Markets Turn to Global Growth Trends as the Fed Continues to Dither

Markets Turn to Global Growth Trends as the Fed Continues to Dither

By:Ilya Spivak

Global growth trends are back in focus for the markets as the Fed resists rate cut pressure

- Fed rate cut outlook change marks a widening divergence with markets.

- Traders anticipate a dovish Bank of England (BOE) despite rate cut pause.

- S&P Global PMIs might fuel global recession fears if US data turns soggy.

The Federal Reserve kept its target interest rate unchanged at this week’s meeting of the policy-steering Federal Open Market Committee (FOMC), as widely expected. The central bank revised down its expectations for economic growth while marking higher its outlook for inflation, echoing recent signaling.

On the path of interest rates, the Fed maintained its call for 50 basis points (bps) in rate cuts for 2025. Next year’s median projection was reduced from 3.4% to 3.6%, implying a move from two cuts down to just one. That makes for a widening departure from what the markets have priced in.

Benchmark Fed Funds futures price in 43bps in cuts this year and 58bps in 2026. This puts the markets firmly on the dovish side of the central bank. As much is echoed in the bond market, where priced-in inflation expectations tracked by so-called “breakeven rates” have been falling in recent weeks.

Markets see a dovish Bank of England even with rate cuts on pause

From here, the spotlight moves across the Atlantic as the Bank of England (BOE) delivers a monetary policy announcement of its own. A pause is expected after a rate cut last month. Markets expect the nine-member Monetary Policy Committee (MPC) to vote 7-2 in favor of a hold, inverting May’s tally approving a 25bps reduction.

Earlier this week, UK consumer price index (CPI) data showed that inflation has slowed to 3.4% year-on-year, as expected. This marks a modest downtick from the 15-month high recorded in April. The core rate excluding volatile food and energy prices came down a bit more than analysts predicted to 3.5%, marking a three-month low.

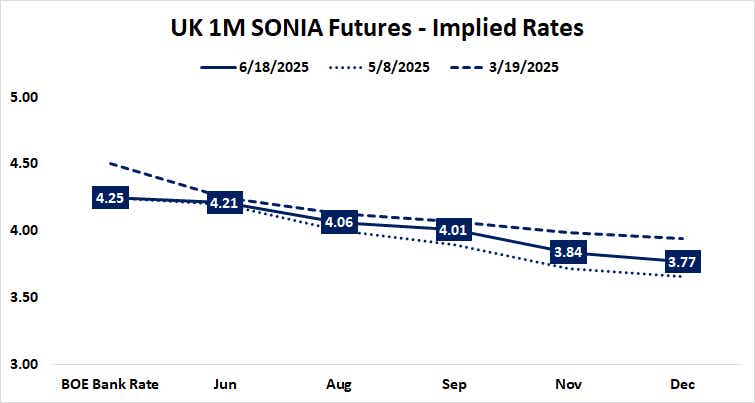

The markets think the bias at the BOE will remain dovish despite the decision to leave policy as-is this month. Benchmark SONIA interest rate futures have priced in 44bps in further cuts this year, with the first move slated to appear by September and the second in December. Another 27bps – that is, one further cut – is on the menu for 2026.

Global recession worries may return if US PMI data disappoints

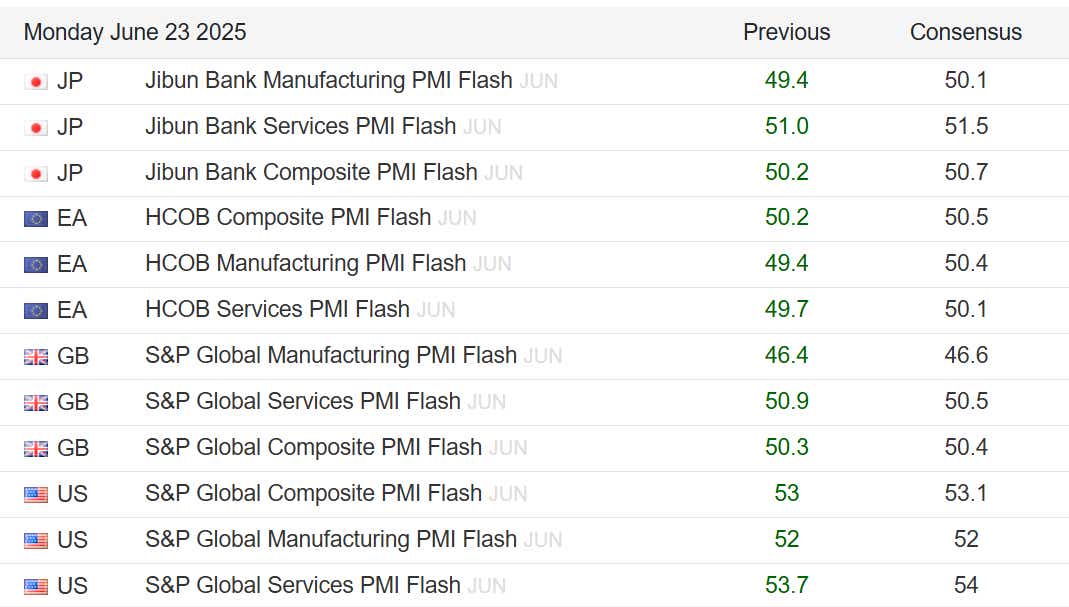

Early next week, a timely update on global economic growth trends will come from S&P Global with the first look at June’s purchasing managers index (PMI) data. Baseline forecasts point to a familiar picture. Ongoing standstill is expected in Japan, the UK, and the Eurozone. A resilient services sector is seen powering expansion in the US.

Worldwide economic activity growth picked up a bit in May after sliding to the weakest in 17 months in April, according to a roundup of last month’s PMI surveys from S&P Global and JPMorgan. Nevertheless, the trend has unmistakably pointed to ongoing slowdown since growth peaked a year ago.

Analytics from Citigroup warn that US economic data flow has increasingly disappointed relative to baseline forecasts over the past four weeks. The closely watched gross domestic product (GDP) “nowcast” from the Atlanta Fed paints a similar picture: its running estimate of growth in the second quarter has moderated since mid-May.

If this foreshadows disappointment in US PMI figures, worries about global recession may resurface. Traders may reason as much if deceleration in the world’s largest economy resumes without the safety net of growth from other key drivers, most critically the Eurozone and China.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices