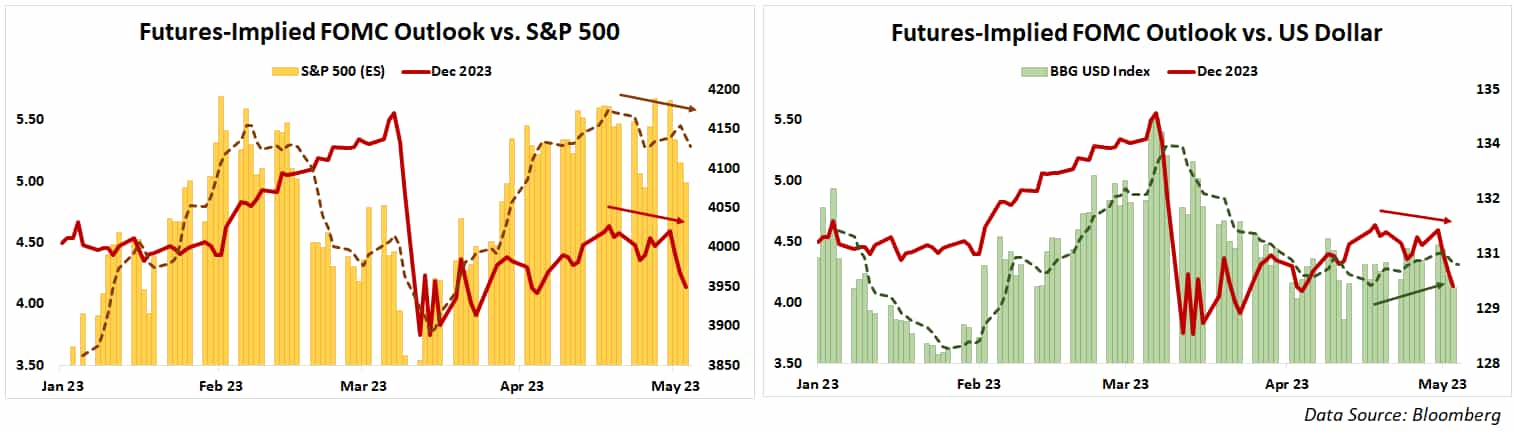

Tellingly, the markets now seem to trade as though recession worries have risen to the forefront. Where stocks might have cheered a dovish turn in Fed policy expectations, the bellwether S&P 500 now declines in tandem. The US Dollar tells a similar story: it is now edging higher even as its own yield appeal is undermined by building interest rate cut speculation, signaling that it has reasserted its place as the cash-out venue of choice amid market turmoil.

All eyes on April’s US jobs report

With that backdrop in place, the markets turn to April’s US employment figures for direction. They are expected to show that the economy added 185k jobs last month. The unemployment rate is seen ticking up slightly to 3.6 percent, a reading well within the narrow range prevailing since the beginning of last year.

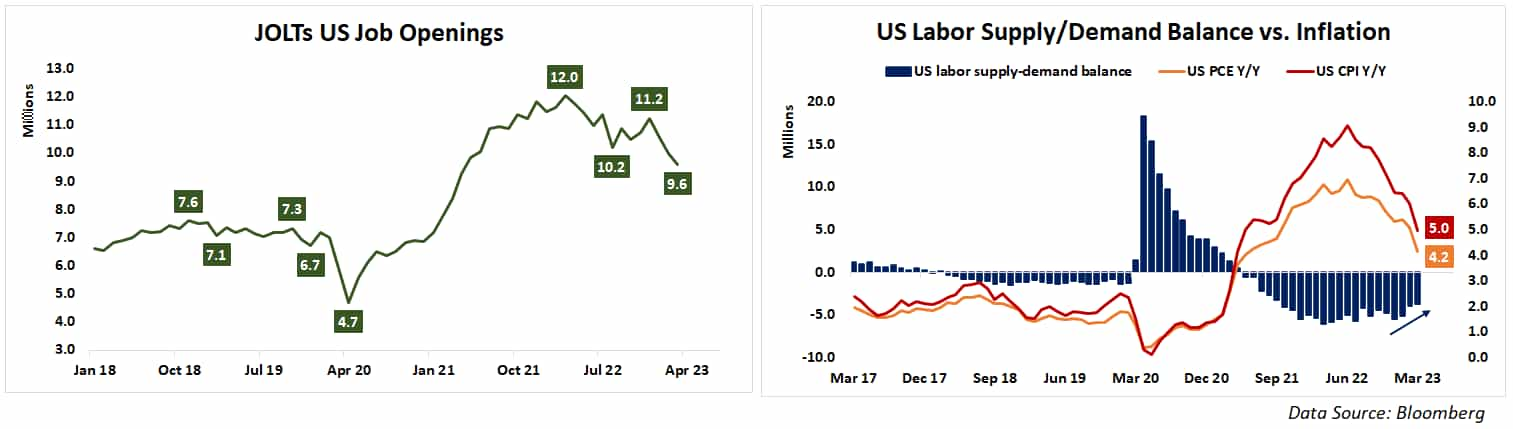

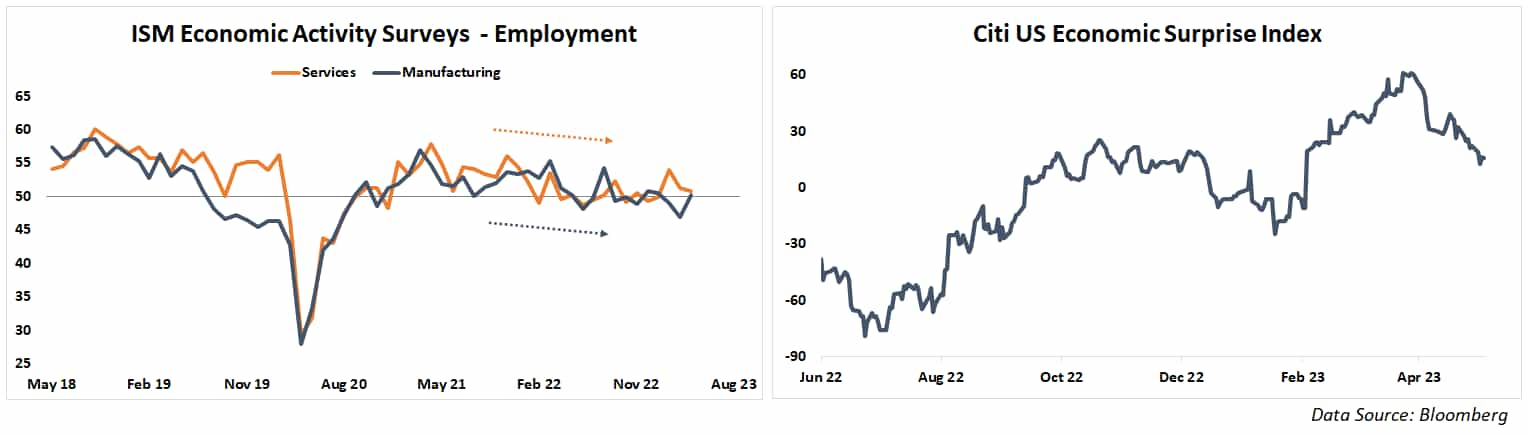

Signs of weakness have emerged in recent leading indicators. This week, the markets seemed especially taken with JOLTs Job Openings data that unexpectedly put the number of vacancies at just 9.6 million in March, the lowest since April 2021. This implied the narrowest shortfall between labor supply and demand since September 2021, at 3.75 million.

Broader trends help make the case for labor market weakness. The latest ISM manufacturing- and service-sector activity surveys suggest the trend toward deceleration in hiring continues, with readings just barely above the neutral “50” line on measures of employment growth implying it is at near-standstill. A catch-all Citigroup index tracking US economic data surprises relative to baseline forecasts points to a souring tone in overall macro news-flow.

Soft data may boost US Dollar, Yen and gold as stocks decline

If all of this comes together to produce a downbeat report feeding the markets’ recession fears, stocks appear likely to decline while further deterioration in the Fed policy outlook will probably bring yields lower, boosting bond prices. That might bode well for gold and the Japanese Yen, which tend to gain when interest rates decline. Meanwhile, safety-seeking capital may scurry to the ultimate liquidity of the US Dollar, driving it higher.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices