Tariff War or Not, Stocks Face Mounting Recession Risk: ISM Preview

Tariff War or Not, Stocks Face Mounting Recession Risk: ISM Preview

By:Ilya Spivak

Trade war headlines distract from the real reason that the markets fear incoming recession.

- Stock markets jolted as the Trump administration hits out with new tariffs.

- New duties may not hurt U.S. growth too much, but it remains in trouble.

- Global recession risks may spook markets anew on soggy U.S. ISM report.

Stock markets fell out of bed as the Trump administration moved ahead with new tariffs targeting Canada and Mexico. The two countries along with the U.S. are part of the United States-Mexico-Canada Agreement (USMCA), a regional free trade deal that President Trump negotiated and signed in his first term in office.

The new levies were due to take effect in February, but Mexico’s President Claudia Sheinbaum and Canada’s Prime Minister Justin Trudeau convinced Trump to delay them for further negotiation. Now, the U.S. has triggered broad 25% duties on all imports from its largest trading partners. China was hit with further 10% tariff too.

The bellwether S&P 500 stock index fell as much as 2.2% intraday. The Nasdaq 100 and the Russell 2000 indices dropped as much 2.6% and 3%, respectively.

Equities stormed higher from these lows toward the end of the trading day, however. Tech names led the rebound, moving to add close to 1% on the day. Every other sector is trading flat or down.

Stocks seesaw as new U.S. tariffs hit Canada, Mexico and China

The bounce might speak to hopes for a relatively short-lived clash that sets the stage for successful renegotiation of the USMCA – up for renewal in 2026 – while leaving the U.S. economy relatively unscathed at the margin. The world’s largest economy has vastly outperformed global peers since last year thanks to a buoyant service sector.

U.S. services demand is mainly served by domestic firms, while imports mainly fall on the “goods” side of the ledger. Lopsided inflation data has shown that demand there is already anemic. This helps explain why U.S. economic strength has not spilled over to other markets in recent months.

Perhaps the markets thus concluded that the tariffs would do little to disrupt the tech-centric, services-driven U.S. growth in the near term even as they motivate their goods-exporting target countries to quickly placate the Trump administration. Such rose-tinted optimism may prove to be short-lived, however.

Global recession worries may return on U.S. ISM data

The markets have been gripped by swelling global recession fears since shocking S&P Global purchasing managers index (PMI) data showed service sector activity growth shrank for the first time in 25 months in February. New orders growth fizzled, and business sentiment soured, reflecting “uncertainty [about] government policies.”

This is a stark reminder that the growth scare now preoccupying markets is rooted in service sector sentiment. New tariffs might not make the situation worse here meaningfully worse in that their direct impact is aimed at the goods sector, but that does not mean it is necessarily going to improve either.

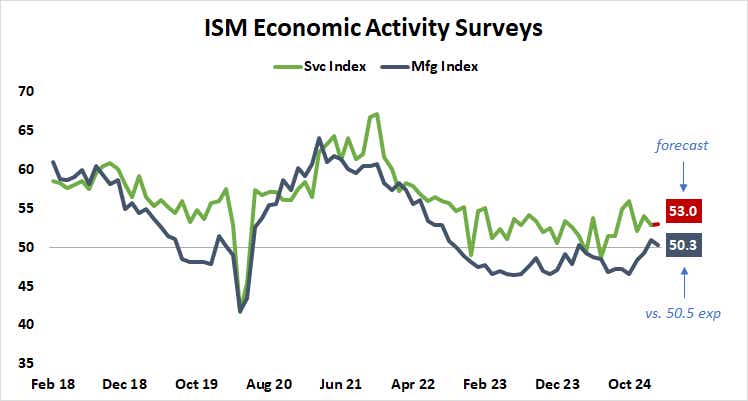

With that in mind, the spotlight turns to the service sector purchasing managers’ index (PMI) survey from the Institute of Supply Management (ISM). Analytics from Citigroup suggest U.S. data outcomes now tend toward disappointment relative to forecasts.

If the ISM result thus echoes the soggy S&P Global version, stock markets may swoon anew as recession fears return. In turn, that might send Treasury yields and the U.S. dollar lower amid a dovish rethink of Federal Reserve rate cut expectations.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.