Stock Market Rebound May Fizzle as Global Recession Worries Swell Anew

Stock Market Rebound May Fizzle as Global Recession Worries Swell Anew

By:Ilya Spivak

Active investors found little to celebrate in U.S. CPI data. Signs of a global slowdown may spell trouble ahead.

- U.S. CPI data left Wall Street steady but flags slowing demand dynamics.

- Global economic news-flow increasingly warns of broad-based deceleration.

- Markets may struggle with upbeat Japanese GDP data on hawkish BOJ bets.

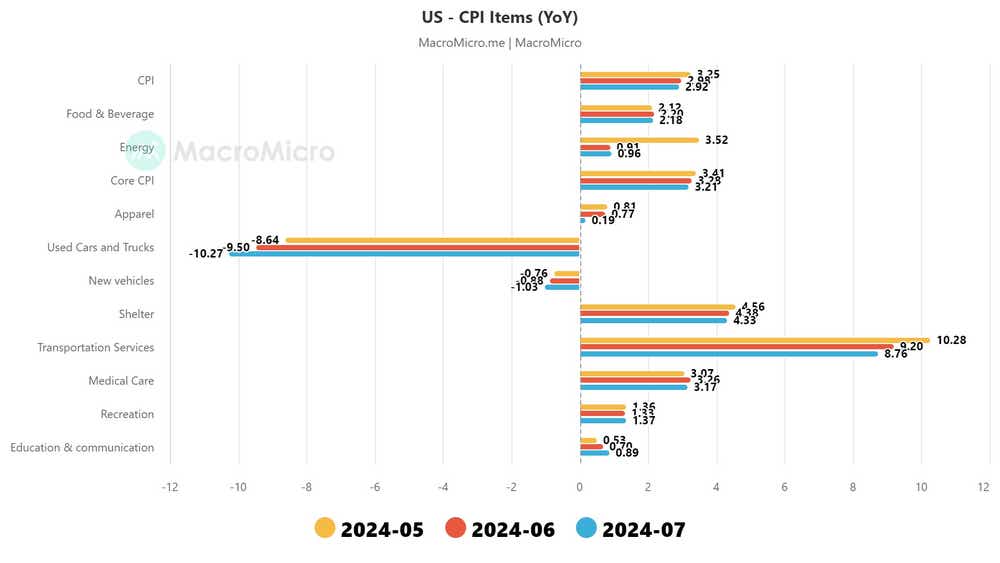

Stock markets offered a lukewarm reaction to slightly cooler U.S. inflation data than economists expected. A much-anticipated consumer price index (CPI) report showed headline price cooled to 2.9% year-on-year in July. The core reading excluding volatile energy and food prices ticked down to 3.2%.

While these outcomes constituted the lowest readings in three years—a meaningful milestone for the Federal Reserve in its battle to bring prices to heel after the COVID-19 pandemic—they were broadly in line with economists’ expectations ahead of the release. That seemed to leave Wall Street without a lasting directional lead.

U.S. CPI data adds to evidence of slowing global demand

The Bureau of Labor Statistics (BLS) said an increase in the shelter component tracking housing costs accounted for 90% of the 0.2% monthly rise in overall CPI. New and used vehicle prices marked the most pronounced price declines. Overall, the pace of year-on-year inflation cooled in almost every major spending category compared with June.

Taken together, the report’s broad tilt to disinflation appears to confirm ebbing consumer demand dynamics foreshadowed in July’s producers’ price index (PPI) data published yesterday. This comes after another batch of global economic updates pointing to decelerating growth.

The Reserve Bank of New Zealand (RBNZ) surprised the markets with an interest rate cut today. The central bank lowered its cash rate by 25 basis points (bps) to 5.25%, while slashing growth and inflation forecasts. It now expects a local recession in the second half of the year, slashing annual inflation to 2.3% from an average of 3.7% in the first half.

Meanwhile, July’s U.K. consumer price index (CPI) printed lower than expected at 2.2% year-on-year, while declines in confidence were measured in Australia, Germany and Eurozone-wide. Chinese credit growth data disappointed, with new loans unexpectedly posting the weakest rise since October 2009 at 260 billion yuan ($36.4 billion).

Stocks may struggle if U.K. GDP and U.S. retail sales data disappoint

Evidence of a slowdown may compound if U.K. gross domestic product (GDP) and U.S. retail sales figures underwhelm. The former is seen rising 0.6% in the second quarter – a slight slowdown from the 0.7% rise in the first one. The latter is penciled in for an increase of 0.3%, a modest pickup after receipts growth stalled in June.

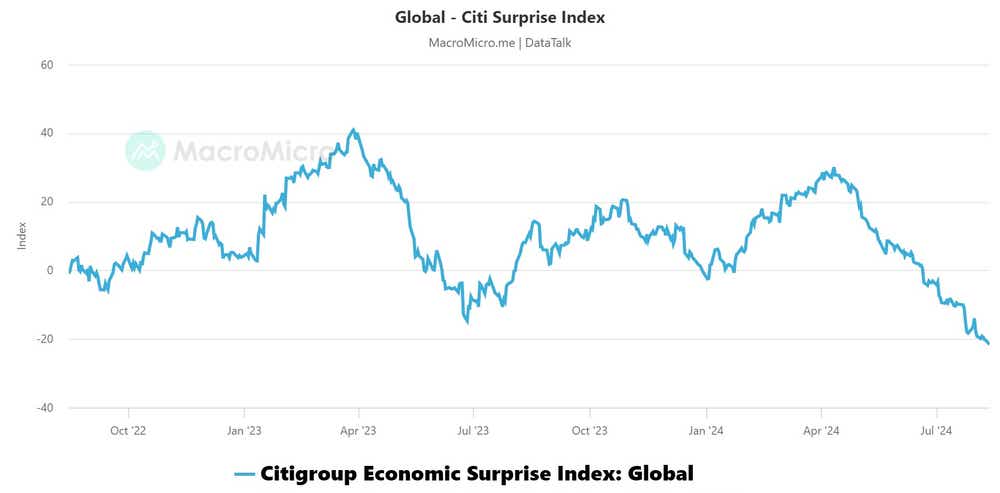

Analytics from Citigroup show that U.S. economic news flow has increasingly disappointed relative to consensus forecasts since mid-April. A similar turn toward weakness has played out in U.K. results, and at a worldwide level. The bank’s global economic surprise index has dropped to the lowest point in over two years.

Leading purchasing managers index (PMI) data from S&P Global already shows that manufacturing- and service-sector economic activity growth has cooled globally over the past two months. Stock markets may be back on defense if incoming releases continue in the same direction, stoking recession fears.

Japanese growth pickup may feed BOJ appetite for rate hikes

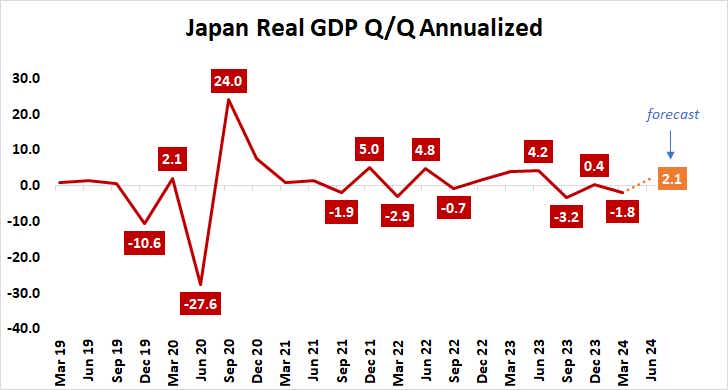

A pickup in Japanese economic growth may not be helpful in this context. Incoming GDP data is expected to show acceleration in the second quarter, with output rising at an annualized pace of 2.1%. That would mark the strongest expansion in a year.

Leaving aside the onset of the COVID-19 pandemic in 2020, the three months through June appear to have some positive seasonality. That may be linked to an upswell of demand as new outlays are made following the rolling over of Japan’s fiscal year, which begins in April.

Still, an upbeat result coupled with solid PMI activity readings into the second half of the year may help reinforce a hawkish bias at the Bank of Japan (BOJ). News that dovish Prime Minister Fumio Kishida will not seek reelection may set the stage for more BOJ-supportive fiscal leadership. All this may sting stocks and breathe new life into the Japanese yen.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.