China Will Not Save the Global Economy if the US Falters: PMI Preview

China Will Not Save the Global Economy if the US Falters: PMI Preview

By:Ilya Spivak

The global economy will get no help from China if growth in the US gives way

- Official PMI data to show China’s economy remains near standstill in June.

- S&P Global PMIs this week showed Europe idling while the US soldiers on.

- Citigroup analytics warn US momentum is ebbing, flagging recession risk.

The United States continues to carry global economic growth on its shoulders, according to purchasing managers index (PMI) data reported by S&P Global this week. In the weak ahead, analog data tracking China’s performance is expected to underscore as much yet again.

The US, China, and the Eurozone account for a hefty 58% of global gross domestic product (GDP). Much of the remaining 42% are vendor countries that rely on feeding demand from the “big three” economies to generate their contributions to overall growth. If all three of the engines powering demand misfire a worldwide recession is inevitable.

PMI data to show China’s economy probably remains near standstill

The latest batch of S&P Global data put the Eurozone near standstill for a second consecutive month in June. The composite index subsuming the manufacturing and service sectors registered at 50.2 for a second consecutive month, a hair above the 50 “boom-bust” level where economic activity is neither growing nor contracting.

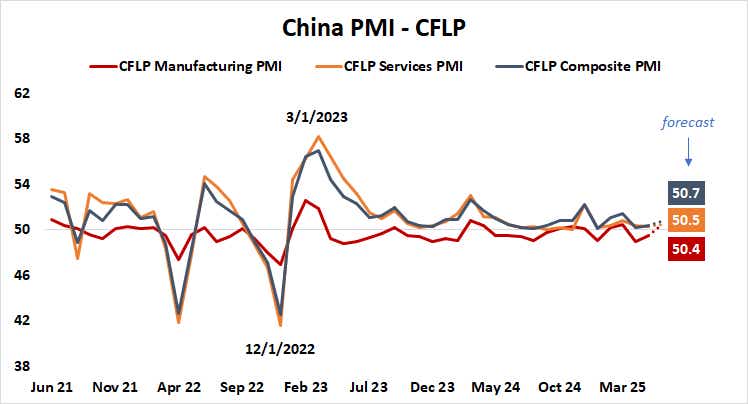

The China Federation for Logistics and Purchasing (CFLP) alongside the National Bureau of Statistics (NBS) are expected to produce similar results with Beijing’s official PMI data. The composite gauge here is expected to come in at 50.7 in June. Despite a slight uptick from 50.4 in May, this would still make for near-idle growth conditions.

These soggy readings are hardly unusual. Eurozone composite PMI has averaged 50.1 for the past 12 months. China’s CFLP composite PMI has averaged 50.7 over the same period. Another version of the same measure from S&P Global and Caixin has averaged a seemingly more encouraging 51.5, but that mostly reflects higher volatility in the data.

The US is the single point of failure for global growth. Is it wobbling?

US PMI figures paint a decidedly brighter picture. The economy’s performance has undeniably cooled since the second half of last year, when the booming service sector produced the fastest expansion in two years. Nevertheless, with a composite PMI reading at 52.8 in June, activity growth looks solid and near the top of the range for 2025 so far.

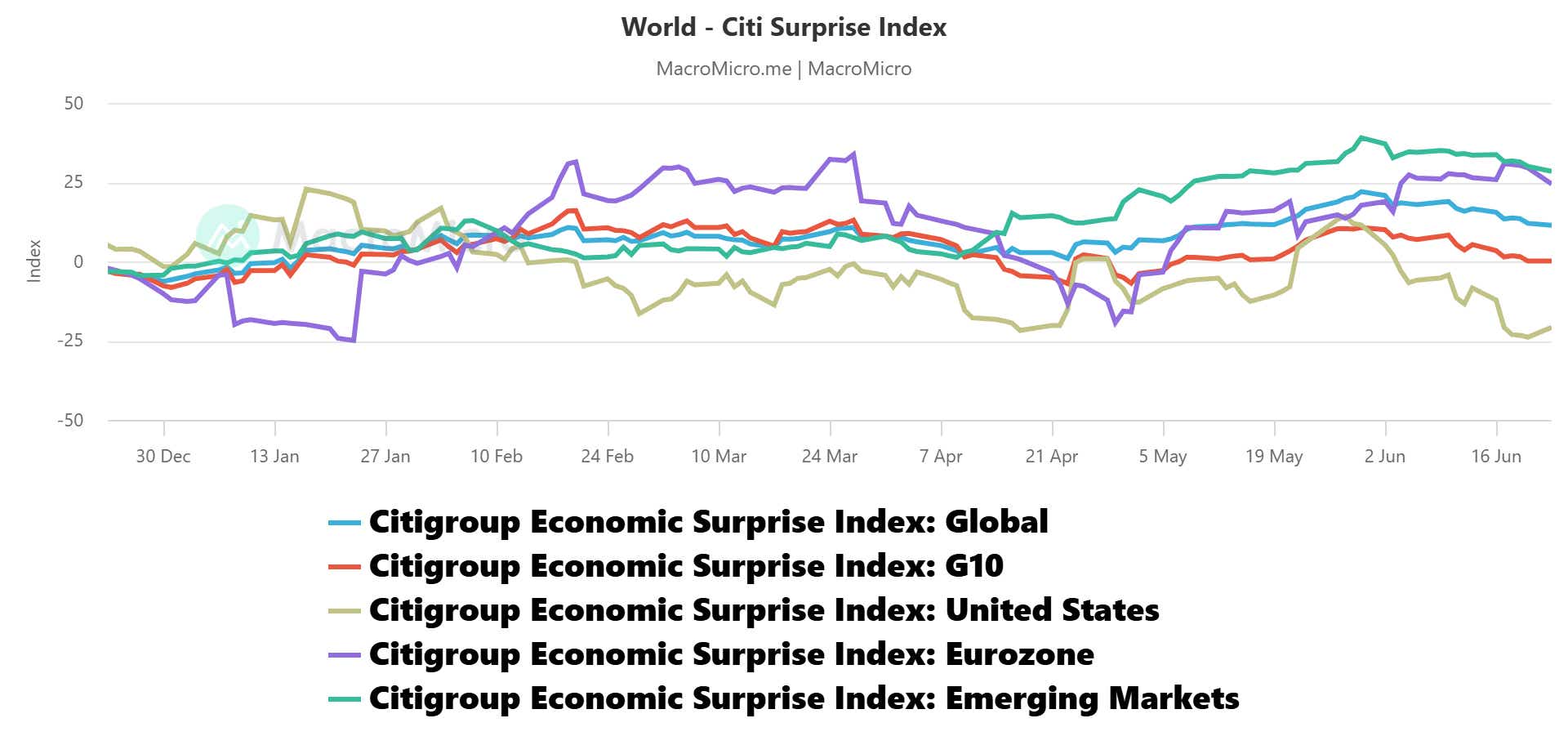

In all, this means that global growth hinges on that of the US, with no safety net from Europe or China in the event that something goes awry. As it happens, analytics from Citigroup warn that US economic data has increasingly disappointed relative to baseline forecasts over the past month. The stage-setting for a global recession may be taking shape.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices