Nasdaq 100 Steadies as Traders Look Past Tesla Sales Miss and ADP Report

Nasdaq 100 Steadies as Traders Look Past Tesla Sales Miss and ADP Report

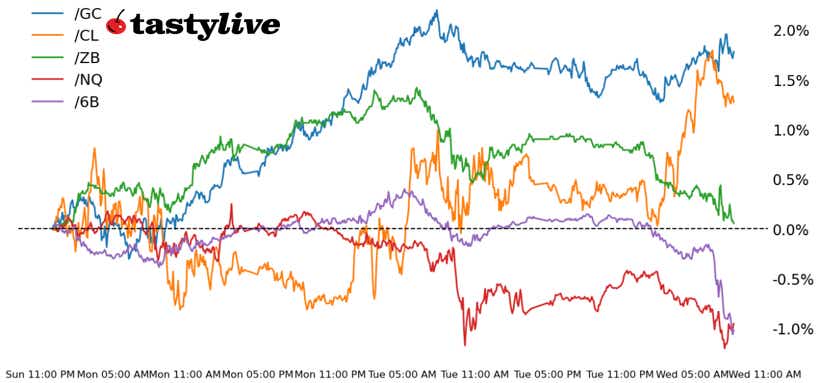

Also, 30-year T-bond, gold, crude oil and British pound futures

- Nasdaq 100 E-mini futures (/NQ): +0.02%

- 30-year T-bond futures (/ZB): -0.73%

- Gold futures (/GC): +0.07%

- Crude oil futures (/CL): +0.81%

- British pound futures (/6B): -1%

The markets were off to a turbulent start today after passage of the One Big Beautiful Bill Act in the Senate and a contraction in the June U.S. ADP employment report. U.S. equities are mixed, with Tesla (TSLA) bouncing back after ‘not-as-bad-as-expected’ sales numbers on the heels of yesterday’s Musk-Trump tiff. A push higher by US Treasury yields may be helping the US dollar, which is having its best day in over two weeks. Lastly, a reminder that, with US markets closed on Friday for the July 4 holiday, the June US non-farm payrolls report will be released tomorrow at 8:30 a.m. EDT.

| Symbol: Equities | Daily Change |

| /ESU5 | -0.09% |

| /NQU5 | +0.02% |

| /RTYU5 | +0.19% |

| /YMU5 | -0.08% |

Nasdaq futures (/NQU5) fell after the ADP jobs report put a crack in the one of the last linchpins for the US economy — the labor market. Still, the ADP report hasn’t performed well in predicting the non-farm payrolls report, which commands more market influence. The Financial Select Sector SPDR Fund (XLF) — a reflection of the banking sector — rose 0.21% in pre-market trading after large banks announced dividend increases following the successful completion of the Federal Reserve’s stress tests. Tesla recovered ahead of the bell following yesterday’s decline of over 5%, which was driven by comments from President Trump.

| Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 21000 p Short 21250 p Short 24250 c Long 24500 c | 65% | +1115 | -3885 |

| Short Strangle | Short 21250 p Short 24250 c | 71% | +5170 | x |

| Short Put Vertical | Long 21000 p Short 21250 p | 84% | +630 | -4370 |

| Symbol: Bonds | Daily Change |

| /ZTU5 | 0% |

| /ZFU5 | -0.08% |

| /ZNU5 | -0.22% |

| /ZBU5 | -0.73% |

| /UBU5 | -0.92% |

Treasuries declined this morning to extend losses from yesterday. 10-year T-note futures (/ZNU5) were down 0.22% ahead of the New York open. The chances for a rate cut at the July Federal Open Market Committee (FOMC) traded around 22.2% after the ADP data, according to the CME’s FedWatch tool. That’s up from 20.7% yesterday but down from a month ago when a 23.9% chance was baked in. Traders in the bond market appear to be holding out for tomorrow’s data to get a better feel for how the Fed will act.

| Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 108 p Short 110 p Short 119 c Long 121 c | 62% | +484.38 | -1515.63 |

| Short Strangle | Short 110 p Short 119 c | 68% | +1062.50 | x |

| Short Put Vertical | Long 108 p Short 110 p | 84% | +234.38 | -1765.63 |

| Symbol: Metals | Daily Change |

| /GCQ5 | +0.07% |

| /SIU5 | +0.21% |

| /HGU5 | +1.09% |

Gold prices rose slightly after the ADP data sparked some risk-off moves in the equity market. Gold has rallied over 3% since the start of this week, with that advance taking us to the 50% retracement level from the sell-off off the June swing high. Gold could see more strength if tomorrow’s jobs report comes in on the light side, as it would likely cause further selling in equities and bolster rate cut bets for the Fed’s July meeting.

| Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3125 p Short 3150 p Short 3525 c Long 3550 c | 63% | +720 | -1780 |

| Short Strangle | Short 3150 p Short 3525 c | 71% | +4070 | x |

| Short Put Vertical | Long 3125 p Short 3150 p | 85% | +250 | -2250 |

| Symbol: Energy | Daily Change |

| /CLQ5 | +0.81% |

| /HOQ5 | +1.03% |

| /NGQ5 | +1.52% |

| /RBQ5 | +0.39% |

Crude oil prices were up about 1% in early trading today after Iran suspended its cooperation with the International Atomic Energy Agency (IAEA) by approving a law that would require the approval of the Supreme National Security Council. The news injects some geopolitical premium back into crude prices. Still, there are little supply disruptions in the market, and traders are expecting OPEC+ to extend production cuts soon for an additional month. A weak US jobs report tomorrow could derail the rally in prices if traders expect the US economy to struggle, which would affect demand for oil.

| Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 56 p Short 58 p Short 75 c Long 77 c | 68% | +390 | -1610 |

| Short Strangle | Short 58 p Short 75 c | 73% | +1330 | x |

| Short Put Vertical | Long 56 p Short 58 p | 83% | +260 | -1740 |

| Symbol: FX | Daily Change |

| /6AU5 | -0.29% |

| /6BU5 | -1% |

| /6CU5 | +0.07% |

| /6EU5 | -0.11% |

| /6JU5 | -0.19% |

A striking scene during PMQs (Prime Minister’s Questions) in Parliament today may be hurting the British pound: UK Chancellor of the Exchequer Rachel Reeves was seen crying on the floor during Prime Minister Keir Starmer’s PMQ after he refused to confirm she would remain at her post moving forward. Not that Starmer’s answers were particularly constructive from a fiscal perspective: UK Gilts and Sterling have been selling off together. Overall, it’s the best day for the US dollar (via $DXY) since June 17.

| Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 1.32 p Short 1.33 p Short 1.39 c Long 1.4 c | 61% | +218.75 | -406.25 |

| Short Strangle | Short 1.33 p Short 1.39 c | 69% | +643.75 | x |

| Short Put Vertical | Long 1.32 p Short 1.33 p | 84% | +112.50 | -512.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.