EUR/USD Outlook: Will the Fed Move the Needle at Jackson Hole for the Most Liquid Currency Pair?

EUR/USD Outlook: Will the Fed Move the Needle at Jackson Hole for the Most Liquid Currency Pair?

EUR/USD, FED, POWELL, INFLATION, US DOLLAR, CHINA, JACKSON HOLE - TALKING POINTS:

Markets remained subdued ahead of the Jackson Hole symposium.

Fed-speak around inflation expectations will be closely watched

EUR/USD liquidity may be short on surprises. Will the Euro downtrend resume?

Increasing Covid-19 Delta variant cases in Asia continue to cause concern, particularly in China, which weighed on Hong Kong’s Hang Seng Index (HSI) stock benchmark as well as indices on mainland China. Other bourses were little changed in the session. The Bank of Korea raised rates by 25 basis points today to 0.75%, with BOK Governor Lee saying that Fed policy will be important for future direction. Strong private capex data in Australia, showing a rise of 4.4% against 2.5% expected, left AUD little-changed.

With Jackson Hole almost upon us, the focus will be whether Fed Chair Powell will maintain a transitory view of inflation or tilt the rhetoric more toward structural inflation. Going into the symposium, the market believes the Fed and their inflation expectations.

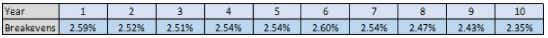

Inflation is currently being priced at or near 2.5% all the way out the curve, with the benchmark 10 year breakeven inflation rate at 2.35%. The “breakeven” is the difference between the yield on a US Treasury bond and the equivalent tenor Treasury Inflation Protected Security (TIPS).

US Market Priced Inflation (Break-evens)

Source: Bloomberg

There has also been market chatter about when any tapering effort might end. While this is an important aspect of the overall story, the market appears to be getting ahead itself. As with most projected outcomes in markets, it depends. The one thing the Fed has made clear is that unfolding circumstances will determine the trajectory of tightening.

There is also US jobless claims and US GDP data out tonight that may impact markets. An explosion in volatility may see some markets gap. The most traded currency pair, EUR/ USD, could see more interest than usual as participants gravitate toward more liquid markets should the Fed deliver something unexpected.

EUR/USD TECHNICAL ANALYSIS

The Euro made new lows last week and despite a rally this week, it remains trending lower within a channel chart formation. Should volatility break out, the big levels to watch for resistance will be 1.1910, the most recent high, and 1.2095, the pivot breakdown level. Support at 1.1600 will be critical as a breach could suggest an acceleration in the downtrend.

Chart created in TradingView

Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.