China Property Meltdown Deepens as Evergrande Misses Debt Payment

China Property Meltdown Deepens as Evergrande Misses Debt Payment

By:Ilya Spivak

China’s property market woes deepen as Evergrande misses payments, adding to swelling global recession fears

- China’s property market woes deepen as Evergrande misses a bond payment.

- Beijing’s stimulus efforts are falling flat, compounding global recession fears.

- Slight uptick in upcoming China PMI data may be cold comfort for investors.

China continues to struggle with a crisis in its property market, and local stocks are suffering.

The CSI 300 index of Chinese stocks—a broad benchmark tracking the largest firms traded on the Shanghai and Shenzhen exchanges—is on track for the lowest weekly close in almost a year, with prices down 1.22% so far. That’s after another spate of unwelcome news from China Evergrande Group (3333.HK).

The company—until recently, one of the country’s top developers—said its mainland unit defaulted on a 4-billion-yuan bond on Monday. It promised to “actively” negotiate with creditors, repeating a mantra it has been repeating since March, when it missed another payment.

The latest turmoil is compounded by reports that Chinese authorities have arrested Xia Haijun and Pan Darong, Evergrande’s former CEO and CFO respectively. This further complicates a restructuring effort meant to ease pressure on at least $30 billion in offshore debt. The company said it will have to revisit the plan.

Property slump threatens a huge share of China’s economy

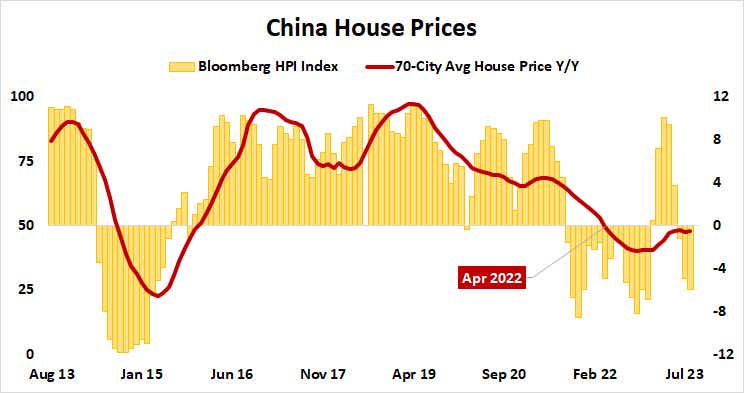

Property price growth has been slowing since mid-2019. Home values have been outright falling since April 2022. Data from Bloomberg shows that—after a brief pop just after the reopening from COVID restrictions in December–less than 30% of Chinese cities now report house price gains. That means they are falling across most of the market.

This makes for a potent headwind. Property commands an outsized part of the world’s second-largest economy, from employing a large swathe of the labor force to dominating investment portfolios. Its size and impact have been estimated at 25% to 30% of gross domestic product (GDP).

Easing of regulations meant to spur housing demand alongside attempts at boosting credit availability have mostly disappointed so far. Lending growth turned positive in August after three months of double-digit losses, but financial conditions remain restrictive, according to data from Citigroup.

China’s woes add to global recession fears

That undermines Beijing’s attempts to bring back growth derailed by China’s belated exit from pandemic-era lockdowns. It also warns of deepening global recession risk as the Europe slips closer to a confirmed recession while the Federal Reserve aims to keep interest rates “higher for longer” in the U.S., cooling growth.

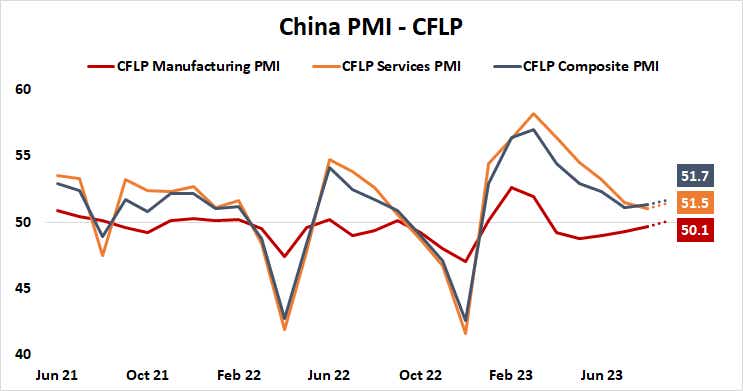

Purchasing managers index data due over the weekend is expected to show a bit of improvement, with the composite index projected to put manufacturing- and service-sector growth at the highest in three months.

Still, values dangerously close to standstill may be cold comfort for investors, especially as Chinese economic news-flow has tended to undershoot relative to forecasts (according to another Citigroup data set). That bodes ill for ETFs tracking Chinese markets like FXI and ASHR as well as linked commodities like copper and currencies like the Australian dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices