USD/JPY Hits Two-Decade Highs as US Yields Roar

USD/JPY Hits Two-Decade Highs as US Yields Roar

By:Diego Colman

USD/JPY OUTLOOK:

- USD/JPY soars to two-decade highs as U.S. yields charge higher

- The dollar may continue to strengthen if U.S. May inflation data surprise to the upside and boost calls for more aggressive Fed tightening

- Japan’s government is unlikely to intervene to support the Japanese yen at this time, but if disorderly moves persist, this scenario should not be ruled out

USD/JPY spent much of May on a downward path, falling from a high of 131.35 to a low of 126.35, dented by the pullback in U.S. government rates. However, the correction in the U.S. dollar was short-lived, with the pair resuming its explosive rise this month, reaching a two-decade high of 134.47 today after posting solid gains over the past four sessions.

The rally in the last several days has coincided with the rebound in U.S. yields, which has been sparked by a reassessment of the Fed’s monetary policy outlook (both the 2-year and 10-year yield are back near their cycle’s high). For instance, markets had expected the FOMC to front-load rate hikes in 50 bps increments only at its May, June, and July meeting, but bets are increasing that the bank could continue to tighten at this pace through September amid persistently elevated price pressures in the American economy.

Although headline inflation may have topped out during the first quarter at 8.5%, its convergence toward the Fed’s 2% target will be extremely slow. In fact, soaring energy costs could prevent any meaningful improvement in the trend in the coming months, leaving policymakers with no choice but to press ahead with super-sized half a percentage point interest rate increases in all remaining conclaves in 2022, and only return to the standard 25 bps adjustments in 2023.

We will get a better picture of the inflation situation on Friday, when the U.S. Bureau of Labor Statistics releases its May Consumer Price Index. Analysts polled by Bloomberg News expect headline CPI to advance 0.7% m-o-m and 8.3% y-o-y, though the results could easily surprise to the upside given recent developments in the fuel market (gas + diesel at the pump surging). If numbers blow past forecasts, U.S. Treasury yields could reprice significantly higher on bets of accelerated hikes to neutral, widening differentials with Japanese rates, a situation that will bolster the greenback.

In the current environment, the Japanese yen is likely to remain subdued against the U.S. dollar over the next days and weeks. Perhaps the only possibility for a substantial USD/JPY bearish reversal would be foreign exchange intervention by the Japanese government.

Japan's Finance Minister Shuichi Suzuki has indicated that he is watching the currency market with a sense of urgency, but has not shown a strong willingness to intervene to stem the yen's slide. However, if disorderly moves persist, we could see measures aimed at shoring up the Asian currency ahead of key national elections in the coming months. For the time being, traders will be well served by keeping a close eye on the Japanese government's intervention comments.

USD/JPY TECHNICAL ANALYSIS

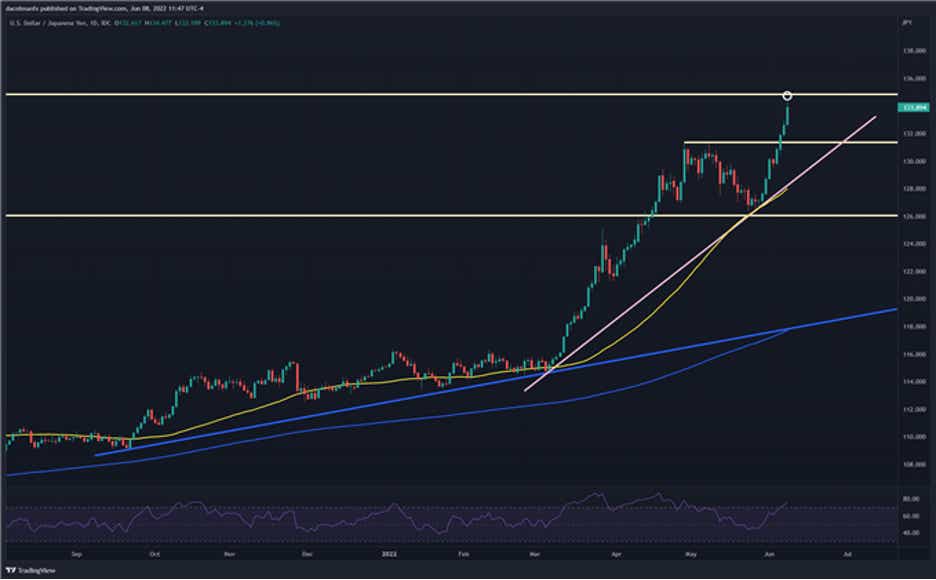

The U.S. dollar rallied for four straight days against the yen and briefly hit a twenty-year high near 134.50 on Wednesday. While USD/JPY continues to have a bullish bias, the monthly chart below shows that the pair has been overbought and is within striking distance of key resistance near the psychological 135.00 handle, a situation that could pave the way for a near-term pullback. If prices are rejected from current levels, initial support appears at 131.35, followed by 128.50. On the flip side, if bulls maintain control of the market and manage to push USD/JPY above 135.00 decisively, the focus shifts upwards to the 1998 high at 147.65.

USD/JPY Monthly Chart

USD/JPY Daily Chart

USD/JPY charts prepared using TradingView

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices