Crude Oil Surges Nearly 3% on Trade War Truce: Is it Enough for Bulls to Press Higher?

Crude Oil Surges Nearly 3% on Trade War Truce: Is it Enough for Bulls to Press Higher?

Fear of recession has faded, but petroleum prices hinge on whether the US and China make a deal within the 90-day window

- Crude oil prices have risen nearly 3% as traders cheer the US-China trade truce.

- Meanwhile, an improving economic outlook is combining with a better-supplied market as OPEC releases oil.

- But prices face technical resistance following a 10% rally since last week.

Crude oil futures (/CLM5) rose nearly 3% yesterday as traders cheered progress on the US-China trade war, following optimism-fueled rallies in the US equity market.

Oil prices sank at the beginning of April as the expected effects of tariffs hit demand forecasts for crude oil. Prices fell from about $70 per barrel to as low as $55 per barrel.

But Washington and Beijing have agreeded to pause tariffs for 90 days as negotiators go back and forth. The US tariff rate will drop to 30% from 145%, and Chinese tariffs on US goods will drop to 10% from 125%.

The ceasefire eased fears that the oil market would quickly move into an oversupplied condition, especially amid increasing supply from the Organization of Petroleum Exporting Countries and its allies, known as OPEC+.

It’s planning to increase output by over 400,000 barrels per day (bpd) in June. That increase would follow a 130,000 bpd rise from April and a 411,000 bpd increase in May. Some speculate OPEC is attempting to cause some pain for US producers, and others see it as the group placating President Trump who has a friendly relationship with Saudi Arabia. Trump has made lower energy prices a priority.

Whether driven by diplomacy or an itch to punish US producers, the results are the same for crude oil prices. More supply on the global market means lower prices. The question now is how will this additional supply will affect prices if the economic outlook continues to improve. This is likely to depend upon how trade war talks pan out over the next few months.

That said, the oil market remains fragile. We are potentially just one Truth away from seeing prices quickly rise or fall. Regardless, the additional supply from OPEC creates an artificial top on oil prices because higher prices could incentivize OPEC to release more spare capacity. Moreover, fear of recession may have faded for now, but there remains a chance that growth will slow enough from knock-on effects from the tariffs, especially if a deal isn’t reached within the 90-day window. Are traders confident enough to push oil prices higher on a contingency?

Trading crude oil

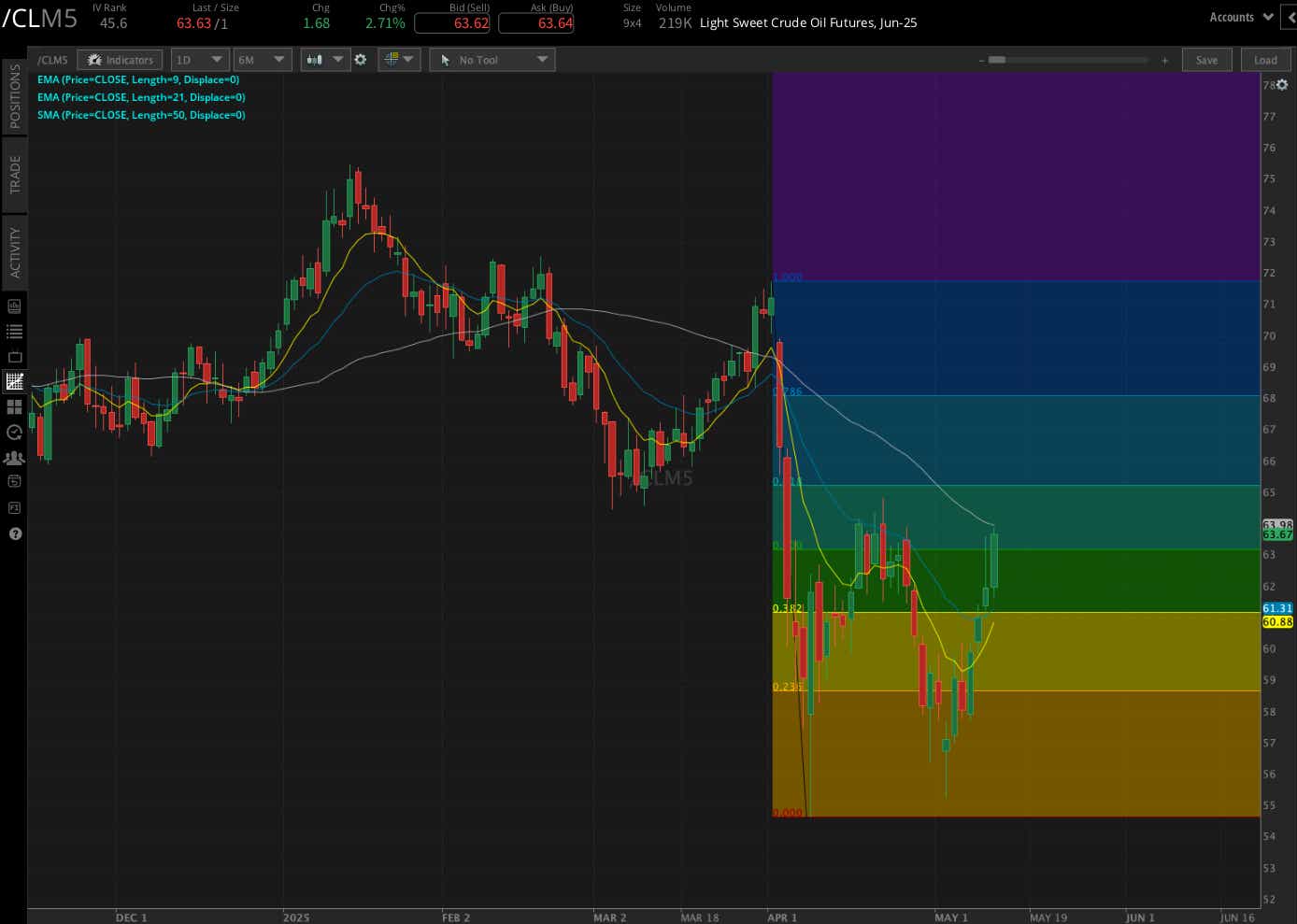

Crude oil prices have retracted a little more than 50% of the move from its early April swing high at 71.76 to the swing low in April at 54.67. A break above the 9- and 21-day exponential moving averages (EMAs) was accomplished over the last four trading day as prices rallied 10%.

The immediate technical challenges for bulls to overcome is the 50-day simple moving average (SMA), which sits at 63.98, and the March swing low at 64.49. A break above 65 would likely bolster the bullish technical position for crude oil prices, but these levels also may present an opportunity for traders to take some profits.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices