Fed Rate Hike Odds May Rise as China Roars to Life

Fed Rate Hike Odds May Rise as China Roars to Life

By:Ilya Spivak

China has returned to rapid growth after scrapping ‘zero-Covid’ lockdowns, cheering the markets. The mood may sour however as reopening stokes inflation, beckoning action from the Fed.

- Chinese economic activity is accelerating rapidly, according to PMI data

- Investors cheer reopening after ‘zero-Covid’, but the mood might sour

- Commodity price rise may boost inflation, demanding Fed rate hikes

China is accelerating after scrapping Covid-19 lockdowns

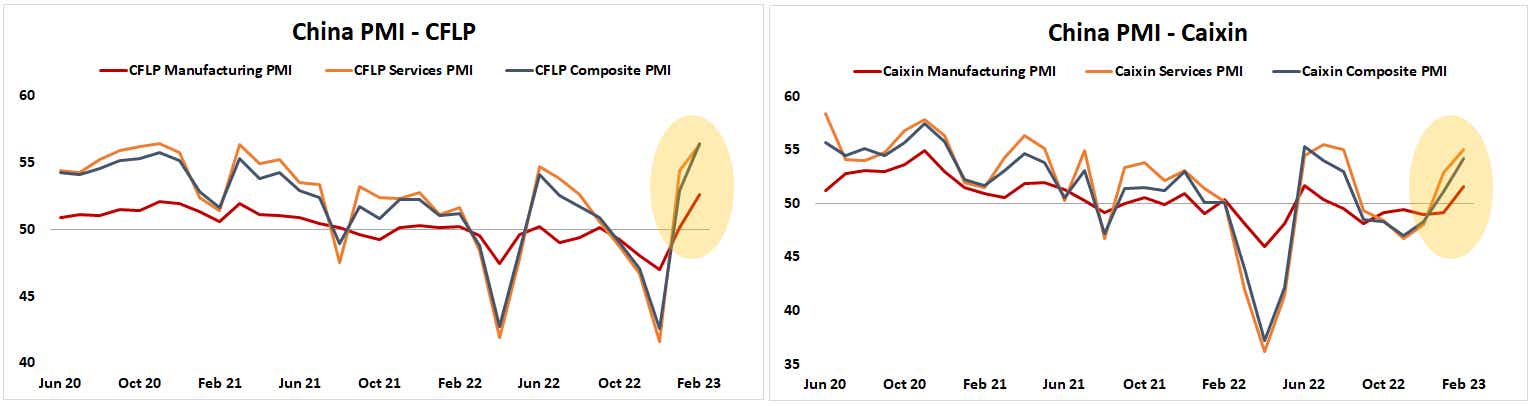

The world’s second-largest economy is finally showing signs of life after scrapping ultra-restrictive ‘zero-Covid’ virus containment policies in December 2022. The latest round of PMI figures – an official set from the China Federation of Logistics & Purchasing (CFLP) and a private-sector analog from S&P Global and Caixin – shows rapid pick-up in manufacturing- and service-sector growth.

These indicators are centered around “50”. Readings above this level mark expanding activity in the economic sector being tracked – either manufacturing or services – while values below it indicate contraction. The greater the distance from 50 in either direction, the faster the process underway. That puts growth at the fastest pace in at least 8 months (Caixin), and perhaps over 6 years (CFLP).

Investors seem to have greeted the news with enthusiasm. The tell-tale Australian Dollar – a bellwether for the markets’ view on China because of its home country’s tight-knit trading links with the East Asian giant, as a well as a go-to reflection of market-wide risk appetite – rose gingerly when the PMI figures crossed the wires. The mood may sour as markets ponder the dark side of reopening however: inflation.

Reopening may drive up inflation, beckoning Fed action

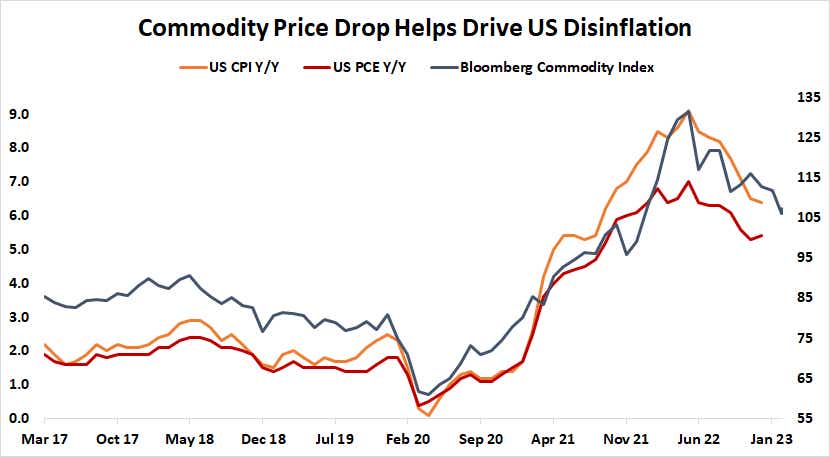

Moderating price growth in the second half of 2022 has tellingly tracked a pullback in commodity prices. Some of this surely owes to the Fed’s blistering rate hike effort. It slowed economic growth, and inflation with it. A warmer winter that kept Europe from feeling the pinch of absent Russian natural gas supply helped as well. Still, a sharp drop in demand from China – the world’s top importer of most commodities – played a key part.

With the pace of economic activity growth accelerating, Chinese commodities demand seems likely to swell. If that overpowers demand destruction elsewhere – a seemingly strong possibility considering how much ground must be made up after lengthy lockdowns – prices are likely to rise. That will feed into another inflationary pickup, pushing the Fed toward a still-move hawkish stance. That may hurt stocks and gold prices, while the US Dollar gains.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.