Poking Holes in a Robotics Rally

Poking Holes in a Robotics Rally

AI and robotic-themed stocks are not keeping pace with the broader tech sector

- The Nasdaq 100 is up by more than +38% year-to-date as of August 9, 2023.

- But tech companies with AI exposure are suffering: the Global X Robotics & Artificial Intelligence ETF (BOTZ), is down nearly 9% this month.

- A meaningful technical breakdown in BOTZ could be a bad omen for stocks, particularly the Nasdaq 100, in the near term.

The technological revolution that has gripped markets—sorry, not you superconductors—may have reached a turning point.

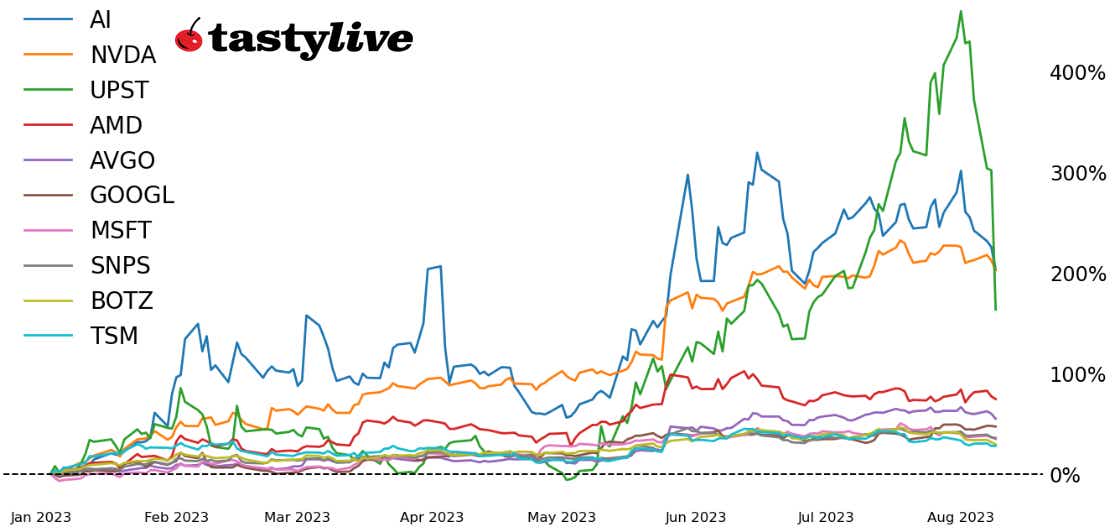

For much of 2023, artificial general intelligence (AGI, or AI in layman’s terms) has offered the promise of improving productivity and innovation for companies that hop on the bandwagon. It hasn’t just been names like NVDA or MSFT that have benefited—several AI-related companies have had outstanding years thus far.

Alas, the punch bowl may be getting low. The party may end soon. The Global X Funds Robotics & Artificial Intelligence ETF saw a meaningful sell-off in August, down 8.61%, while the tech-heavy Nasdaq 100 lost just 3.62%.

If the outperformance by robotic and AI-related stocks was a reason to cheer on stocks during the first half of the year, then it’s equally concerning that they have underperformed so dramatically in recent weeks. And the technical alarm bells are ringing in BOTZ, plain and simple.

BOTZ Price Technical Analysis: Daily Chart (August 2022 to August 2023)

The uptrend from October 2022, December 2022, March 2023, and May 2023 swing lows—four points of contact, indicating a very reliable move higher—has been broken.

In turn, the lows from June and July have been breached as well, bringing into focus a potential double top pattern which could produce a return back towards 25.00. Momentum has rolled over, with moving average convergence/divergence (MACD) fully trending below its signal line for the first time since October 2022, and Stochastics have found themselves holding in oversold territory.

The ‘buy the dip’ mindset has been materially harmed, at least for now. But in the short-term, air coming out of the AI bubble may be a bad omen for the broader stock market, particularly the tech-heavy Nasdaq 100 (QQQ or /NQ).

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.