Corn Prices Sank 7% in February. Where are Grain Prices Headed?

Corn Prices Sank 7% in February. Where are Grain Prices Headed?

Corn Futures Fell 7% in February, Biggest Drop Since June as Supply Prospects Improved

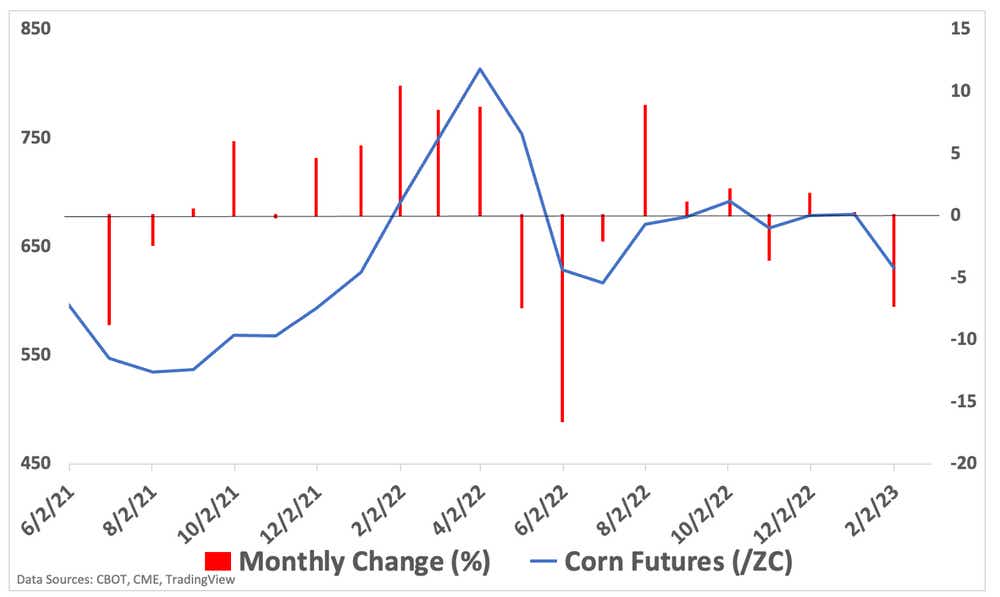

Corn futures (/ZC) fell 7.28% in February to the lowest level since August at $630 as the grain’s supply outlook improved. That was the sharpest drop since June when prices fell 16.56%, and it follows several months of rangebound trading.

The price for corn exploded last year as turmoil from Russia’s incursion into Ukraine and resulting Western sanctions threw the global agricultural markets into disarray. Farmers, particularly U.S. farmers, are reacting with plans to significantly increase their planted acreage this season.

That attitude is evident across the United States, according to recent surveys. Farmers are opting to go heavy on corn not only due to the relatively high prices compared to the last decade, but also because corn provides farmers with more certainty regarding crop yields versus other products. Those other products, such as soybeans, have outpaced corn prices in the second half of 2022, but not enough to entice enough farmers.

Waning Demand Points to Potential Supply Glut

As with most agricultural products, the impacts of supply and demand are the driving forces for prices. With farmers planning to plant more corn at a time when the global economy is expected to cool following rate hikes from central banks, the price outlook for corn is bearish.

Some expect China, a country that has steadily decreased its reliance on U.S. corn, to start buying in mass again as it exits years of harsh lockdown measures. However, that outlook is likely flawed, as China has increasingly turned to Brazil for its corn imports. While the United States remains the largest shipper of grain, export volumes have disappointed expectations for the last several years.

If Chinese buyers don’t start ordering corn in mass again, it may leave a glut of the grain in domestic U.S. markets. That would likely see prices fall back toward levels not traded since 2020 around the $350 mark. A drawdown may not occur until September, when supply hits the market following harvest. The United States Department of Agriculture’s WASDE report will cross the wires on March 8, which should provide the next directional cue for traders.

Trading Corn: Don’t Expect Prices to Pop

Corn prices declined sharply in February, with the last week of trading making up the bulk of its losses. That drove prices into oversold territory, as measured by the Relative Strength Index (RSI), which may suggest that the selling is overdone for now. That said, prices may see a retracement to the upside, but given the fundamental factors, an extended run higher is unlikely unless the backdrop changes significantly.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices