Is Global Inflation Coming Back? The Evidence is Adding Up

Is Global Inflation Coming Back? The Evidence is Adding Up

By:Ilya Spivak

Inflation is coming back across the world even as growth slows. When will markets care?

- Signs of returning inflation appear in Eurozone and Canada CPI data.

- Markets are skeptical about seemingly “normal” US inflation figures.

- UK CPI may add to “stagflation” fears as the global economy slows.

At the start of the week, an update of Eurozone consumer price index (CPI) data confirmed preliminary reports showing headline inflation stopped falling in April after two months of decline, anchoring at 2.2% year-on-year. Core price growth excluding volatile food and energy costs rose to 2.7%, the highest in three months.

Cooler energy prices offset rising costs in the headline figure, but the core measure stripping this away alongside the uplift from higher food prices left building pressure in the service sector. This accounted for 1.8 percentage points in the overall inflation reading. The hospitality sector stood out.

Signs of returning inflation are appearing in major economies

In Canada, overall inflation cooled largely as expected, slowing to a seven-month low of 1.7% year-on-year. However, this mostly reflected a sharp 1.7% drop in energy prices. Gasoline and natural gas prices fell 18.1% and 14.1% respectively. This seems to mostly reflect the removal of the consumer carbon tax as of April 1, 2025.

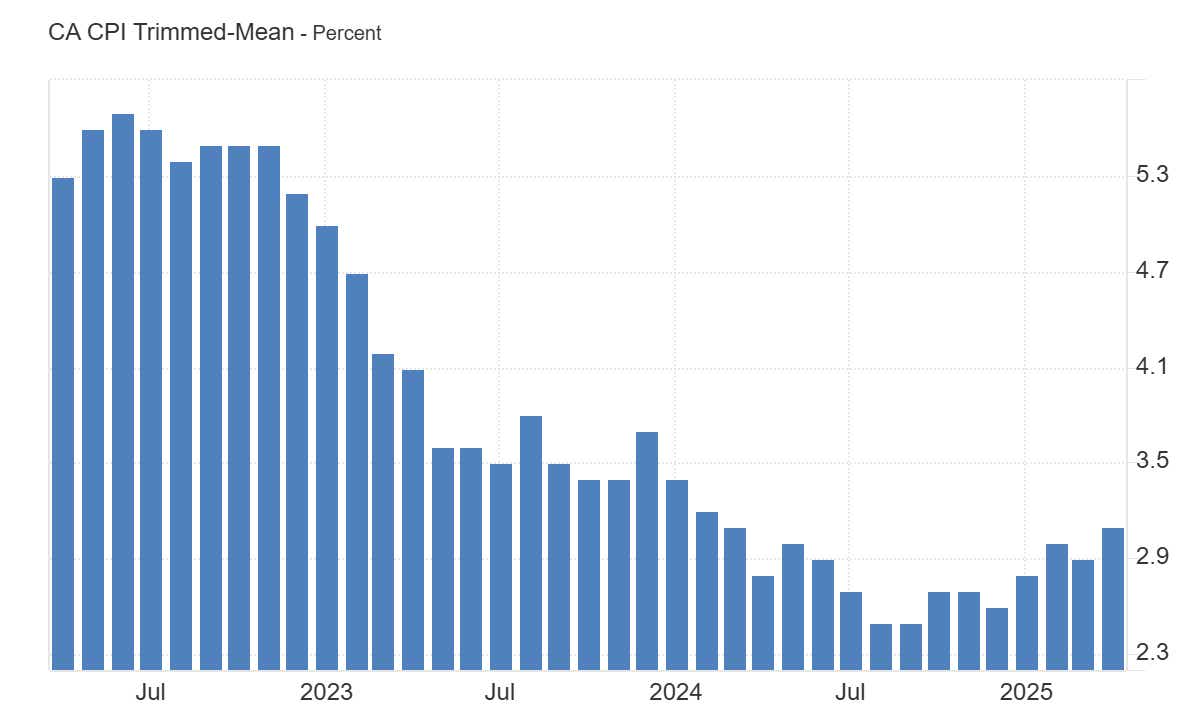

By contrast, core inflation rose to 2.5%, a two-month high. More striking still, the “Trimmed Mean” CPI gauge stripping out the most volatile price spikes regardless of spending category unexpectedly jumped to 3.1%, the highest in 13 months. The Bank of Canada (BOC) closely tracks this measure for a view of underlying price growth trends.

In the US, traders welcomed a seemingly “normal” April CPI report that showed no obvious signs of a tariff-induced goods price shock, but this may have been a mirage. Producer price (PPI) data later revealed that businesses appear to be absorbing a rise in moving goods along the supply chain without passing it along to consumers, at least for now.

Rising U.K. inflation set to keep interest rate cuts at bay

Incoming UK data is expected to show that inflation quickened last month. Headline CPI is penciled in for a rise of 3.3% year-on-year in April, marking the fastest price growth since February 2024. Core CPI is seen at 3.6%, the highest in three months.

.png?format=pjpg&auto=webp&quality=50&width=768&disable=upscale)

The markets repriced for a less-dovish Bank of England (BOE) policy path after the central bank’s last meeting, even as it issued a widely expected 25bps rate cut. This seemed to imply that traders expect officials to be slow to dial up stimulus in response to signs of economic weakening. Warming inflation data may reinforce as much.

“Stagflation” fears find evidence amid slowing global growth

A similar response followed Canada’s CPI report. Rate cut expectations fell, yields jumped, and the Canadian dollar rallied. Inflation expectations priced into US bond markets are on the rise as well, suggesting they’re looking through the smoke and mirrors in the latest data.

![World - Purchasing Managers' Index [PMI].png](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blte478fa8b3f205148/682d0cf5f16fa003a6f7e4eb/World_-_Purchasing_Managers_Index_[PMI].png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

Taken together, all this seems to suggest that inflation is perking up across the world, tying up central bankers in wait-and-see mode. This is happening at a most inconvenient time: S&P Global purchasing managers index (PMI) data puts worldwide growth at the weakest in 17 months in April, and another soft showing is expected in May.

Worries about “stagflation” – a divergent policy nightmare when inflation is rising even as growth weakens – have grown louder from top central bank officials like Fed Chair Jerome Powell and business leaders like JPMorgan CEO Jamie Dimon. Stocks have yet to get spooked, but growing evidence hints that they ought not be complacent.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.